- The head-and-shoulders pattern signaled a potential bearish reversal for Ripple, with key support levels at $2.40 and $2.15.

- On-chain activity remained strong, with rising active addresses and a balanced market sentiment.

Ripple [XRP] has been riding a wave of volatility recently, with a significant price surge followed by the formation of a head-and-shoulders pattern on the chart. This pattern, typically signaling a reversal, raises concerns about whether XRP’s bullish momentum can continue.

At the time of writing, the altcoin was trading at $2.40, down 1.96% in the last 24 hours.

The question is whether this pattern will result in a price decline, or if XRP can break through resistance levels and keep its upward trend intact.

Head-and-shoulders pattern: Is XRP headed for a fall?

The head-and-shoulders pattern is a well-known technical indicator that signals a potential bearish reversal. This formation features a central peak (the head) flanked by two smaller peaks (the shoulders), suggesting weakening buying pressure.

The neckline acts as a critical support level, and a break below it often confirms a downward trend.

However, XRP has key support levels at $2.40 and $2.15, which may prevent a significant price drop. If these levels hold, XRP could stabilize and continue testing higher resistance zones, such as $2.61 and $2.90.

Source: TradingView

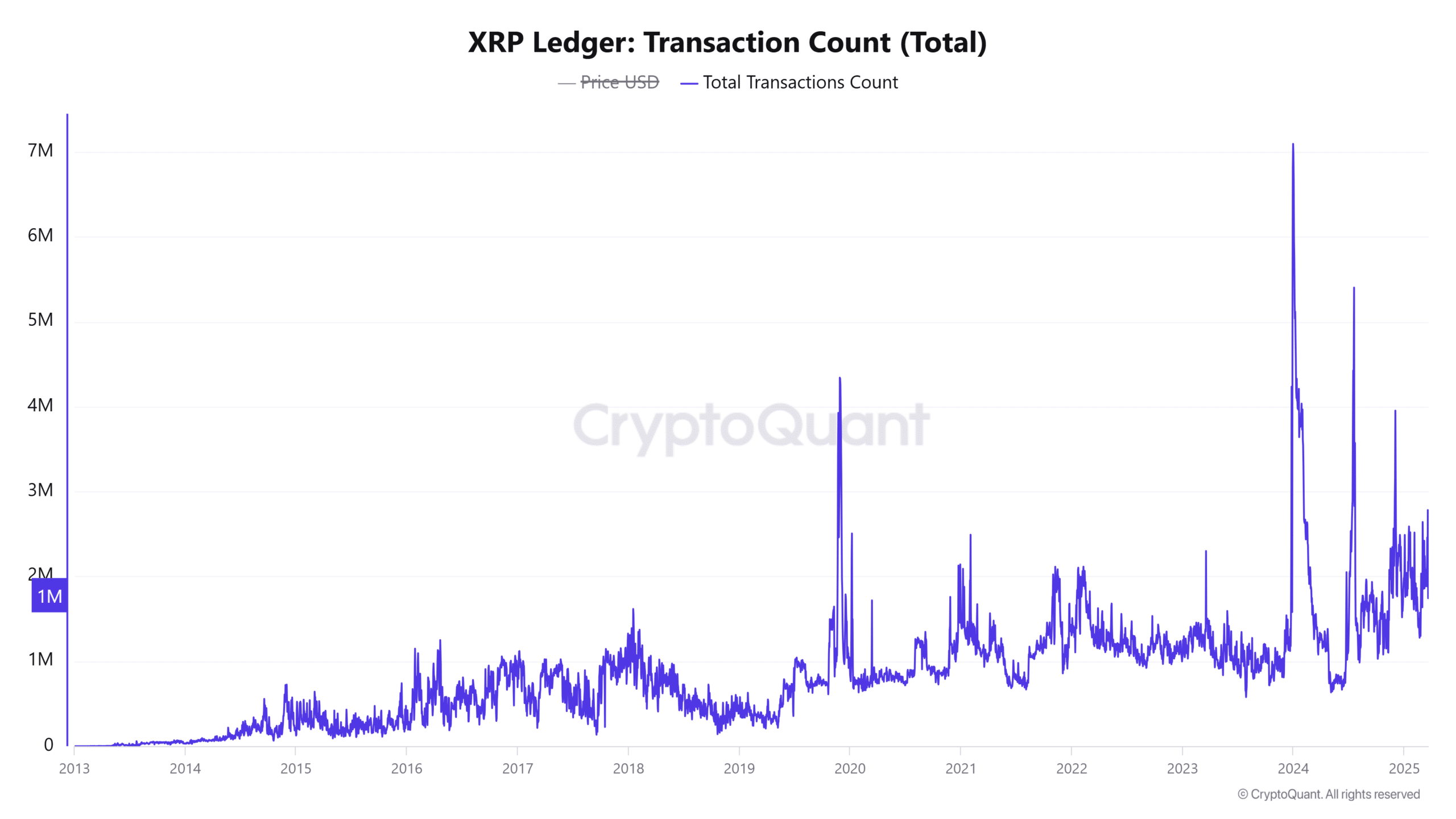

Active addresses and transaction count: Are users still engaged?

Despite the price fluctuations, XRP’s on-chain activity remains strong. Active addresses have increased by 1.12%, reaching 30.39K, indicating rising participation within the network.

Source: CryptoQuant

Additionally, the transaction count has seen a slight uptick of 0.77%, showing continued interest in XRP despite recent volatility. This suggests that, regardless of price movements, XRP’s network activity is healthy and growing, which could support its value in the long run.

