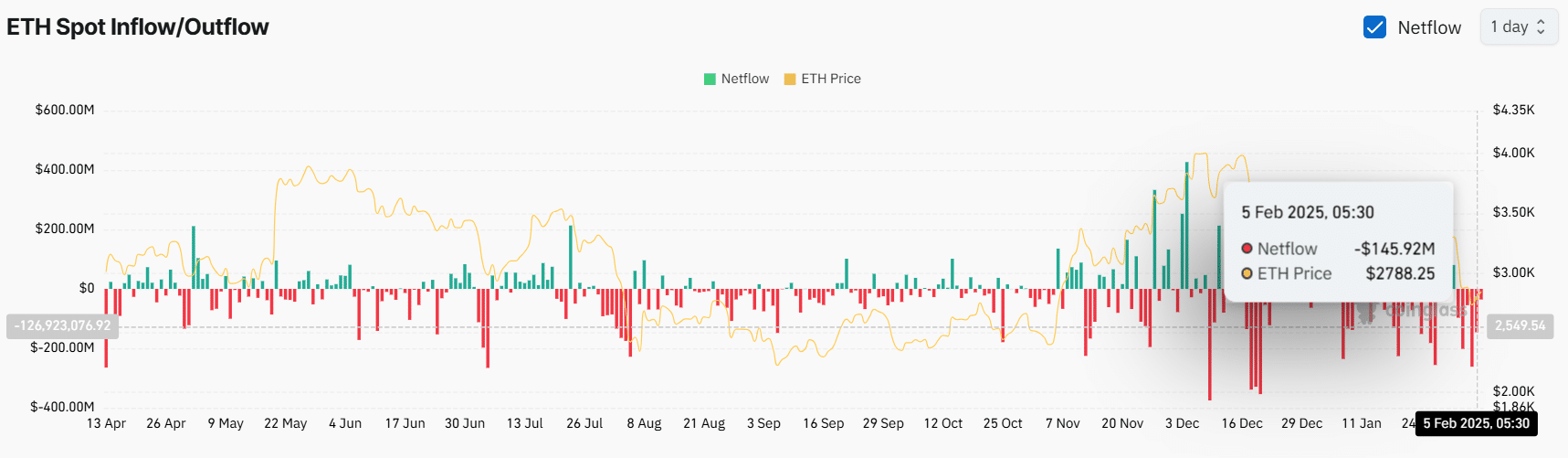

- On-chain metric revealed that exchanges have seen outflows of $180 million worth of ETH

