Have you been the subject of a crypto scam? If yes, you are not alone – crypto users lost close to $2 billion to scams, rug pulls, and hacks in 2023, and over $1.4 billion in the first half of 2024.

One of the best ways to keep yourself safe is to fully understand the types of crypto scams out there. From phishing attacks to Ponzi schemes, scammers use a wide array of tactics and will continue to exploit them in the future. Therefore, you can protect yourself against risks by remaining alert and staying informed.

In our guide, we identify the 8 common types of crypto investment scams, as well as list platforms where these scams are most often seen. We also provide advice on ways to avoid crypto scams or threats. Let’s get into it.

What Is a Crypto Scam?

Put simply, a crypto scam occurs when someone attempts to steal money, personal information, or digital assets from another person using cryptocurrencies. This fraudulent activity is made possible because scammers take advantage of cryptocurrencies’ decentralized and anonymous nature. Sadly, it’s hard to recover and recoup any of the money stolen in a crypto scam.

Scams can vary in type and take different forms, making it hard to know what’s a scam and what isn’t. However, they often come alongside claims that they can make investors a large return with little to no risk, luring people in with the potential to make a lot of money. Scammers also try to dupe a wide range of people, not just novices. They have even targeted experienced investors and large companies.

8 Common Types of Cryptocurrency Scams

Based on our research, these are the most prevalent types of crypto investment scams around:

- Phishing scams

- Romance scams

- Impersonation and giveaway scams

- Crypto Investment scams

- Blackmail and extortion schemes

- Cloud mining scams

- Fake crypto exchanges and wallets

- SIM-swap sc

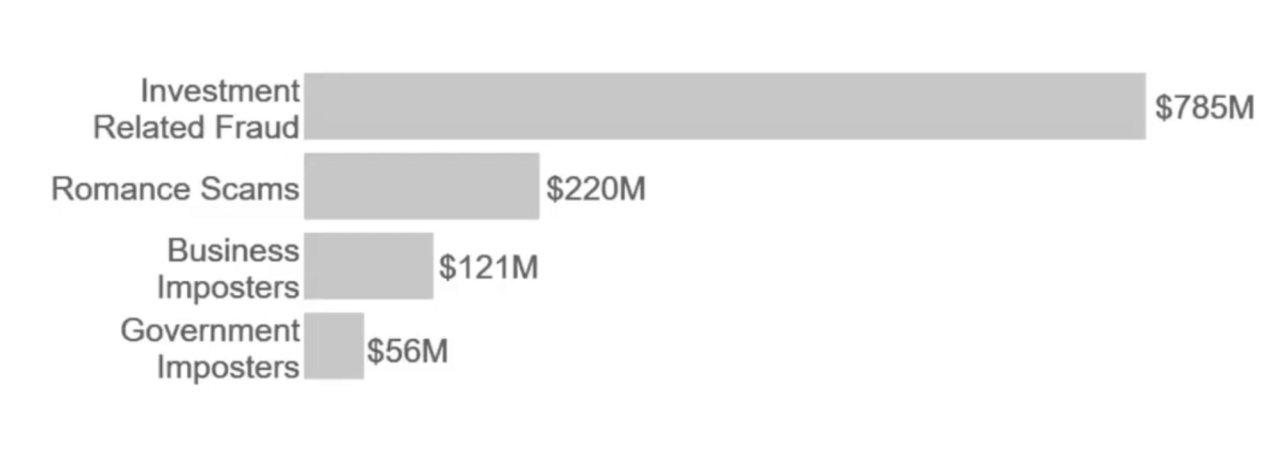

Top Cryptocurrency Scams by Type and Amount Lost

As we mentioned above, crypto users lost close to $2 billion to scams, rug pulls, and hacks in 2023 and over $1.4 billion in the first half of 2024. Let’s dive deeper into each of the scams, see how they work, and how you can prevent falling victim to them.