Taker buy-sell ratio: Is the market in equilibrium?

According to CryptoQuant, XRP’s Taker Buy-Sell Ratio currently stands at 0.49, indicating a balanced market with no clear dominance from buyers or sellers. This ratio, alongside a 0.99% increase in the last 24 hours, suggests that traders are waiting for clearer price direction.

This market balance implies that XRP may experience short-term consolidation, as neither side exerts strong buying or selling pressure. This could result in range-bound price movements until a breakout occurs.

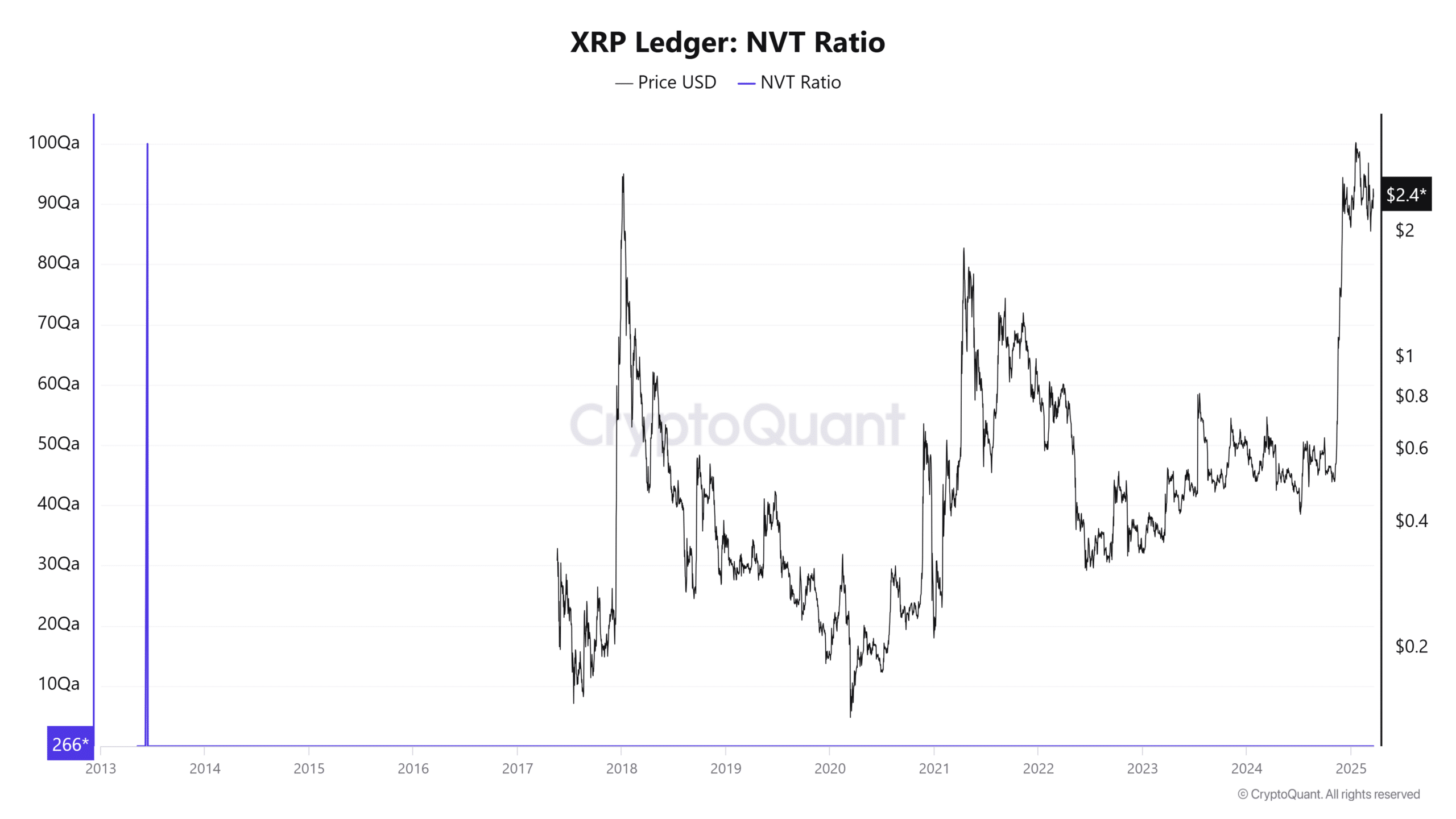

Meanwhile, XRP’s Network Value to Transactions (NVT) ratio has risen by 41.61%, reaching 266.07, suggesting that XRP may be overvalued compared to its transaction volume.

A high NVT ratio often signals the potential for a price correction, as it indicates market capitalization is outpacing transaction activity.

The surge in the NVT ratio raises concerns about XRP’s valuation, potentially signaling that a price pullback might be imminent.

Source: CryptoQuant

What next for XRP

The classic head-and-shoulders pattern signals a potential decline for XRP. However, strong on-chain activity and balanced market sentiment suggest it could retain its value.

The rising NVT ratio, though, indicates possible overvaluation, increasing the likelihood of a price correction.

Holding key support levels is critical for XRP to avoid a significant drop. The coming days will determine whether it continues to climb or if bearish signals take control.

Credit: Source link

![Ripple [XRP] shows reversal signals – Is THIS pattern a warning?](https://i1.wp.com/ambcrypto.com/wp-content/uploads/2025/03/XRPUSDT_2025-03-21_10-03-57.png?w=1024&resize=1024,1024&ssl=1)