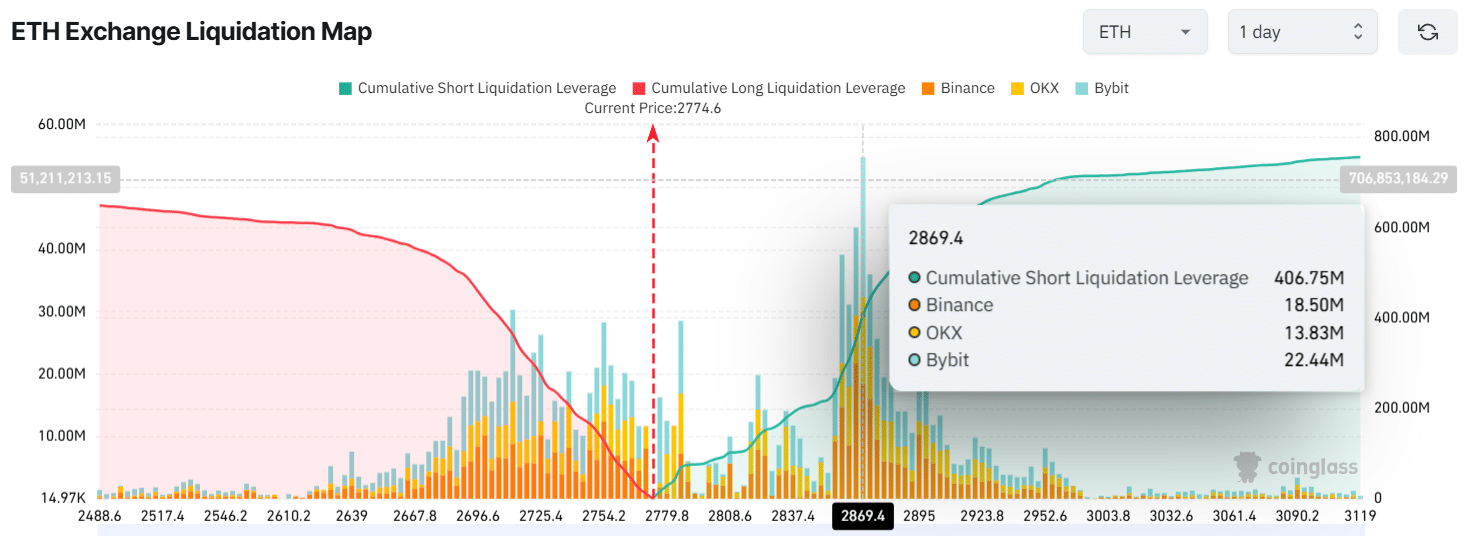

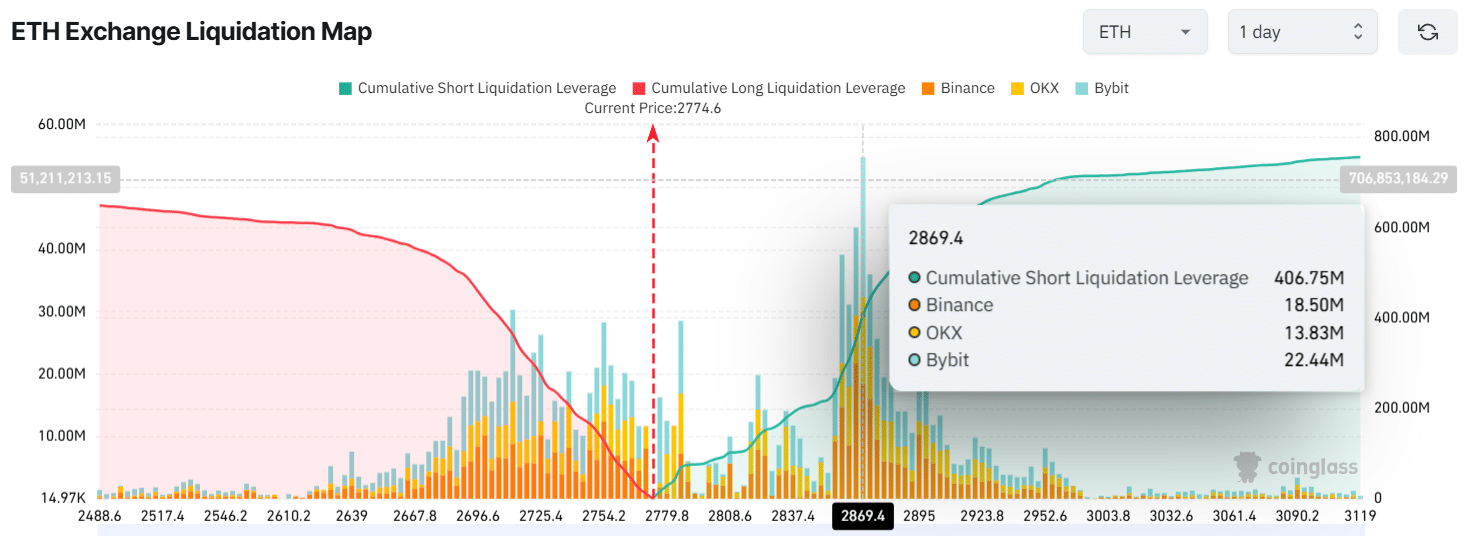

- Intraday traders are currently over-leveraged at the $2,712-level on the lower side and $2,870 on the upper side

After a sharp price decline across the cryptocurrency market, sentiment has completely shifted. Amid this, Ethereum (ETH), the world’s second-largest cryptocurrency, might just be changing its prevailing market sentiment as it has been gaining significant attention from crypto experts and investors.

$180 million worth of ETH outflows

On 06 February, data revealed that investors and long-term holders have been on a buying spree, possibly taking advantage of the recent price drop.

