Crypto sentiment has slid to what CryptoinsightUk founder Will Taylor describes as “historical lows,” and the damage is starting to show up in higher-timeframe indicators that rarely flash. In a Feb. 14 weekly note, Taylor argued the setup is shifting from “collapse” to late-stage drawdown and pointed to XRP priced in gold as one of the cleanest tells.

Taylor framed the week as “another painful week in crypto,” but said the timing of the pessimism matters. On Bitcoin’s weekly chart, he wrote, BTC “has just hit oversold levels for only the third time in recent history,” adding that the prior two occurrences marked either the bear market low or “very close to it.” In his telling, extreme sentiment paired with a statistically rare signal leans toward exhaustion rather than fresh downside acceleration.

The core of Taylor’s argument rests on positioning for a volatility expansion in Bitcoin dominance. He said Bollinger Bands on dominance are “extremely compressed,” a configuration he views as unstable: “Compression leads to expansion. And expansion leads to volatility. In simple terms, volatility is inbound.”

Related Reading

Direction is the debate. Taylor’s base case is a downside break in dominance – eventually below 36% – which, if paired with a resilient or rising Bitcoin price, would imply not just new money entering crypto but rotation across the risk curve. He cited a prior episode as a template: in November 2024, when dominance fell by roughly 10 percentage points, “XRP saw a subsequent move of around 490%,” which he characterized as “a vertical expansion.”

To corroborate the rotation setup, Taylor pointed to the OTHERS/BTC ratio: the market outside the top 10 relative to Bitcoin. On the monthly timeframe, he said RSI “has just crossed bullish,” and that the chart is “on the verge of printing” a second green monthly MACD volume candle after what he described as a bullish cross near the lows. The combined picture, he argued, is alignment: altcoins starting to regain relative strength as dominance volatility compresses.

XRP Against Gold: A ‘Historic Zone’ Setup

Taylor’s more specific claim centered on XRP priced in gold, a pairing he said is largely ignored despite being structurally informative. “When you look at XRP priced against gold, what you’ll notice is that we’ve pulled back into an extremely strong historical support region,” he wrote. “At the same time, on the monthly timeframe, the RSI has reached levels we have only ever seen once before. And that was just before the 2017 parabolic expansion.”

From there, Taylor sketched a scenario rather than a prediction: if XRP holds that support and completes what he called a 4.236 Fibonacci extension “from this structure,” the move could be “around 20x against gold.” He stressed the usual caveat that relative performance doesn’t map cleanly to the dollar pair. “That does not automatically mean 20x against the dollar,” he wrote, noting gold itself could weaken, and “macro conditions could shift.”

Related Reading

Still, he argued the relative signal is the point. In his framework, sustained outperformance versus gold suggests capital “aggressively rotating into risk,” a backdrop where altcoins tend to lead.

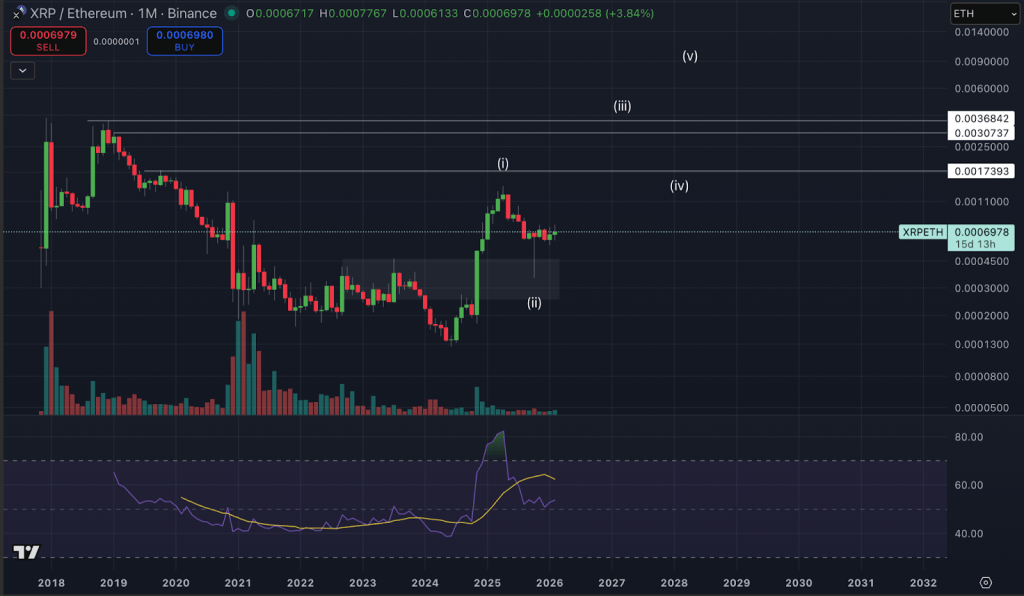

Taylor added a second relative-strength angle: XRP versus Ethereum. He floated an Elliott Wave interpretation in which XRP may have completed wave one and wave two against ETH, setting up a potential wave three: “typically the most aggressive, most explosive leg.” While calling Elliott Wave “a framework, not a certainty,” he emphasized a momentum detail: monthly RSI holding above 50 through consolidation, which he viewed as consistent with continuation rather than breakdown.

At press time, XRP traded at $

Featured image created with DALL.E, chart from TradingView.com

Credit: Source link