- TRX whales are moving large amounts, indicating potential volatility in the market

- TRX has been testing critical support levels recently, with a balanced market between bulls and bears

A massive transfer of 92.9 million TRX, valued at approximately $21.4 million, has been moved from an unknown wallet to Binance. Such significant transactions typically signal upcoming volatility, which could influence the TRON [TRX] market in the near future.

At the time of writing, TRX was trading at $0.2242, following a 3.07% fall over the last 24 hours. The market is now on alert, with investors closely watching to see if this activity will spark a bullish breakout or lead to further downside pressure.

Is TRX in the money or out?

At press time, a significant portion of TRON holders were “in the money,” with 48.43% of addresses holding 41.31 billion TRX worth $9.39 billion. This meant that the price seemed to be favorable for many investors, offering some support at these levels.

However, 24.61% of addresses were “out of the money,” holding 20.99 billion TRX valued at $4.77 billion.

Therefore, while a majority of holders have been seeing profits, a significant number are still underwater. This could contribute to selling pressure if TRX fails to maintain its prevailing price levels.

Source: IntoTheBlock

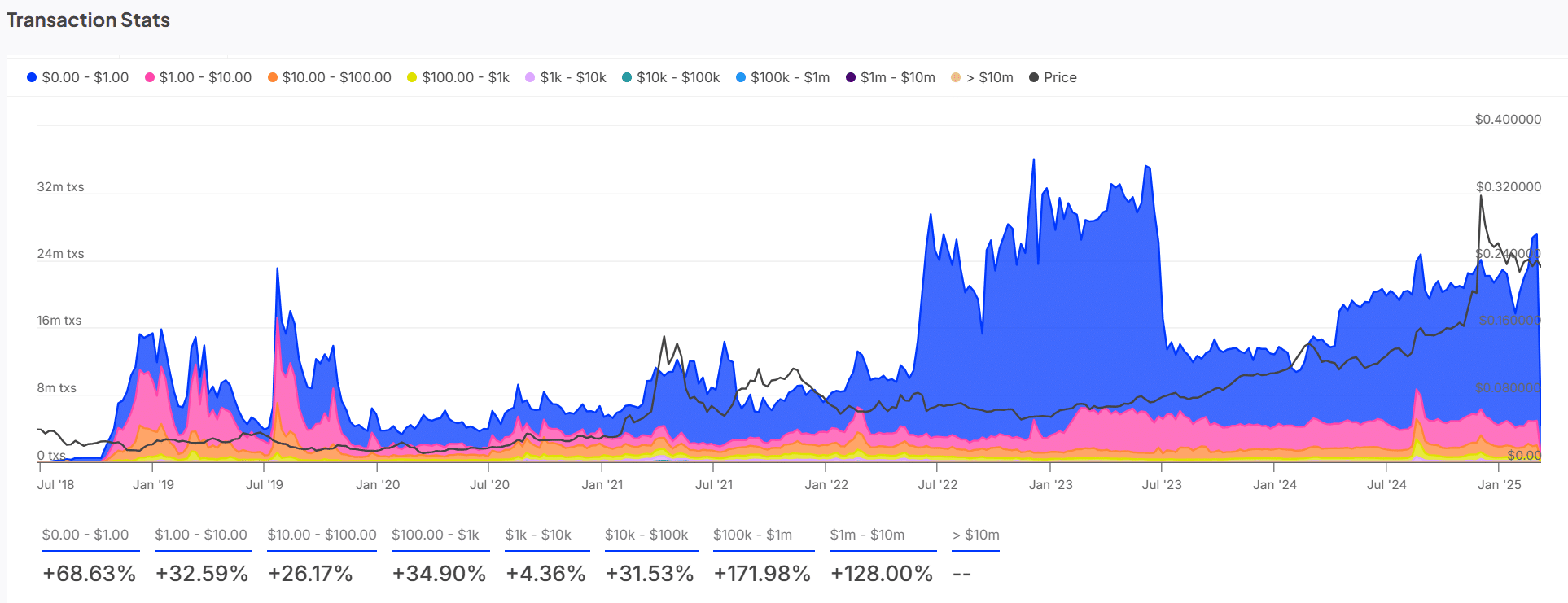

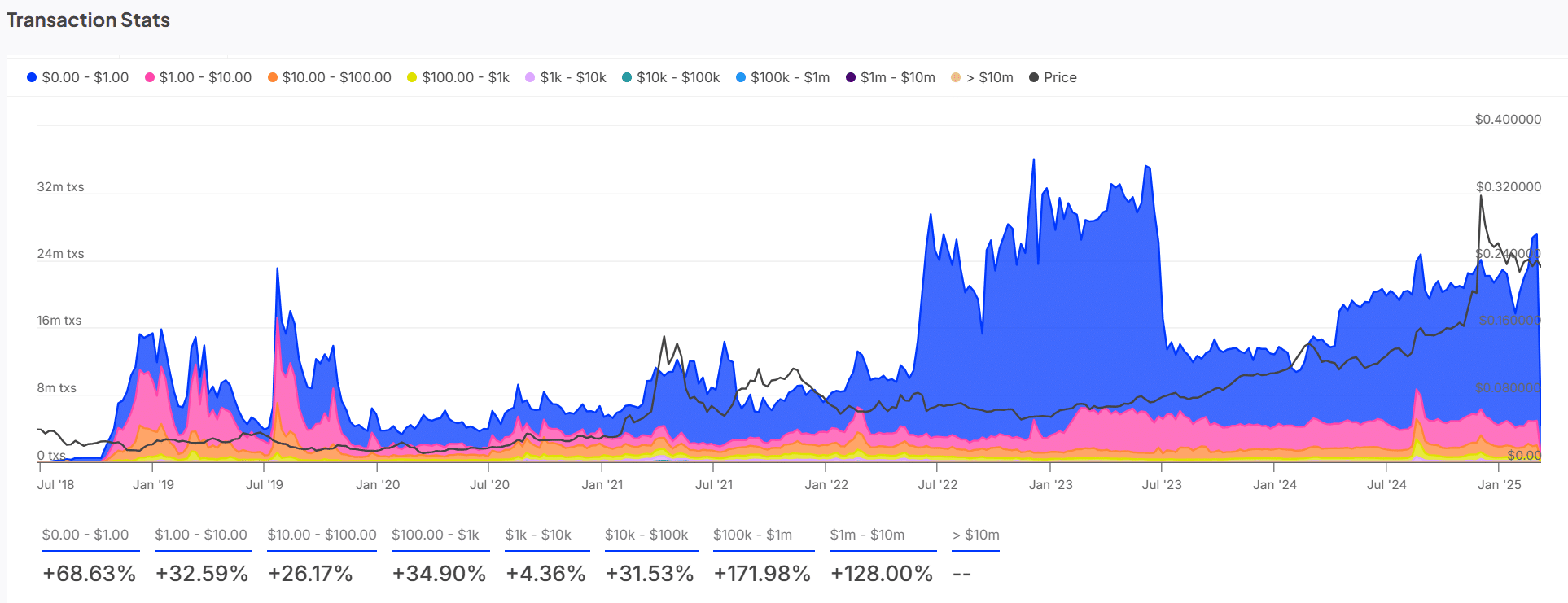

How do TRON transactions look?

Looking at TRX’s transaction volume, an uptick in larger trades can be seen. Epecially in the $100k+ range. This growing interest from larger investors, such as whales and institutions, could indicate that market participants are preparing for potential volatility.

Additionally, the rise in high-volume transactions seemed to suggest that some players have been positioning themselves for a possible price surge. All while others might be offloading their positions ahead of a potential downturn. This dynamic could lead to more price fluctuations in the coming days, as the balance of power between buyers and sellers shifts.