Data from spot inflows and outflows showed that exchanges witnessed outflows of $180 million in ETH in the last 48 hours, potentially indicating accumulation.

Source: Coinglass

Such outflows from exchanges can fuel buying pressure and lead to a further upside rally.

Short positions and liquidation levels

Besides the bullish sentiment among long-term holders and investors, intraday traders seem to be betting on the bearish side. Particularly due to the current market sentiment.

In fact, ETH’s exchange liquidation map revealed that traders may be over-leveraged at the $2,712-level on the lower side and $2,870 on the upper side. This hinted at the actual support and resistance levels for the altcoin.

However, if the market sentiment remains unchanged and the price falls to the $2,712-level, nearly $365 million worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price crosses the $2,870-level, approximately $406 million worth of short positions will be liquidated.

Source: Coinglass

These liquidation levels suggested that the bulls were weak, while traders holding short positions have been leading the asset at the intraday level.

Experts eye on critical levels for long-term

For the longer time frame, popular crypto expert Ali shared a post on X (formerly Twitter), stating that if ETH holds above the $2,500-level, there is a strong possibility it could rebound to $4,000 or even $6,000 in the future.

Meanwhile, if the altcoin fails to hold this level and closes a daily candle below $2,500, it could fall to the $1,700-level – Its next support.

