- ENA’s price exhibited notable fluctuations, rising 1.89% from $0.4020 to $0.4096 before dropping to $0.3790 underselling pressure.

- ENA’s CME Futures Open Interest surged to $120,000 on the 6th of March 2025, coinciding with Bitcoin’s rise to $65,000.

Ethena [ENA] recently unlocked 2.07 billion ENA, worth $740.71 million, marking a major increase in circulating supply.

This move, along with large investor deposits into major exchanges, has raised questions about potential price movements and market stability.

The Ethena unlock

On the 5th of March 2025, Ethena released 2.07 billion ENA into circulation, constituting 39.17% of its total supply. Following this event, large investors moved 125 million ENA, worth $45 million, to Binance, Bybit, and FalconX.

Historically, similar unlocks have triggered price declines due to increased supply and profit-taking by investors. The significant deposit volumes indicate that investors may be hedging or securing profits in anticipation of a market downturn.

Despite the dilution risk, long-term stability could arise if demand effectively absorbs the new supply. However, if selling pressure continues, ENA might test lower levels, potentially dropping to $0.30.

This pattern aligns with previous altcoin unlocks, where deposit surges often preceded price corrections.

Navigating ENA’s market swings

Recently, ENA’s price exhibited notable fluctuations, rising 1.89% from $0.4020 to $0.4096 before dropping to $0.3790 under selling pressure. The Volatility Index stood at 0.3769, indicating moderate market swings.

Meanwhile, aggregated spot CVD declined from -108.707M to -107.359M and later to -107.07M, signaling a bearish volume imbalance where sellers dominated buyers.

Source: TradingView

The downward CVD trend discouraged traders from aggressive buying, as sustained selling momentum suggested further downside risk.

If CVD reverses into positive territory, a recovery to $0.4200 could be possible. Conversely, should volatility exceed 0.4000 and CVD remain weak, ENA may dip toward $0.3500.

This pattern resembled ADA’s recent dump, where similar CVD trends preceded further declines.

ENA Market sentiment and price implications

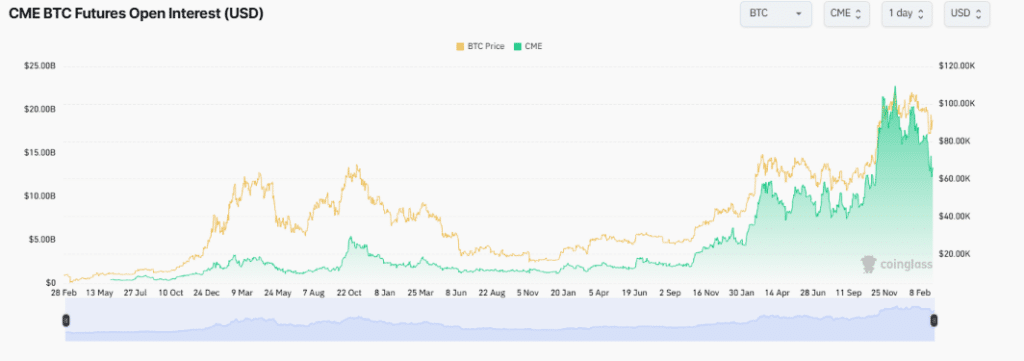

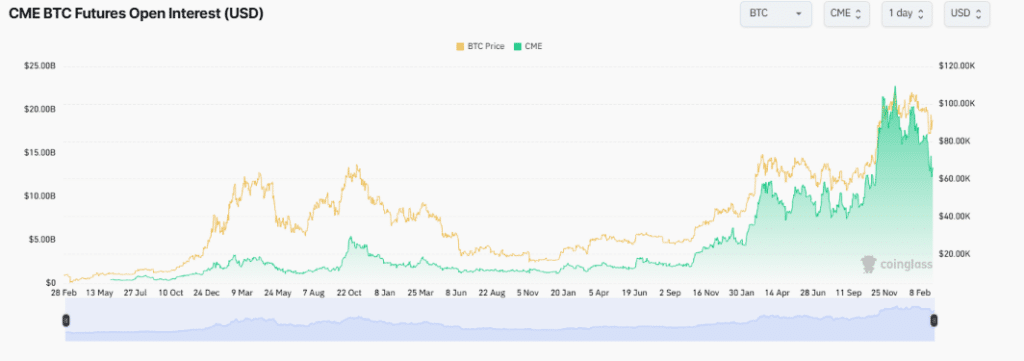

ENA’s CME Futures Open Interest (OI) surged to $120,000 on the 6th of March 2025, coinciding with Bitcoin’s rise to $65,000. Over prior weeks, OI grew from $20,000 to $100,000, peaking at $110,000 in late February.

This uptrend indicated increased leveraged exposure, with open interest closely tracking Bitcoin’s price movements around $60,000.

Source: CoinGlass

If OI stays high, bullish sentiment could drive $ENA toward $0.4500. However, a drop in OI below $50,000 might trigger liquidations, potentially dragging prices down to $0.3800.

Ethena’s $ENA unlock event introduced significant supply-side pressure, with 125 million tokens transferred to exchanges, likely for profit-taking.

Although $ENA initially saw a 1.89% price increase, a declining CVD points to ongoing selling pressure.

Credit: Source link