1. Phishing Scams

A phishing scam is a type of scam where a scammer sets up a fake website or social media profile or sends fake emails – all for the purpose of acquiring your personal information (identity, passwords, wallet keys, etc.). These scams will often mimic legitimate crypto entities, such as exchanges, so that they appear trustworthy to you. Any emails or messages you receive also appear trustworthy but will ask you for sensitive information such as your private key or login details.

There will often be the lure of a fantastic deal in these messages, or a request to give your information urgently. Once you have given the scammers your information, they can then steal your digital assets – perhaps by draining your exchange accounts on legitimate sites using the information you have given them.

Example:

You get an email that looks like it’s from Coinbase. The email says you need to verify your identity again – as soon as possible. You are told to click the link so you can complete your verification. However, the link doesn’t take you to the legitimate Coinbase website. Instead, it takes you to a fake one where you are asked to enter your login details. The scammer records your details and can now access your actual Coinbase account to take out any funds you have there.

2. Romance Scams

Another key scam to keep an eye out for is when you may be being emotionally manipulated. Crypto romance scams are when scammers set up fake profiles on a dating website or other mainstream social media to lure you into trusting them. They do so by building a relationship with you over a number of weeks or months.

Once the scammer feels you trust them, they’ll ask for an investment into a crypto scheme or for a crypto transfer. The transfer will simply go straight into the scammer’s pocket and not be used at all for the investment. The money scammers steal can amount to eye watering sums. According to AARP, in November 2023, the U.S. Justice Department and Secret Service retrieved $9 million worth of Tether from scammers who had targeted more than 70 victims. A large portion had been targeted through romance schemes.

Example:

A crypto scam artist builds a profile on a dating app where they pose as a successful businessperson. They start talking to you online for a couple of weeks, where the conversation turns increasingly romantic. Soon, the scammer mentions – almost in passing – about an investment in a cryptocurrency scheme where there is a great deal of money to be made. You transfer Bitcoin to the scammer’s wallet, under the impression that you are investing in a legitimate scheme. However, you never hear from the scammer again.

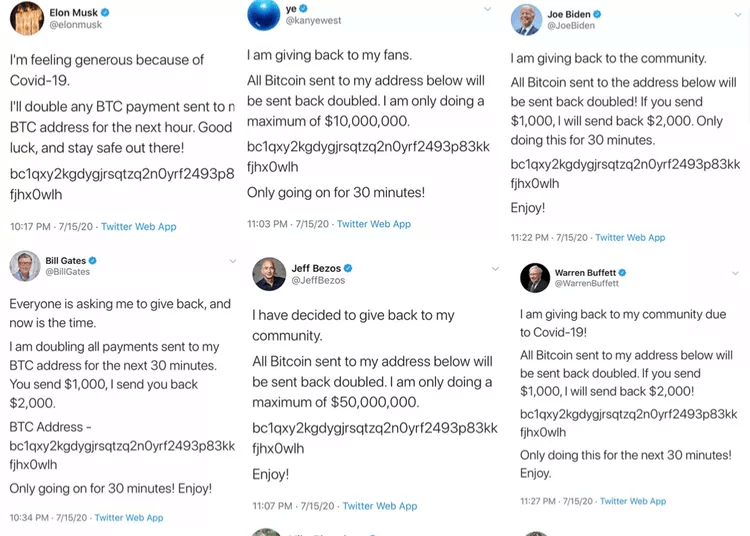

3. Impersonation and Giveaway Scams

Increasingly, scammers pretend to be celebrities, influencers, or well-known companies and promote investment opportunities or giveaways—all of which are fake. Here are ways these scams occur:

Fake Celebrity Endorsements

Scammers either create a social media profile that’s fake or hack into a verified account. They’ll use these accounts to promote fraudulent crypto schemes – such as a giveaway or an investment opportunity – and then claim a celebrity endorses them. The endorsement will often claim there are high returns to be made. The post will ask you to send some cryptocurrency to an address, giving you the impression that you’ll get back a larger amount in the future.

