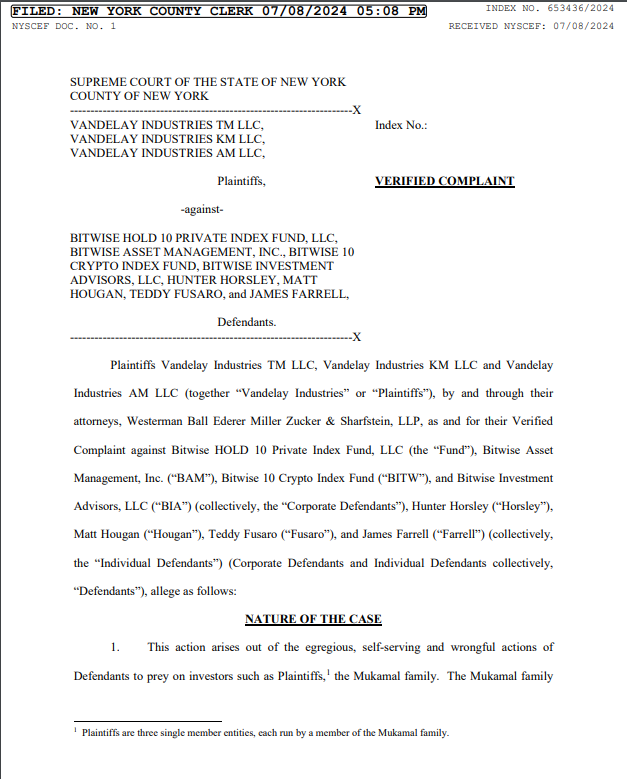

Bitwise Asset Management is facing a lawsuit from the Mukamal family. The July 8 lawsuit accuses Bitwise’s top executives of fraud, negligence, and executing a “pump and dump” scheme that resulted in significant financial losses for investors.

The complaint, filed in the New York Supreme Court, highlights Bitwise’s alleged fraudulent actions and mismanagement practices, which have cast a shadow on the company’s trustworthiness and impacted thousands of investors.

Bitwise Accused of Securities Fraud and Mismanagement in $2 Million Lawsuit

The Mukamal family, powerful early investors in Bitwise, allege that the company’s top executives—CEO Hunter Horsley, President Teddy Fusaro, and CIO Matt Hougan—engaged in a “pump and dump” scheme and misled investors, resulting in over $2 million in damages.

“Bitwise CEO Hunter Horsley and executives Teddy Fusaro and Matt Hougan lied to the Mukamal family and committed securities fraud for which we are seeking over $2 million in damages,” stated Theodore Mukamal, a son of the Mukamal family during his conversation with Crytponews.

According to the lawsuit, the timeline of events begins in March 2018, when the Mukamal family invested $1.3 million in the Bitwise HOLD 10 Private Index Fund.

In April 2020, Bitwise allegedly altered the investment terms, breaking agreements and converting the fund to an OTC product against investor wishes.

“They executed a reckless and negligent pump and dump scheme for their own personal benefit, leaving their flagship product, the Bitwise 10 Crypto Index Fund (BITW), trading 35-65% below NAV for the past three years, which is devastating to thousands of investors,” Theodore Mukamal stated.

By November 2020, Bitwise initiated a campaign to liquidate shares, encouraging investors to sell at a premium to NAV, which led to losses.

The complaint accuses Bitwise executives of securities fraud and negligent mismanagement, citing a series of fraudulent actions that have greatly devalued the family’s investment, now trading at a 35–65% discount below the Net Asset Value (NAV).

The Mukamal family liquidated their initial 2018 investment in March 2021, turning a net profit, but reinvested $4.85 million based on what they describe as misleading assurances from Bitwise executives.

A February 2024 article criticized the fund’s management fees and performance, highlighting its significant trading discount to NAV.

Subsequently, the Mukamal family sold their shares at a substantial loss in March and April 2024, realizing $1.9 million in damages due to Bitwise’s actions.

Additionally, the lawsuit accuses Bitwise of reckless and self-serving management practices, including breaking signed agreements and altering the structure of investments without investor consent. Multiple violations of the SEC Act of 1934 and other regulatory breaches are cited.

Breach of Fiduciary Duty, Negligence & Fraud

The Mukamal lawsuit brings serious accusations against Bitwise on multiple grounds, including breach of fiduciary duty, negligence, negligent misrepresentation, fraud, conspiracy to commit fraud, and violations of Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5.

The Mukamal family demands that Bitwise pay damages, legal fees, and other related expenses. The final amounts will be determined at trial.

These allegations question Bitwise’s integrity and could affect thousands of investors, potentially damaging the company’s reputation and future operations.

Theodore Mukamal added that while Bitwise claims to be trustworthy and offers low fees to attract investors to their new ETF products, the experience of the Mukamal family’s claim alleges that Hunter Horsley, Teddy Fusaro, and Matt Hougan have breached agreements, increased fees, and defrauded many investors, causing millions of dollars in damages.

Fraud allegations and lawsuits in the crypto space have been endless. Among the newest similar lawsuits is Keith Gill, known as Roaring Kitty, who has been accused of securities fraud in a class-action lawsuit concerning GameStop.

The lawsuit alleges that his social media posts caused volatility in GameStop stock prices between May and June, which was called a pump-and-dump step.

On the other hand, Australian mining billionaire Andrew Forrest’s lawsuit against Meta for hosting several crypto ad scams bearing his likeness has been given the green light after Meta failed to have it dismissed, U.S. District Court Judge Casey Pitts ruled on Monday.

Cryptonews has contacted Bitwise, but a response has yet to be received. This story is developing, and further updates will be provided as more information becomes available.

Credit: Source link