Source: IntoTheBlock

Technical outlook – Testing key support zones

TRON has been consolidating within a rectangular range since late December, with price action bouncing between $0.2185 and $0.25701. At the time of writing, TRX was testing its support zone at $0.2185, and this level would be crucial for determining the next move.

If the price holds above this support level, TRX could maintain its consolidation phase or possibly break out higher.

However, if the support level fails, further downside is likely, with the next significant support target being around $0.2185. Traders will be watching closely to see if the support holds, which could indicate a potential reversal or a deeper correction.

Source: TradingView

TRX bulls vs. bears – Who’s winning?

At the time of writing, there seemed to be a near balance between bulls and bears, with 111 bulls and 107 bears. Despite the market’s struggles, the bulls held a slight edge. However, the bears were still active, and the market sentiment was cautious too.

The bulls have been unable to sustain upward momentum for an extended period, and the bears continue to apply pressure, creating a tense market environment. This balanced sentiment leaves TRON vulnerable to either a bullish breakout or further downside – Depending on how the market reacts in the short term.

Source: IntoTheBlock

Conclusion

The massive TRON transfer to Binance has added to the growing volatility in the market. The price seemed to be consolidating within a narrow range, with the altcoin soon testing key support too.

While there is some bullish sentiment, the lack of a clear breakout and the ongoing balance between bulls and bears leaves room for more downside. Therefore, it may be more likely that TRX will see further downside unless a strong catalyst appears to push it higher.

Credit: Source link