- Raydium showed a series of bullish signals in the 4-hour time frame chart.

- RAY’s inflows were positive in the last 24 hours, suggesting a slight return of bulls.

Raydium [RAY] was trading at $5.57, as of press time, which was a 23% increase in the past 24 hours, according to CoinMarketCap. The volume also surged by 94% which was $356M.

RAY has escalated more than 190% from the initial breakout point identified earlier in the trend, suggesting it may be repeating the pattern.

In the H4 timeframe, RAY showed a series of bullish signals, particularly the breakout from a bullish pennant pattern. This suggests a potential continuation of the uptrend.

Source: TradingView

The formation of a bullish pennant, with the price consolidating after a sharp rise followed by an upward breakout, indicated strong buying pressure.

The resistance levels to watch, based on recent price action, are near $6.40 and $7.60. These align with projected increases of about 35% to 50% from the breakout point.

These metrics point out…

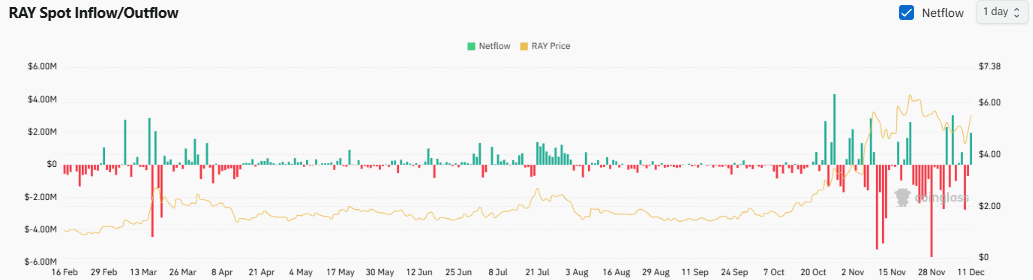

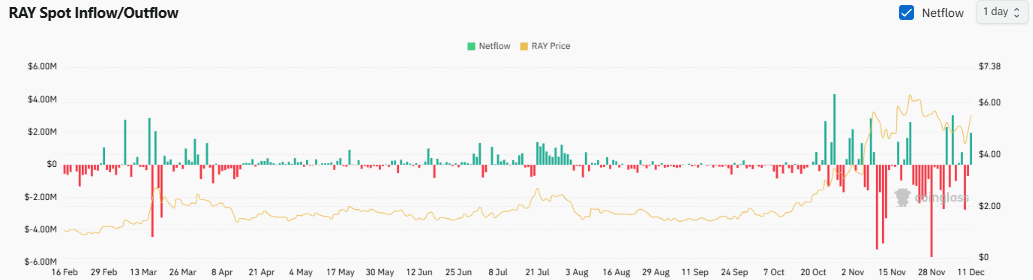

RAY’s Spot Inflow/Outflow has shown substantial variation, with significant spikes in inflow especially visible in recent weeks. These inflows corresponded to price fluctuations in RAY.

The peaks in net inflow suggested renewed buying interest, potentially indicating a bullish sentiment among traders.

Inflow spikes do support the potential 35% increase, but they also bring potential volatility, as evidenced by the quick rebounds to outflow.

Source: Coinglass

A sustained increase in buying pressure is a strong indicator of potential rally continuation, despite the OI-Weighted Funding Rate being -0.0319%. This means short traders are paying long traders.

In the last 24 hours, the positive net inflow suggests a slight bullish return. However, careful observation of continued trends in inflow and outflow is necessary to confirm any long-term price movements.

RAY’s DEX Volume

After trailing Uniswap for most of the year, Raydium surpassed Uniswap in October with a DEX volume of $90.5 billion compared to Uniswap’s $45.3 billion.

In November, RAY achieved a remarkable $124.6 billion, more than doubling Uniswap’s $51.1 billion. This supports the anticipated 35% surge, although it’s subject to change.

Source: Messari

Read Raydium [RAY] Price Prediction 2024-2025

This surge in Raydium’s volume, driven significantly by memecoins which constituted 65% of its November transactions, indicated its recent dominance.

The “Pump Fun” event notably contributed over $100 million in monthly fees to Raydium, indicating strong financial performance and user engagement within the platform.

Credit: Source link