- Bitcoin’s strong 2024 rally and a shift in risk sentiment are fueling its case as a new safe-haven asset.

- Market metrics suggest uncertainty as whales shift positions near $95K, pointing to a possible turning point.

Bitcoin is steadily climbing into territory long held by gold, with fresh support from leading voices in traditional finance.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, pointed out a key shift in performance metrics, noting Bitcoin’s changing role in global markets.

Ironically, gold and bitcoin are negatively correlated to each other. As the chart below shows, both assets have been taking turns lately, as measured by their Sharpe Ratios. From the looks of it, it may well be bitcoin’s turn to take the lead, given that its Sharpe Ratio is… pic.twitter.com/yhTDRemt3e

— Jurrien Timmer (@TimmerFidelity) May 2, 2025

He pointed out that the Sharpe Ratio of Bitcoin is -0.40 while that of gold is much higher at 1.33. The negative correlation between the assets of the two is driving the change of guard discussions.

Bitcoin also got all the attention in 2024, having finally crossed the long-anticipated $100,000 mark last month,” Timmer noted. Gold, however, still had a solid year, coming out ahead of the S&P 500.

But even as it surged, gold suffered an uptick in volatility over the past decade, while its price climb has been dwarfed by the allure of Bitcoin in broader society and its parabolic price trajectory

At present, Bitcoin is trading at $96,505.39. It is just a bit lower than the figure of its last peak, and experts are taking sides on whether the current level is the mark of a long-term consolidation phase or if still another rally is coming up.

Bitcoin Traders Pull Back Amid $92K–$95K Tug of War

Even though Bitcoin has been seeing strong price action, some indicators show that large traders are beginning to adopt a more cautious approach. The $92K-$95K area, as mapped out in data shared by FundingVest, has become crucial.

Aggregate long positions in it have fallen, suggesting that some traders may be distributing rather than accumulating. The second can be inferred from the Long/Short Accounts Ratio, which is visibly biased towards the short side.

High-profile traders have exited positions or are waiting on the sidelines. Position-to-account ratio, which measures risk appetite, has slid from earlier highs. Once again, the investors are taking some of their profits, and others are shorting the market to protect themselves from a slippage.

And if net longs keep falling and shorts grow, this could pressure the market and prices pull back. But if too many traders rush into short positions, a squeeze could drive prices back up in rapid fashion.

Whale Sentiment Points to Rising Short Bias

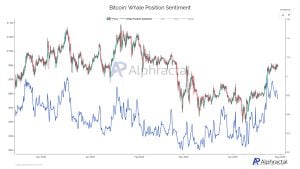

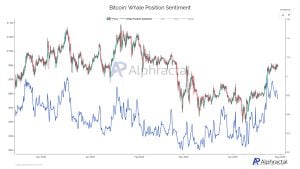

One more significant indicator of the market is the activity of the whales. The Whale Position Sentiment indicator generated by Alphractal exposes some signals that there is a starting movement towards short positions from the most influential whales in cryptocurrency.

This measurement, which takes into account transactions of at least $1M on the premium platforms and compares them with the supply of contracts, shows a historical correlation of 93% with the price of Bitcoin. Bearish whale sentiment has often been a good indication that prices may soon go down.

At this very moment, the metric is decreasing while the price of Bitcoin is increasing, leading to the conclusion that there are big traders now who make short positions.

In case this situation lasts long, this would be the end of Bitcoin’s recent uptrend and the beginning of a short-term price drop. On the other hand, if sentiment turns and the whales move into long positions again, the surge to $100K and even more will be possible.

Recommended for you:

Credit: Source link