Example:

An account on X belonging to a famous businessperson is hacked. The hacker then posts about a Bitcoin giveaway. To enter, followers need to send 0.1 BTC to a specified address to receive 1 BTC in return. None of the followers ever receive anything back.

Social Media Scams

Scammers will set up fake profiles, pages, or groups on platforms such as Facebook or Instagram. They’ll then use those pages to promote fraudulent investment schemes or phishing links – in 2024, fake social media scams, sometimes called deepfakes, surpassed $25b. Scammers managed to achieve this by posting fake testimonials, success stories, and screenshots of large profits to lure victims. The links on these posts will direct users to a site that captures login credentials or private keys.

Example:

A scammer creates a Facebook page made to look like a legitimate crypto investment firm. On that page, they post about success stories and promote a high-yield investment opportunity, convincing you to transfer funds to the scammer’s wallet. However, you never see any return nor your original investment again.

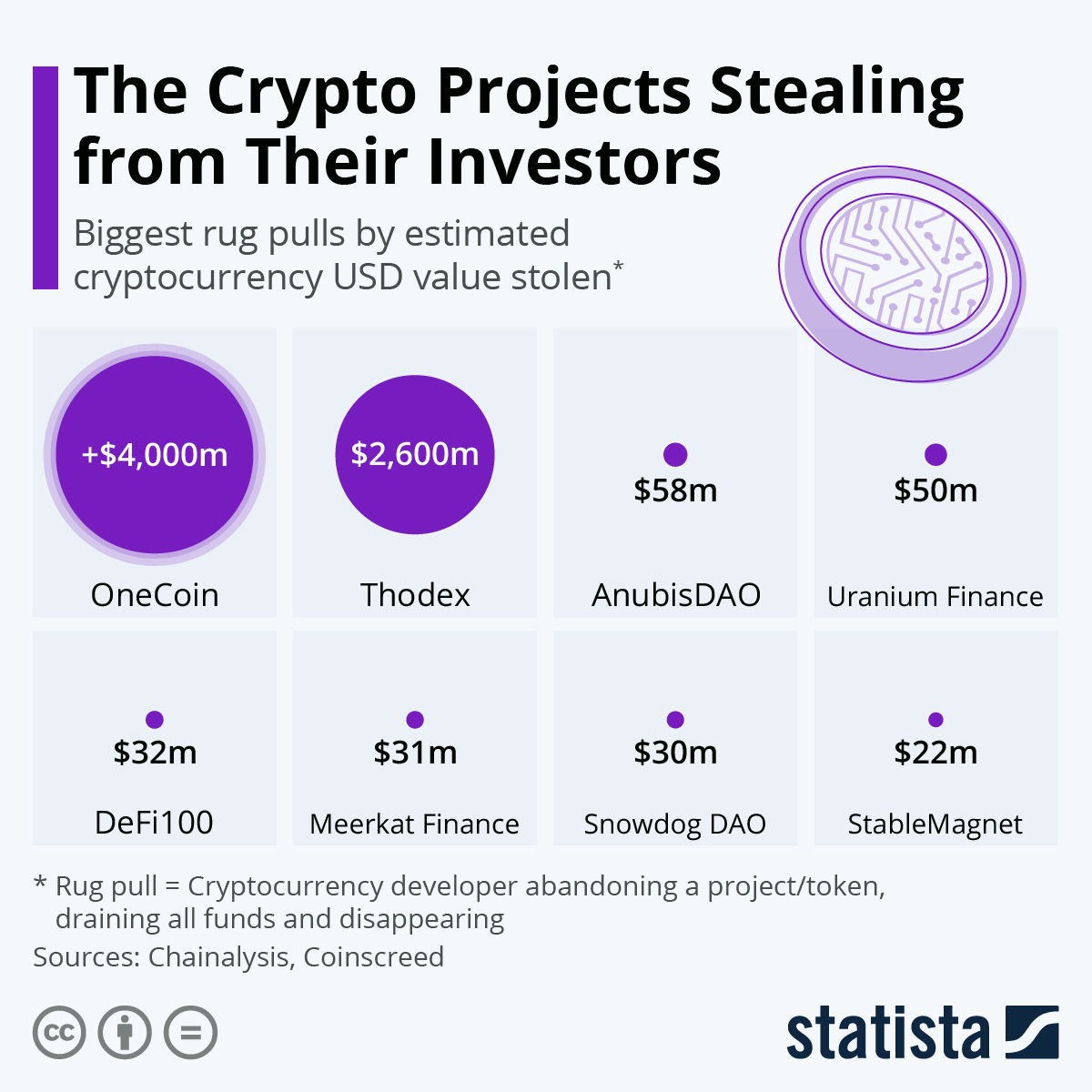

4. Crypto Investment Scams

Scammers sometimes design enticing crypto investment schemes that promise high returns with little to no risk. They often involve elaborate ways to convince you that their investment is safe and profitable. The most common types include Ponzi schemes, pump-and-dump schemes, and fraudulent ICOs and NFTs.

Here’s how they work:

Ponzi Schemes

Ponzi schemes use funds from new investors to pay returns to earlier investors, creating the illusion of a profitable investment. This success attracts more investors, but eventually, the scammer runs out of new investors, and the scheme collapses, leaving most participants with significant losses. While Ponzi schemes exist even today, they were most popular during the 2017/2018 crypto boom, and came in all shapes and sizes, but mainly in the form of high-yield investment programs (HYIPs)

Pump and Dump Schemes

In pump-and-dump schemes, scammers artificially inflate the price of a cryptocurrency through false statements. They buy a large amount of low-value and low-volume cryptocurrency to do so. They then promote the cryptocurrency heavily on social media and via other marketing channels. Other investors are attracted – further driving up the price. The scammer then sells off their holdings at the peak. The price of the cryptocurrency crashes, leaving other investors with worthless coins.

