- Helium is witnessing a resurgence of growth that could be tied to its collaboration with traditional carriers

- HNT bulls are showing off, but signs indicated potential for a natural correction

Helium is one of the crypto-projects that are championing decentralized physical infrastructure (DePIN). However, despite being a pioneer in its segment, the network’s growth has for a long time remained constrained by the pace of adoption.

Despite kicking off slow, however, Helium adoption is now starting to grow at a faster pace. This is particularly evident in its user growth figures. In fact, the latest data revealed an accelerating adoption pace over the last 12 months.

Source: Dune.com

Helium’s subscriber count has been growing exponentially too. The network had less than 1,000 subscribers in the unlimited plan 12 months ago. On the contrary, Helium currently has over 108,000 subscribers on its unlimited plan – A sign that it is well into its robust growth phase.

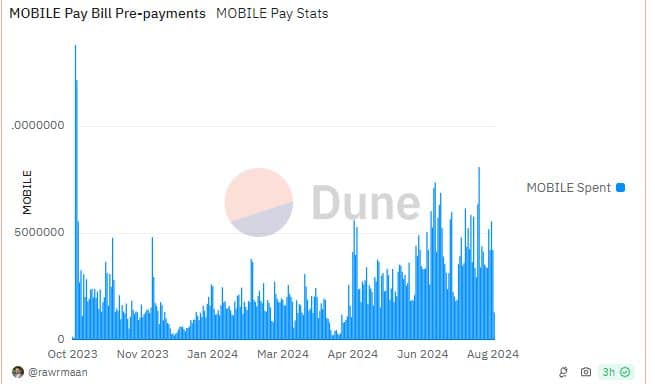

Healthy mobile pay bill pre-payments indicated noteworthy revenue generation too. It is also a signal of Helium customer retention being strong.

Source: Dune.com

Offload subscribers pumping Helium

Now, Helium has been exploring growth by bootstrapping existing carriers. Its new total carrier offload service allows existing mobile carriers to use Helium’s mobile hotspots to decentralize their offerings. This approach presents a chance for Helium to rapidly scale up in terms of adoption.

The network is reportedly already working with 2 carriers to test run the feature.

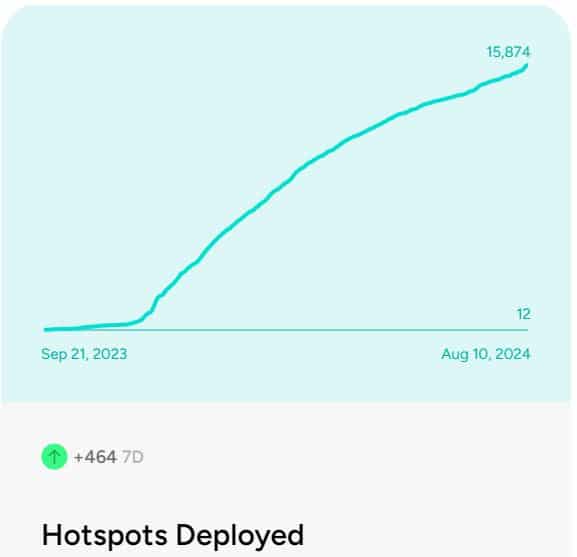

Helium’s physical infrastructure has also been expanding rapidly. In fact, the network revealed on its official website that it has deployed almost 16,000 hotspots so far.

Source: Hellohelium.com

The hotspot data highlighted a strong correlation with the subscriber count – A confirmation that the network has been adjusting to accommodate more users.

Alternatively, one could also view it as an indicator that the network’s expanding infrastructure has been bringing more users onboard.

