- SOL’s $118 zone has defended a price fall several times since start of March 2024

- Binance buying back SOL at the $118 zone after dumping at $135 could shape Solana’s price short-term outlook

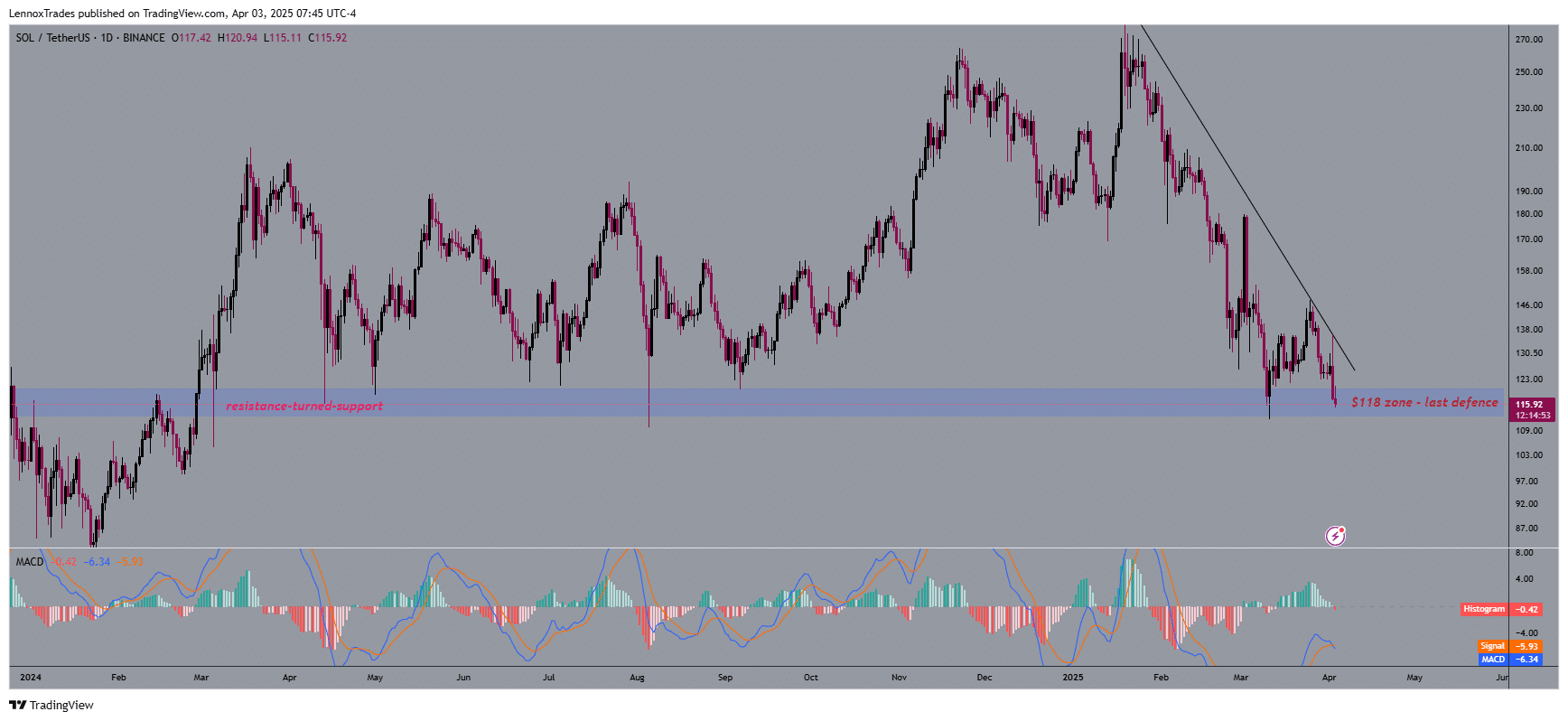

Since March 2024, the $118-price level served as a vital border that stopped Solana’s [SOL] price from falling more severely. The price position below $115.92 created conditions for SOL to face further price drops, despite being within the range of this crucial zone.

Previous attempts to stabilize SOL’s price around $110 and $100 could come into play now though. Especially since traders have failed to reclaim the $118 support after Trump’s ‘Liberation Day’ tariffs.

At the time of writing, both the MACD line and its Signal line remained below zero at -6.34 and -5.93, respectively. The potential formation of a bearish crossover increased both selling forces which could implement more losses for the market.

Source: TradingView

However, the histogram was somewhat positive and indicated that momentum loss could potentially slow down. What this meant was that it could open up opportunities for market stability or recovery.

If SOL reclaims $118, it could result in a move towards the descending trendline approaching the $130-area. A price jump through this resistance zone could create upward momentum to search for targets near $150 or higher.

Generally, Solana’s market has seen some bearish potential because $118 has remained in limbo. This zone’s reaction could determine its next move. Holding below it would signal more bearishness, while reclaiming it might hint at a possible reversal.

How Binance’s SOL buy-back could shape future movements

A deeper look into the on-chain activities showed that through Wintermute, Binance and Coinbase tactically cleared multiple SOL positions.

They initiated a price boost to $135, flushing shorts positions at the peak by selling long positions until the price hit $120. This further led to liquidation of longs below and around $120.

At press time, Binance had initiated the SOL purchases through Wintermute, as per Marty Party’s post on X, after finishing its previous transaction. This alluded to how SOL’s price trends could have been influenced by this transaction.

The buyback operation seemed to indicate a possible market floor at $118, one which could produce positive market sentiment for a recovery towards $135 or higher. Only if bullish conditions return though. And, that will start with reclaiming $115.

An inadequate level of market confidence could lead to another price decline, despite Binance’s buying activities.

Daily DEX volume from top chains

Worth pointing out, however, that Solana saw bullishness in other metrics. Its figures of $2.417 billion in daily DEX volume surpassed the volumes of Ethereum at $1.899 billion, BSC at $1.066 billion, and Base at $973.44M.

Also, more than $550 million has been bridged from other chains to Solana over the past month, including over $400M from Ethereum to Solana alone. Over 1.15M new tokens were launched on Solana too.

Source: DefiLlama

Conditions of elevated DEX usage, combined with multiple token creations, could drive SOL’s price towards $130 as it could appeal to more users on the network.

Profit-taking operations along with market movements could, however, reduce SOL’s pricing to $100 as the market readjusts itself.

Credit: Source link