The Aave community introduced a temporary proposal called “Focusing the Aave V3 Multichain Strategy,” which aims to streamline the protocol’s presence across several blockchains. The plan responds to widening revenue gaps between top-performing networks and smaller chains that generate minimal activity.

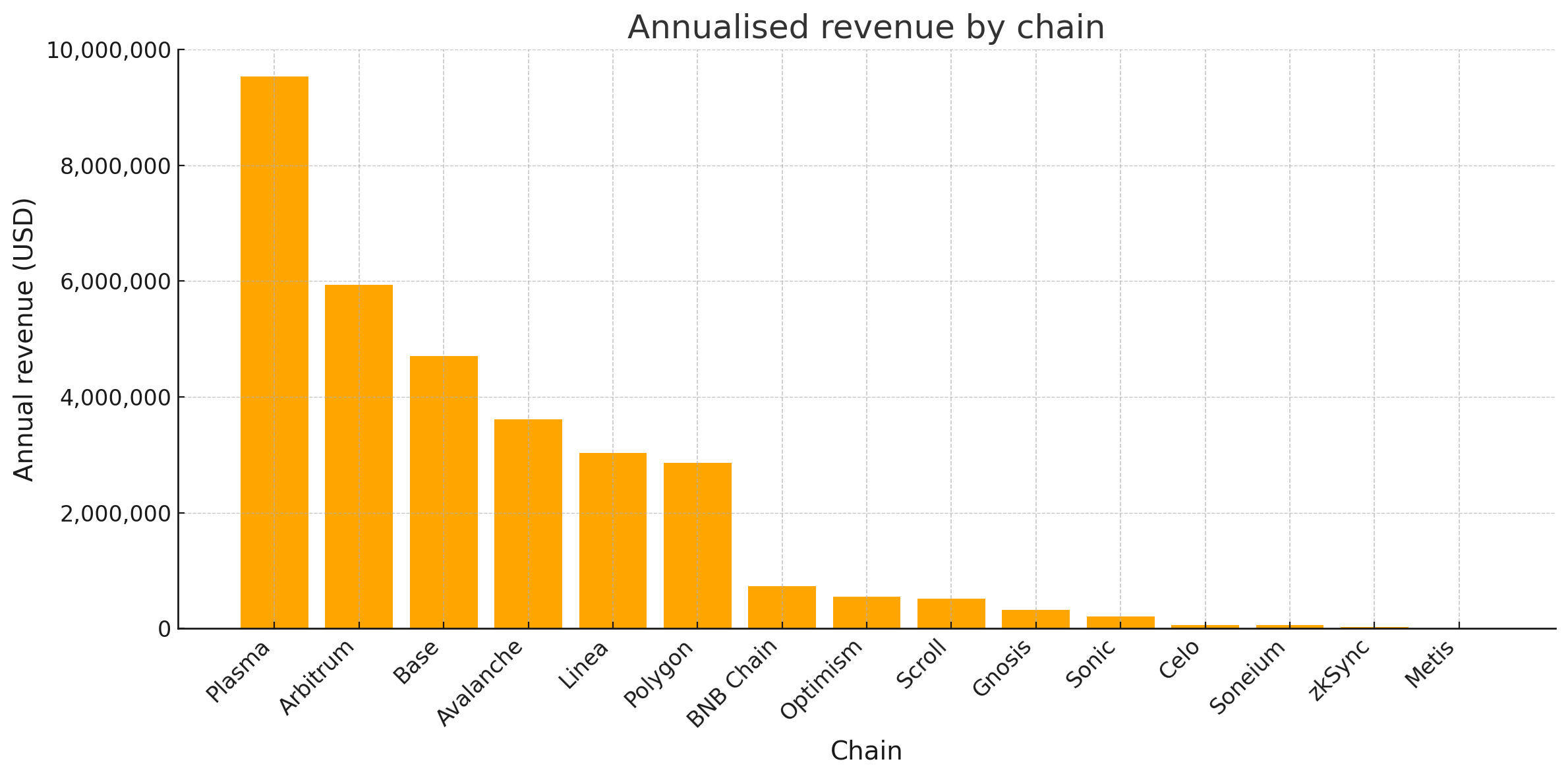

The proposal outlines a revenue-driven approach that raises reserve factors on chains delivering weak returns. Supporters say this step would help Aave capture more fees from markets that remain active but currently contribute little to total revenue. The chart shared with the proposal shows annual revenue ranging from nearly $10 million on Plasma to only a few thousand dollars on networks such as zkSync, Metis and Soneium.

Under the plan, Aave would wind down deployments on these low-revenue chains. zkSync, Metis and Soneium each generate between roughly $3,000 and $50,000 per year, far below the protocol’s operating needs. Therefore, the proposal recommends shutting down these markets to reduce maintenance costs and operational complexity.

The community also wants to establish a clear revenue threshold for any future expansion. The proposal sets a $2 million annual revenue requirement before the protocol considers launching on new networks. Supporters argue that this rule would prevent Aave from spreading liquidity too thin and ensure that each deployment contributes meaningfully to the ecosystem.

If approved, the proposal would mark a shift toward a more selective, performance-based multichain strategy designed to strengthen Aave’s core markets while cutting back on networks that offer limited returns.

Aave Moves Ahead With ETHLend Comeback and V4 Testnet Launch

Meanwhile, founder Stani Kulechov said ETHLend will return in 2026 with support for native BTC instead of wrapped tokens, as we covered in our latest report. The plan stands out because major DeFi platforms rarely use native BTC for lending and signals a more mature design than the 2017 peer to peer model.

As mentioned in our previous news brief, Aave also launched the public testnet for V4, together with a developer preview of Aave Pro for DeFi power users. The move marks a key step toward the V4 mainnet upgrade, which aims to improve capital efficiency, risk management, and modularity.

Under the new Hub and Spoke architecture, Liquidity Hubs pool capital and manage rate accrual, while Spokes act as modular markets linked to those hubs. Each Spoke runs with its own risk settings and collateral rules, and the initial set includes the Base Spoke, Treasury Spoke, and Vault Spoke.

Credit: Source link