ICO and NFT Scams

Initial Coin Offerings (ICOs) and Non-Fungible Tokens (NFTs) can raise funds for legitimate projects. However, scammers often exploit ICOs and NFTs by raising money for nonexistent projects, such as supposed groundbreaking technology or a unique digital asset. Investors are lured into investing through fake promotional materials, but when the scammer has collected enough money, they disappear.

5. Blackmail and Extortion Schemes

These schemes work as they would with traditional money. Crypto scammers blackmail or extort victims, forcing them to pay a fee in cryptocurrency. Victims pay because they are scared of what information the scammers hold over them, such as personal photos, videos, or financial records. Scammers threaten to release this information, often with a deadline, unless the victim pays the scammer in cryptocurrency.

Example:

A scammer claims to have hacked your computer and obtained sensitive photos. They demand a payment in Bitcoin to prevent the release of these photos to your contacts.

6. Cloud Mining Scams

These scams fool victims by duping them through fake companies that are offering mining contracts. Those contracts promise profits from crypto mining without the need to own any of the expensive equipment. However, these companies have been set up by scammers who don’t have the mining equipment either. Plus, they don’t have the means to pay the returns promised to the investors. Some mining scams start as a form of Ponzi scheme – paying initial investors with newer investor money.

Example:

A scammer sets up a fake cloud mining website, promising high returns on Bitcoin mining contracts. Investors purchase these contracts, but the scammer disappears with the funds without ever conducting any mining operations.

7. Fake Crypto Exchanges and Wallets

To steal funds from you, scammers will sometimes create fake crypto exchanges and wallets. These fake platforms often look identical to legitimate ones, making it difficult to distinguish them from the real thing. They lure victims with attractive offers such as low fees, high security, or exclusive features. Yet, when you create an account and deposit funds, the scammers steal these funds and subsequently disappear.

