- ETH price surged by 14.5% over the last week.

- Ethereum active addresses have hit 5 million over the past week as active buyers increased.

Since hitting a weekly low of $2,251 on 16th September, Ethereum [ETH] has been on an uptrend. In fact, as of this writing, ETH was trading at $2,641. This marked a 14.50% increase over the past week.

Prior to the uptick, Ethereum was on a downtrend trajectory over the past month.

The recent shift in market sentiment has left analysts talking about whether this uptrend is a part of a sustained recovery and what’s driving this surge. Analysts have suggested that the current uptrend arises from increased active buyers.

What market sentiment Says

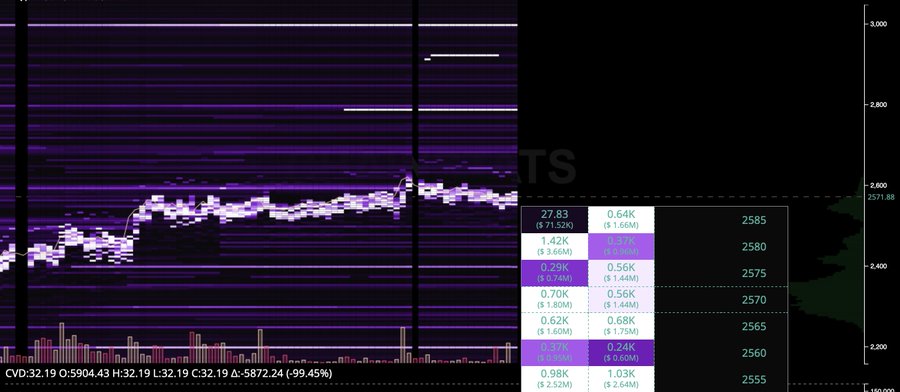

In their analysis, ChainStatsPro cited increased active buyers and spot limits bids.

According to this analogy, liquidation hunts in the future markets for ETH have persisted while spot-limit bids are being filled. However, CVD remains flat, and bids and asks are accumulating at $2400 and $2790.

Source: ChainStatsPro

What this means is that active buyers are acquiring ETH at the current market rates suggesting increased demand. Thus, traders are positioning themselves to buy when ETH declines to $2400 and sell if it reaches $2790. These order bids suggest increased market activity.

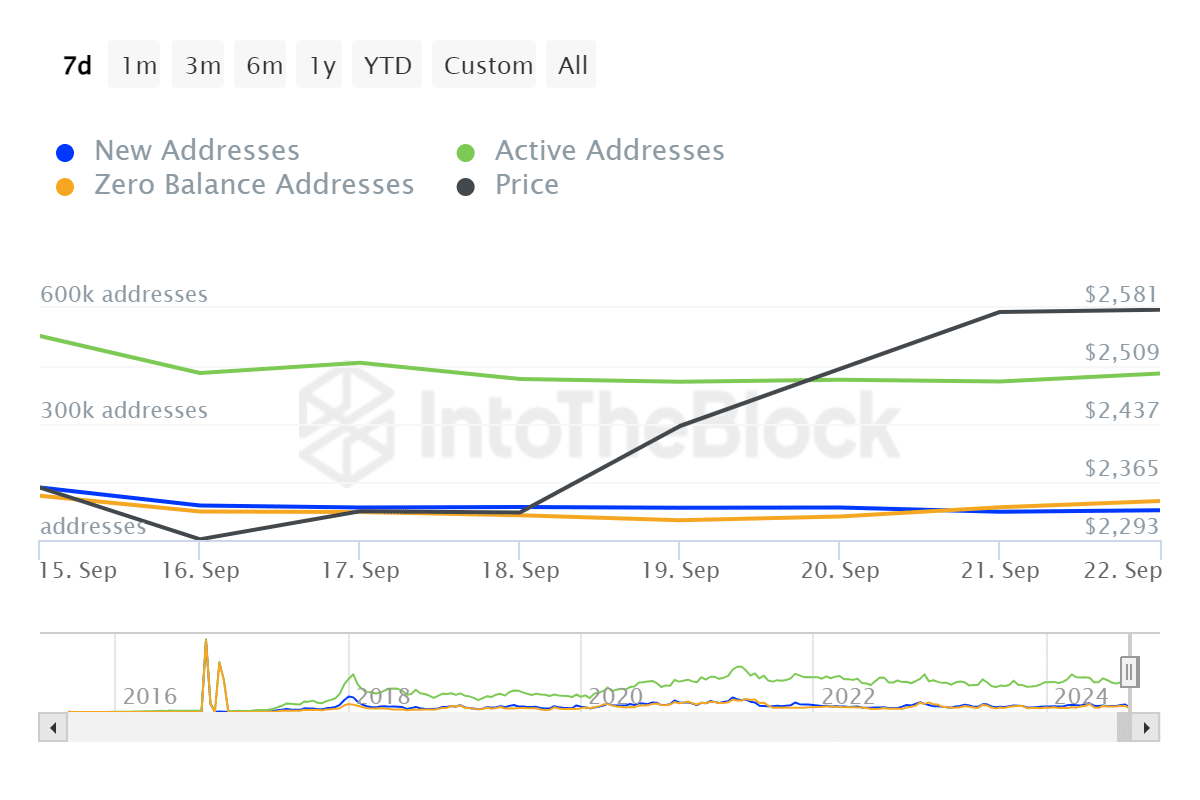

Source: IntoTheBlock

Looking further, the increase in active buyers and investors setting spot limits is illustrated by a higher number of active addresses over the past seven days.

