- Ethereum’s accumulation zones signal investor confidence despite recent market volatility.

- Key price levels at $2,632 and $3,149 could define ETH’s next major price movement.

Ethereum [ETH] has experienced price turbulence recently, leaving market watchers uncertain about what lies ahead. However, a key indicator points to steady, even bullish sentiment among investors.

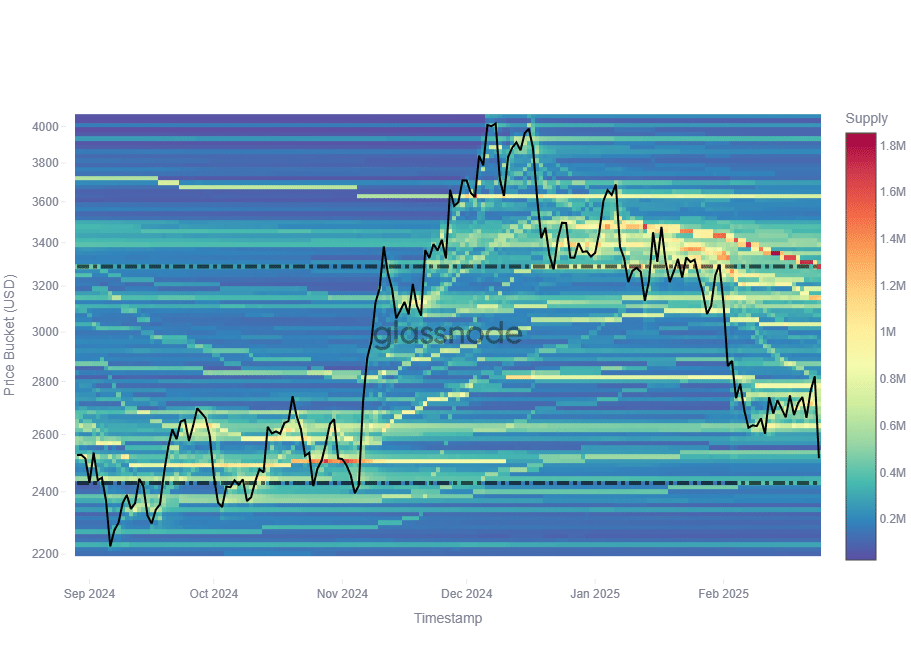

The ETH cost basis distribution reveals a notable trend of accumulation at lower price levels, particularly around $2,632 and $3,149.

These zones are creating a solid support structure, especially at the $2,632 mark, which could signal the beginning of price stabilization after recent downturns.

The question now is: How will this support hold up against broader market dynamics?

What the data shows

The Cost Basis Distribution (CBD) tracks the price levels at which investors acquired their ETH holdings, offering insights into market sentiment and accumulation trends.

A downward shift in cost bases suggests that investors have been buying into dips, reinforcing key price levels.

Recent Glassnode data shows multiple cost bases moving lower, indicating steady accumulation despite price volatility.

This suggests that investors view ETH’s recent decline as a buying opportunity rather than a reason to exit. If this trend continues, it could support price stabilization.

Accumulation zones

Ethereum’s accumulation zones highlighted key price levels where investors actively built positions. The strongest support zone was at $2,632, where 786.66K ETH has been accumulated.

This level represented a potential floor, as past trends showed buyers stepping in aggressively around this price.

Source: Glassnode

On the flip side, resistance looms at $3,149, with 1.22M ETH accumulated. If ETH rallies, this zone could act as a barrier, triggering sell-offs as investors take profit.

Historically, strong accumulation levels have dictated market swings, making these zones critical in assessing ETH’s next move.

Why this matters for ETH’s future

ETH’s recent price action pointed to a critical moment for its future trajectory. The RSI at 33.30 indicated that ETH was nearing oversold territory, meaning a potential bounce could be on the horizon.

However, it hasn’t yet reached extreme lows, suggesting further downside risk remains.

Source: TradingView

The MACD histogram flipping negative reinforces the bearish momentum, with the MACD and signal lines widening apart — typically a sign of continued selling pressure.

ETH’s price breaking below $2,500 is significant, as it threatens to test the $2,632 accumulation zone identified earlier.

If buyers step in at this support, a recovery toward the $3,149 resistance is possible. But failure to hold could trigger a deeper correction, making the next few trading sessions crucial.

Credit: Source link