In May of this year, two men in the UK stole almost £6 million worth of cryptocurrency from victims. They replicated the website of Blockchain.com so they could access victims’ online wallets.

Example:

A scammer creates a fake crypto exchange website that looks exactly like Binance. Users create accounts and deposit their funds, only to find out later that the exchange is fake and their funds are gone.

8) SIM-Swap Scams

These are highly sophisticated forms of crypto fraud. Scammers will target you through your mobile number and use it to gain access to your online accounts – such as your crypto wallet. Scammers can use your number to intercept verification codes sent to your messages, but also to reset passwords. It means they can get direct access to your digital assets.

Scammers can often learn your mobile number through social media, data breaches, or a phishing email. With this information, a scammer can then contact your mobile provider and ask for a SIM swap which is how they can read your messages and bypass any two-factor authentication you have set up on your crypto exchange or wallet.

Worst Platforms for Crypto Scams

Some social media platforms are more prone to crypto scams than others. Here are some of the worst:

Facebook Crypto Scams

Scammers use Facebook to create fake pages, groups, and ads to promote fraudulent schemes. Sadly, the platform’s vast user base and ease of creating fake profiles make it an easy and attractive target for scammers. Scammers often use fake testimonials and success stories to lure victims into their schemes.

WhatsApp Crypto Scams

WhatsApp scams often involve unsolicited messages from unknown numbers. Those messages will promote fake investment opportunities or phishing links, luring people into fraudulent activity. Sadly, the platform’s encrypted messaging service makes it challenging to track and stop scammers.

Twitter (X) Crypto Scams

Twitter is frequently used for impersonation and giveaway scams. It’s common for scammers to hack verified accounts or create fake profiles to promote fraudulent schemes. A recent famous example was when 50 Cent’s X account was hacked and used to promote a fraudulent meme coin based on the Solana blockchain. What makes matters worse for any X crypto scam is the platform’s real-time nature, which allows scams to spread quickly.

Telegram Crypto Scams

Telegram groups and channels are often used to promote pump-and-dump schemes, fake ICOs, and fraudulent investment opportunities. As the platform allows anonymity and supports large groups, it’s a breeding ground for scammers.

How to Spot Crypto Scams Early

Spotting a crypto scam early is a great way of protecting yourself against falling foul of a fraudulent scheme. You can do so by:

- Analyzing the investment’s whitepaper

- Looking for red flags in communication

- Spotting unrealistic promises

Here’s some more detail on these steps for how to avoid crypto scams:

Analyze the Project’s Whitepaper

If a cryptocurrency project is legitimate, it should be accompanied by a whitepaper. A whitepaper from a reputable source will outline the investment/project’s goals, along with detailing its technology and roadmap for the future. Information about the team behind the project should also be included providing information on their credentials and experience. If there is no whitepaper or the whitepaper is badly written, it’s highly likely that you are looking at a fraudulent scheme.

Red Flags in Communication

It’s really important to be wary of unsolicited messages. If you do receive tempting messages out of the blue, scams will often use poor grammar and pressure tactics. Legitimate projects usually employ professional communication.

Spotting Unrealistic Promises

Without doubt, promises of guaranteed high returns or profits are a clear indication of a scam – especially if it mentions how little risk is involved, too. Remember, if it’s too good to be true, it often is. Any vague or incomplete information about how the returns will be achieved is an obvious and immediate red flag.

Strategies to Avoid Cryptocurrency Scams

The best ways to protect yourself against being scammed is to:

- Check third-party reviews

- Ignore unsolicited messages

- Verify any endorsements or partnerships

- Move slowly before investing

- Bookmark important links

Let’s explore these strategies further:

Check for Third Party Reviews

Before investing, it’s always a good idea to check reviews from as many sources as you can. It’s a vital part of your due diligence. When you conduct proper and thorough research, you can verify the legitimacy of the project. To be doubly sure of the investment’s legitimacy, make sure you read reviews provided or published by a third party – rather than relying on testimonials on the project’s website.