According to IntoTheblock, active addresses have hit 5 million over the past week. This suggests increased transactions as more users are actively engaged with the network. This is a bullish market sentiment as a rise in active addresses lead to higher prices.

What ETH charts indicate…

As observed by ChainStatsPro, ETH has experienced a surge in transaction activity over the past week. These market conditions have pushed Ethereum to experience a sustained upward momentum over the past week.

Source: Tradingview

For starters, this increase in buying pressure has been further supported by a positive Chaikin Money Flow (CMF). At press time, Ethereum’s CMF was at 0.28 indicating buyers are actively accumulating the asset.

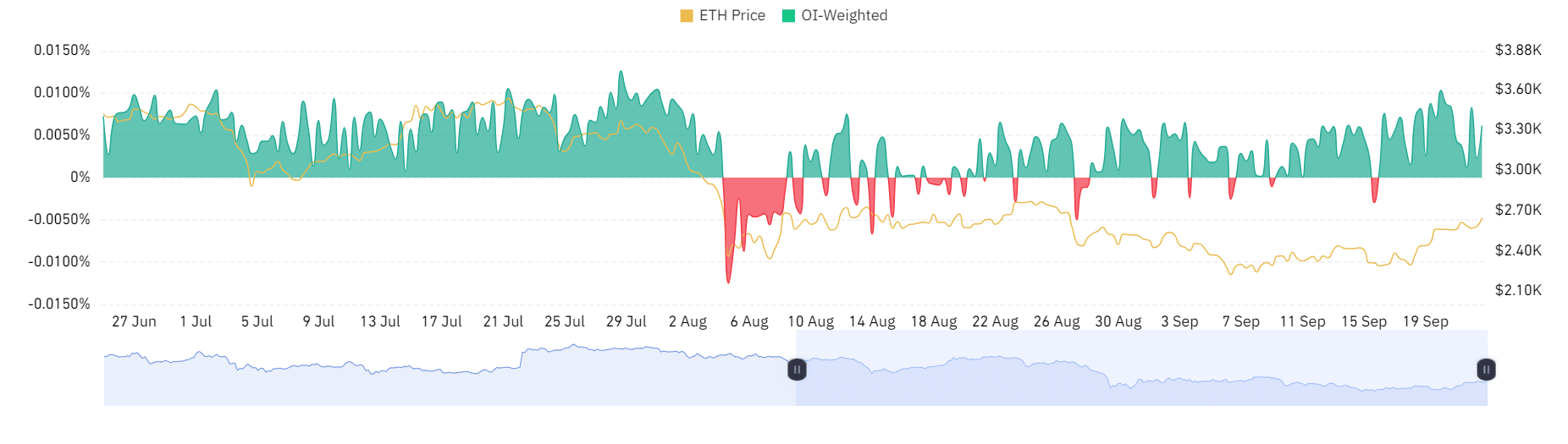

Source: Coinglass

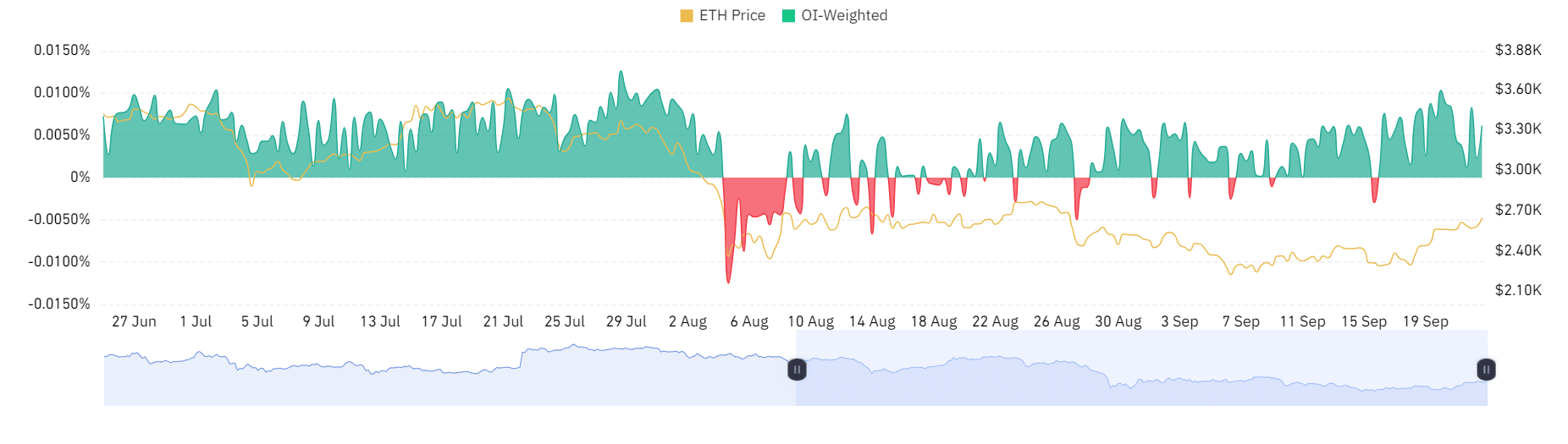

Finally, Ethereum’s OI-weighted funding rate has been positive over the past week. A positive OI-weighted funding rate indicates increased demand for long positions with these holders paying shorts.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Therefore, as noted by ChainStatsPro, ETH is experiencing an increase in active buyers. This positive market sentiment positions the altcoin for further gains.

If the current conditions hold, ETH will attempt a $2800 resistance level in the short term.

Credit: Source link