- Despite bearish market sentiment and a recent Bybit security hack, this Ethereum whale accumulation reflects strong confidence in ETH’s long-term potential.

- The ETH price is approaching a key support level at $2,300, which is crucial for preventing further declines toward $2,000.

Ethereum price action has taken an unusual turn this February, diverging from its long-term trend of robust performance. Large investors or “whales,” however, continue to build up ETH, expressing confidence in the asset’s long-term prospects, as mentioned in our previous post.

Ethereum Whale Accumulation & Market Behavior

Recent on-chain statistics reveal a massive surge in ETH balances in wallets holding between 10,000 and 100,000 ETH. The balances in these holders have grown by 24% in the last year from wallet withholdings of less than 1,000 ETH. CryptoQuant CEO Ki Young Ju identified this trend, stating that the current price is near the cost basis of these accumulation addresses.

“Wow, CT sentiment on ETH is extremely bearish,” he said on social media, expressing puzzlement about the reasoning behind the bearishness. The CryptoQuant CEO added, “Most bears seem to cite the dropping price itself as their reason for selling. Very interesting.”

Ether, despite short-term pressure downwards, looks more bullish as per on-chain metrics and whale activity. Though there has been a large-scale security hack on Bybit that would have provoked huge sell-offs, there hasn’t been much selling pressure yet. The on-chain and market metrics are also neutral, and over-the-counter (OTC) trading contributes little to the price.

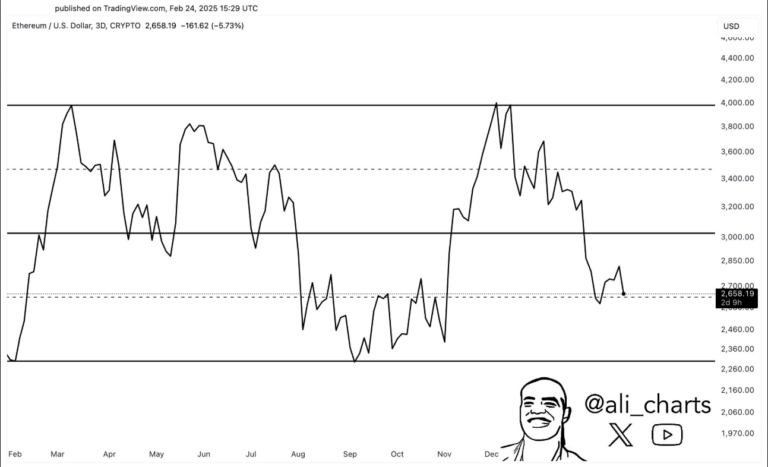

Ethereum price is approaching a crucial support level at $2,300, a threshold it has maintained since early 2023. According to analyst Ali Martinez’s post, this level is critical, if breached, it could accelerate losses towards the psychologically significant $2,000 mark.

Another technical pattern to monitor is the falling wedge on Ethereum’s daily chart. Traditionally, this pattern heralds potential bear trend reversals. If ETH bounces back from the wedge’s lower end and crosses over resistance with substantial buying pressure, it might set off a rally toward $3,200. Failure to hold the support level, however, may cause more pressure to go lower.

Whilst, a dramatic drop in the price of Ethereum was compounded by over $307 million in involuntary liquidations in a 24-hour span, according to Coinglass. Such occurrences tend to cause price declines in the short term but can also provide opportunities for value accumulation. If liquidations normalize, ETH can stabilize and return to its growth trend.

Regulatory Shifts Amid Growing Institutional Interest

Ethereum’s dominance of the stablecoin market is another reason for whale accumulation. ETH currently backs 56% of the entire stablecoin market cap, making it a pillar of blockchain-based finance. As regulatory attitudes in the U.S. change, especially under the Trump administration, more institutional adoption of Ether-based stablecoins and smart contracts may ensue in 2025.

“With Trump easing crypto regs, more firms may use ETH-based stablecoins and smart contracts in 2025,” Ki Young Ju observed. That regulatory change, together with ETH’s well-established position in the digital asset economy, might catalyze institutional demand. On the other hand, as per our recent analysis, ETH developers have successfully deployed the Pectra upgrade on the Horsely testnet.

Additionally, Ethereum’s spot exchange-traded fund (ETF) has already been approved. It’s paving the way for what some analysts believe may be a “Large Cap ETF altseason.” If institutional inflows soon follow, ETH may see substantial price gains over the course of the year.

Credit: Source link