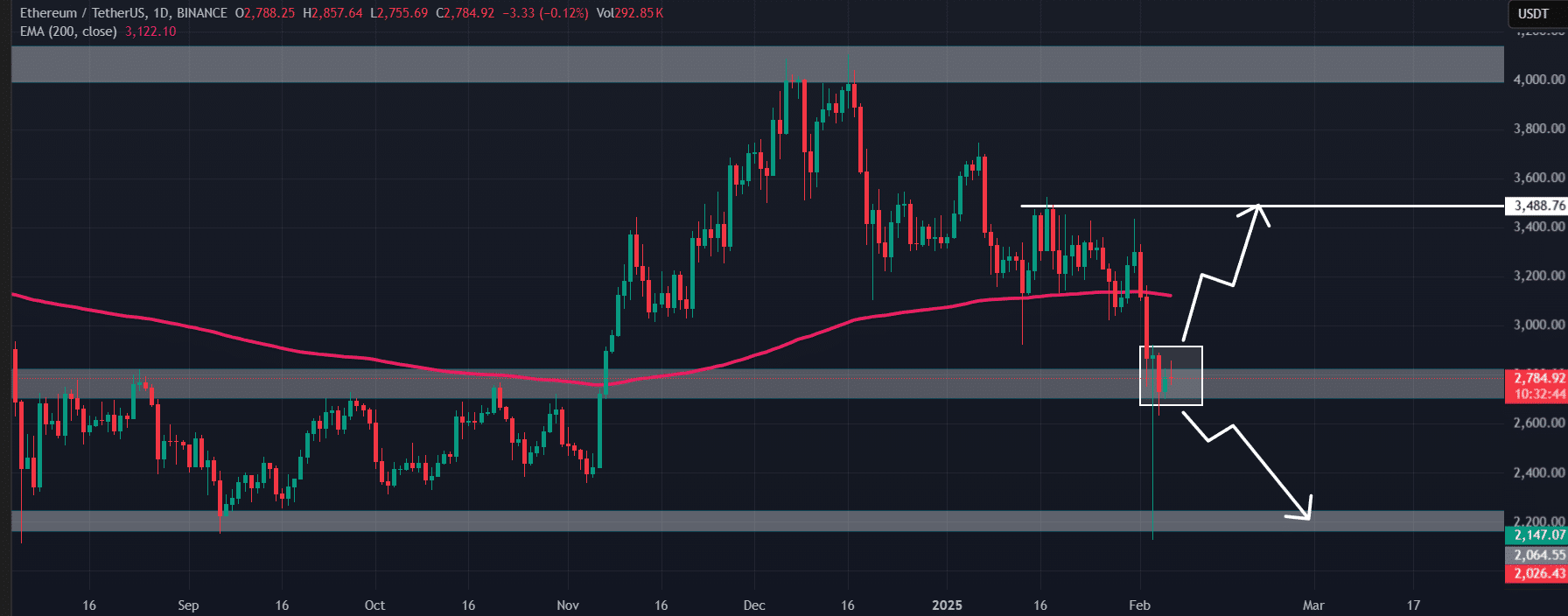

Price action and upcoming levels

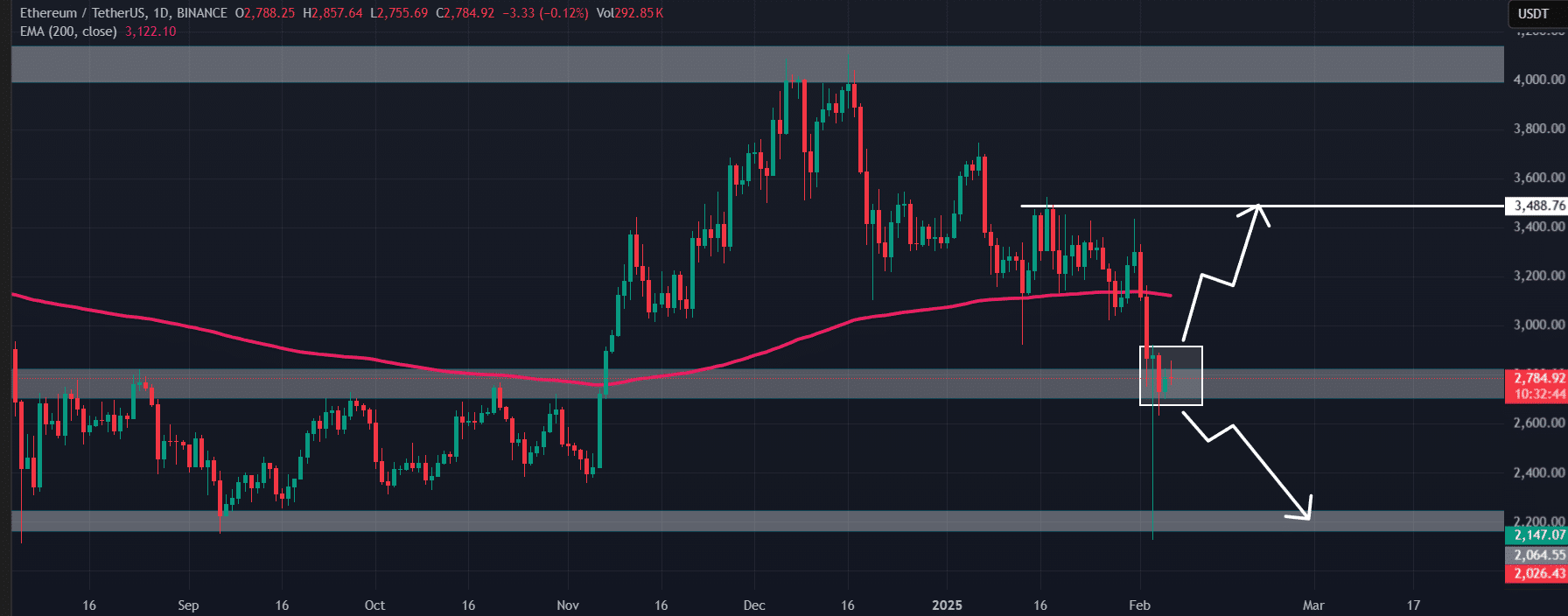

Besides expert predictions, AMBCrypto’s technical analysis suggested that ETH was near the crucial support level of $2,800 at press time. This appears to be a make-or-break situation for the crypto as it has been consolidating at this level for the last three days.

Source: TradingView

Based on the altcoin’s latest price action, if ETH rallies and closes above the $2,880-level, it could see a price surge of over 22% to hit the $3,500-level in the future.

However, if ETH’s price declines further and closes a daily candle below the $2,720-level, we could see the asset drop to $2,200 in the future.

Credit: Source link

![Ethereum’s [ETH] price could hike by 22% to hit $3,500 ONLY if…](https://i2.wp.com/ambcrypto.com/wp-content/uploads/2025/02/image-2025-02-06T185836.992.png?w=1024&resize=1024,1024&ssl=1)