Ignore Unsolicited Messages

Always be cautious of unsolicited messages from unknown individuals or companies promoting crypto investments. If you do receive unsolicited messages, make certain you don’t click on links or open attachments. It’s also a good idea to report the message to the platform where it was received. If you do want to respond to the message, verify the legitimacy of the sender first.

Verify Endorsements and Partnerships

As scammers often falsely claim endorsements or partnerships with reputable companies, verify claims before making any investments. To do so, follow these steps:

- Check the official website or social media accounts of the partner.

- Double-check if there are any press releases or news articles confirming the partnership.

- Contact the company directly and ask if the partnership is real.

Move Slowly Before Investing

One of the best things you can do to protect yourself is to ensure you take your time to research and understand the cryptocurrency investment proposition fully. Do so by:

- Conducting thorough research on the investment.

- Seeking advice from sources you trust and from legitimate financial advisors.

- Invest only what you can afford to lose.

Bookmark Important Links

Finally, it’s a good idea to bookmark important links so you don’t accidentally click on fake exchange websites. Some exchanges also have anti-phishing checkers where you can actually check if the email or social media account is coming from a person from their company.

How to Report Crypto Scams

Arming yourself with the knowledge to spot a scam is key to your financial safety. However, knowing how to report them is a vital way to fight financial crime too. By following these steps, you’ll help protect others:

Steps to Report Crypto Scams

- Contact the platform where it happened (this could either be a social media platform or a crypto exchange).

- Contact relevant authorities such as your local consumer protection agency or equivalent authority.

- Contact the cryptocurrency exchange or wallet provider involved in the scam.

- File a report with the Internet Crime Complaint Center (IC3) or other relevant cybercrime reporting agencies.

Can You Get Money Back From Crypto Scams?

Retrieving your funds from a crypto scam is highly unlikely. The decentralized and anonymous nature of cryptocurrencies can make it challenging, though it is becoming increasingly possible. In Q2 2024, the crypto market recovered over half of its stolen funds, according to Hacken’s Web3 Security Report Q2 2024. You can try to recoup your funds by following these steps.

Steps to Recover Money from Crypto Investment Scams

- Report the Scam: Immediately report the scam to the relevant authorities and platforms as mentioned above.

- Seek Legal Help: Consult with a legal professional experienced in cryptocurrency cases.

- Blockchain Analysis: Use blockchain analysis tools to trace and possibly recover funds. Crypto forensic companies, such as CipherBlade and Crystal Intelligence, could help you with this.

- Public Pressure: Sometimes, publicly exposing the scam can put pressure on the scammer to return the funds.

Conclusion

With the crypto world evolving at a pace, it’s essential to stay aware of scammers and their increasingly cunning and conniving ways of defrauding you. By staying aware through reading guides such as this and remaining vigilant when investing, you can protect yourself from falling victim. Remaining informed by conducting research is one of the best things you can do before making any investment decisions.

FAQs

How can you tell if someone is a crypto scammer?

It’s really important to be aware of common red flags such as unsolicited messages, unrealistic promises or pressure tactics. Doing due diligence before investing in any crypto scheme is vital too.

How many scams are there in crypto?

It’s hard to say as the number is constantly changing. For instance, CBS News reported in March 2024 that there have been 67,000 reports of scams, while Time Magazine reported in June that more than 46,000 people reported losing money in scams from January 2021 to June 2022.

What was the biggest crypto scam in history?

One of the biggest crypto scams was the OneCoin scam, which reportedly defrauded victims of over $4 billion. The company simulated transactions not registered by a blockchain. It was a pyramid scheme in which the company paid early investors using money from newer ones.

What should you do after getting scammed?

Without a doubt, you should report the scam to the right authorities and the relevant platform(s) as soon as possible. You should also seek legal advice before trying to trace and then recover your funds using blockchain analysis tools.

References

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

Credit: Source link