- Crypto trading volumes hit second monthly low post-BTC halving event.

- Derivatives dominated the crypto market at +70% because of ETH ETF speculation.

The typical financial lull associated with summer seems to be playing out in crypto markets.

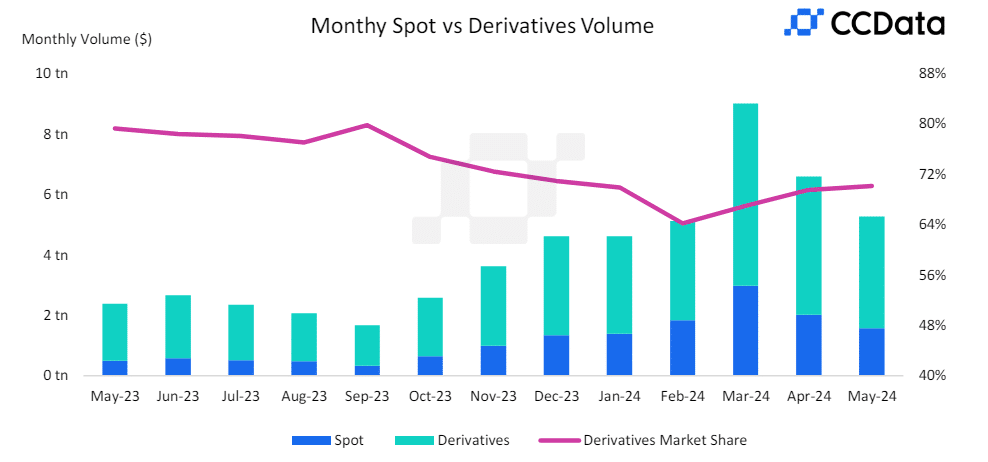

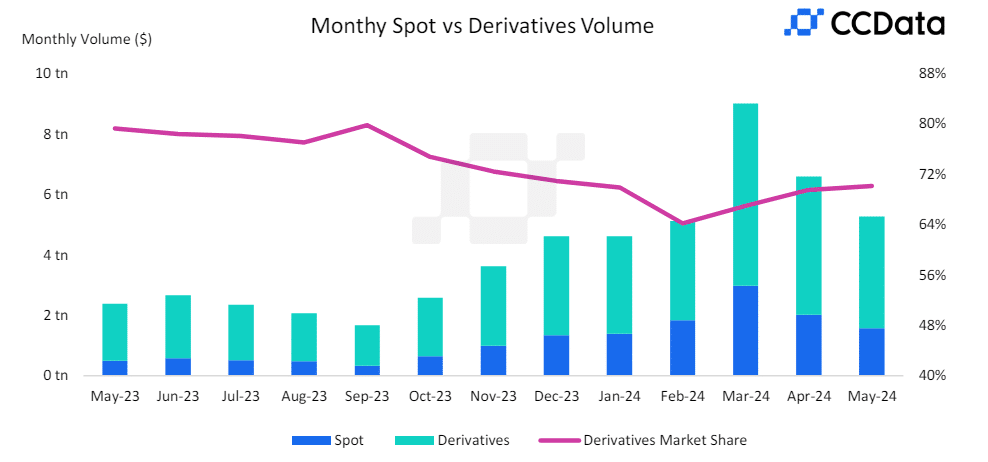

In May, crypto trading activity fell by 20%, marking the second month of a drop in trading volume across major exchanges, per a CCData report.

Part of the report cited the ‘rangebound’ market for the trend and read,

‘In May, the combined spot and derivatives trading volume on centralised exchanges fell 20.1% to $5.27tn as the prices of major digital assets continued to trend rangebound following the Bitcoin halving event in March.’

A downtrend in crypto trading volume

Source: CCData

The report noted that in the spot market segment, May’s trading volumes across centralized exchanges dropped 21.6% to $1.57 trillion, lower than the +$2 trillion volumes hit in April.

Based on individual exchanges, Binance was the top contender on the spot market trading volume at $545 trillion in May. In descending order, other exchanges that followed Binance’s lead were Bybit, OKX, Coinbase, and Gate.io.

However, each exchange recorded key drops in trading volumes in May compared to April.

On year-to-date performance on the spot market share, Binance saw the most significant gains and ramped up its dominance to 34.6%.

Bybit, Bitget, and XT.com also surged in market share over the same period. But Coinbase saw a modest decline while Upbit, OKX, and MEXC Global recorded ‘the greatest decline in market share.’

Derivative market dominance surge to 70%

However, money in the crypto market was concentrated mainly in the derivatives market. Per the report,

‘The derivatives market now represents 70.1% of the entire crypto market (vs 69.5% in April).’

Source: CCData

Despite the spike in derivative market dominance, overall trading volumes were subdued like the spot market. The report noted that,

‘Derivatives volumes decreased by 19.4% in May to $3.69tn, recording the second consecutive decline in monthly derivatives volume.’

Unlike the typical sluggish financial activity in TradFi during the summer, the report attributed the low volumes to historical patterns associated with low activity after the Bitcoin halving events.

Amidst the lull, the report noted that traders were still bullish, based on an uptick in funding rates and a surge in Ethereum [ETH] option volumes on US ETH ETFs speculation.

‘Across the four exchanges analysed, the average funding rates continued to decline, reaching 3.23%. However, the funding rate started trending upwards on May 23rd as traders turned bullish after the SEC’s surprise pivot on the Spot Ethereum ETF applications.’

Credit: Source link