According to Nate Geraci, Grayscale’s spot Chainlink (LINK) ETF is set to launch sometime this week. ETFs have played a massive role in the current market cycle. Bitcoin (BTC) and Ethereum (ETH) have both hit new all-time highs in 2025 due to increased ETF inflows. A similar pattern could emerge for LINK as well.

Will Chainlink Rally After an ETF Launch?

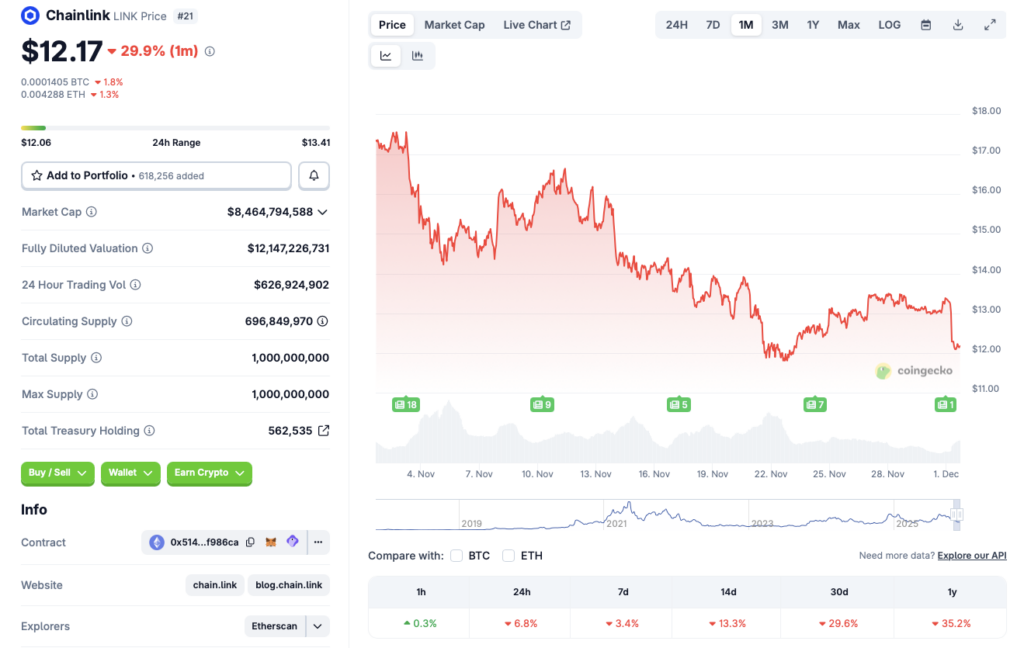

The crypto market has faced a massive price dip today, just days after the market showed signs of a recovery. Bitcoin (BTC) has fallen to the $86,000 price mark after hitting $92,000. Chainlink (LINK) also follows the market downtrend. According to CoinGecko data, LINK’s price is down 6.8% in the last 24 hours, 3.4% in the last week, 13.3% in the 14-day charts, 29.6% over the previous month, and 35.2% since December 2024.

There are two reasons why Chainlink (LINK) could rally over the coming weeks. Firstly, the ETF launch could lead to a surge in investor confidence in LINK as it brings more institutional interest in the asset. Increased ETF inflows could lead to a massive price rally for Chainlink (LINK).

Secondly, there is a high chance that the Federal Reserve will roll out another interest rate cut later this month. Rate cuts often lead to a spike in risky investments. Cryptocurrencies are among the riskiest of all financial assets. Chainlink (LINK) and the larger crypto market could see increased investments if borrowing becomes easier.

Also Read: Brace for Turbulence: A Heavy Week of Economic Data Could Jolt Market

However, there is also a possibility that the ETF launch will not aid Chainlink’s (LINK) price. For example, when the SEC approved Ethereum (ETH) ETFs in 2024, the asset did not see much price movement. It was only a year later that ETH hit a new all-time high. LINK could follow such a trajectory. How things unfold is yet to be seen.

Credit: Source link