Impact on HNT’s performance

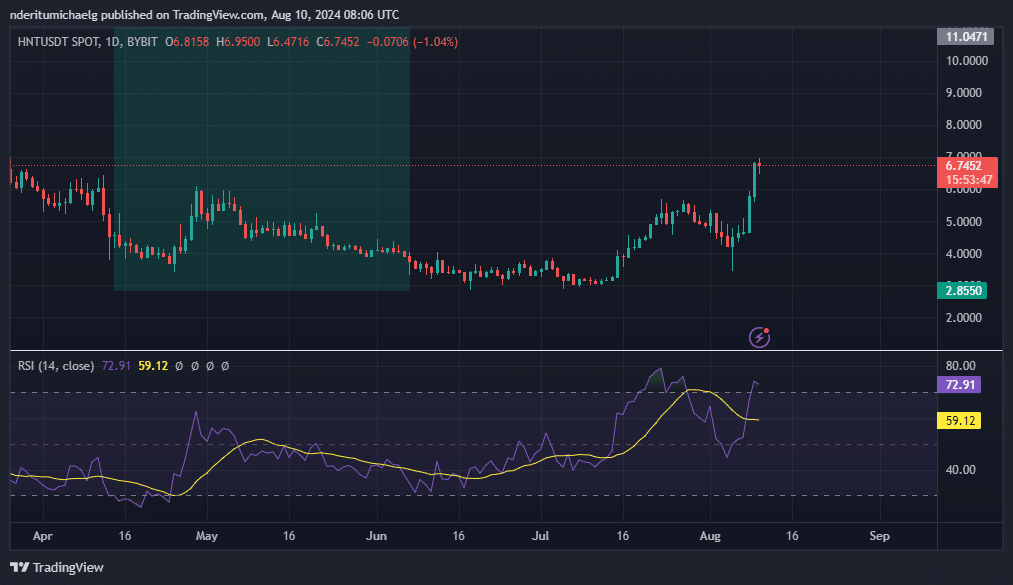

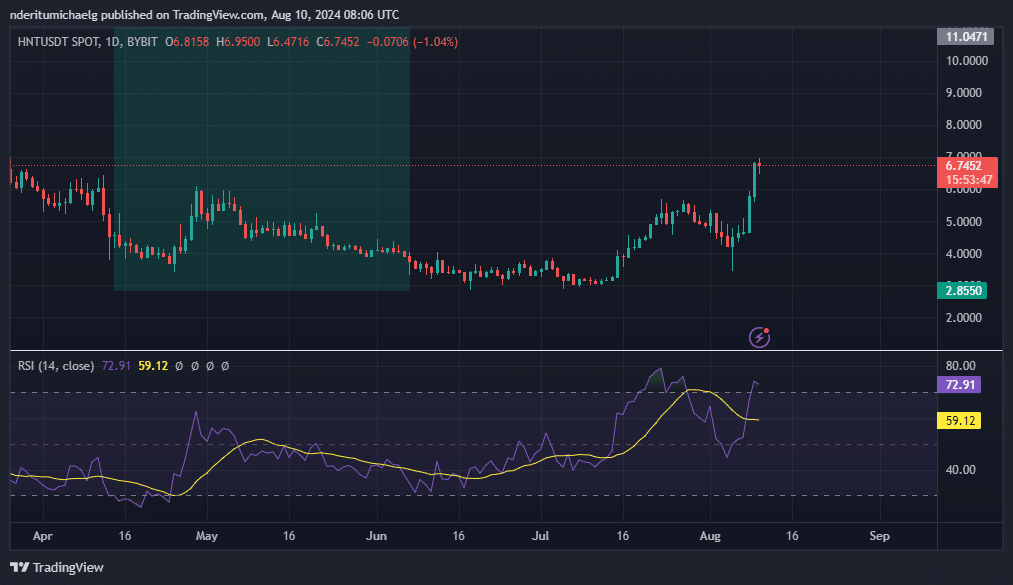

Helium’s native token HNT has been on an overall bullish trajectory since the second week of July. This is a clear sign that it is recovering after previously going through a harsh bearish period that saw it fall from its 2024 high of $11.06. – A 74% discount to the bottom range just below the $3 price level.

HNT was valued at $6.74, at the time of writing. This price point was a 133% recovery from its bottom range.

Source: TradingView

Our analysis indicated that HNT could be due for some sell pressure though. This, because its price was not only overbought but, it also demonstrated price-RSI divergence. The RSI had a lower high compared to the previous peak towards the end of June, while the price is higher now than it was in its June peak.

While a bearish pullback could be on the menu, it is hard to tell whether it will be an intense one or whether it can hold its current price. This may be because the new found pace of growth could encourage HNT holders to hold on for longer in anticipation of higher prices.

Credit: Source link