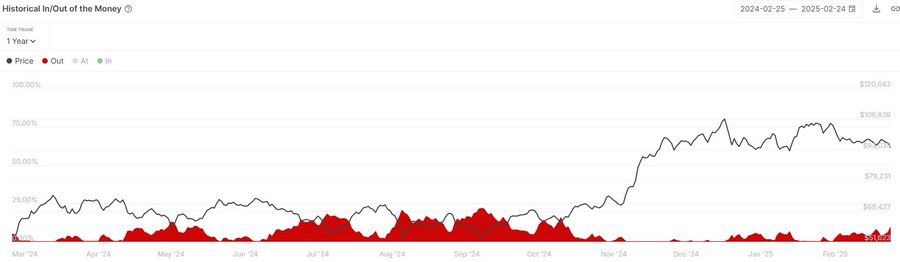

- Around 12% of Bitcoin addresses are now in unrealized losses, the highest level recorded since October 2024.

- Market liquidation surpassed $1.2 billion in the last 24 hours, triggering increased volatility and uncertainty among traders.

Bitcoin price is under heavy pressure again after falling below $89,000, a level last seen in November. BTC is down 7.28% in a day and down 15.20% in the last 30 days. As of press time, it is $88,749.87. The sudden decline set off large-scale liquidations and left many investors wondering: is this the end of the bull run or only a passing adjustment?

Liquidation Wave Shakes the Market

The effects of a sudden decline in BTC were felt right across the crypto community. More than $1.2 billion in optimistic positions were sold in the past 24 hours, suggesting that many investors who expected the price to rise had to leave the market, suffering significant losses.

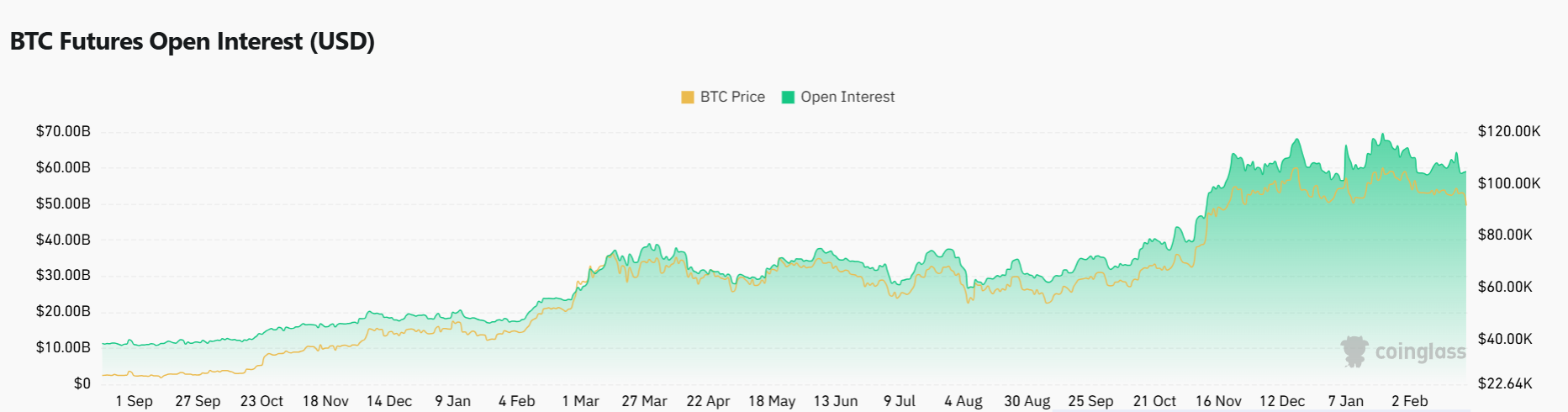

While options open interest climbed 3.68% to $31.37 billion, derivatives markets also saw a boom in activity with options trading volumes rising 245% to $4.51 billion. Although open interest dropped by 2.82% to $57.52 billion, data from CoinGlass showed that general trade volume rose by 115.33% to $143.17 billion.

The long/short ratio for the BTC/USDT pair on Binance came out to be 2.8595, suggesting that many traders remain hopeful in spite of the price fall. Still up for contention, though, is whether this indicates a reversal or a more gradual downturn.

Low Volatility, Big Move Ahead?

CNF previously reported that the low volatility phase of Bitcoin usually predicts a significant near future movement. Based on past trends, a price spike of 20–30% frequently follows this kind of scenario. Furthermore, likely to be the key causes of Bitcoin’s future surge are further institutional accumulation and more favorable legislative reforms.

Unquestionably, though, the great selling pressure over the previous few days has fundamentally altered market mood. This situation resembles what happened in early 2022, when Bitcoin fell drastically before rebounding greatly.

Should Investors Hold or Ditch Their Bitcoin?

According to IntoTheBlock, about 12% of all Bitcoin addresses right now are carrying unrealized losses. Since October 2024, this is the greatest number and proof that selling pressure is still somewhat strong. While some long-term investors might see this as a chance to raise their holdings, others would decide to leave the market before the price declines any more.

Though the state of the market right now seems negative, history suggests that Bitcoin usually recovers following times of volatility such as this. The question now is, will we see BTC fall more until it finally recovers or is this a good opportunity to buy?

On the other hand, as we previously reported, Ki Young Ju, the CEO of CryptoQuant, is still optimistic for the long run about Bitcoin. He claims that even if Bitcoin has corrected by 30% from its peak, it does not mean the market would decline in 2025. He underlined how the continuous bull cycle is supported by institutional inflows and growing ETF demand.

Furthermore, the progressively powerful movement of altcoins points to a possible change in market dynamics, which might lower the effect of selling pressure on Bitcoin.

Recommended for you:

Credit: Source link