Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

As Bitcoin (BTC) hit a new all-time high (ATH) of $111,980 on Binance crypto exchange yesterday, technical data suggests that the latest BTC rally is being dominated by buyers. If this trend continues, BTC may see further price appreciation in the near term.

Buyers Regain Control Of Bitcoin Spot Market

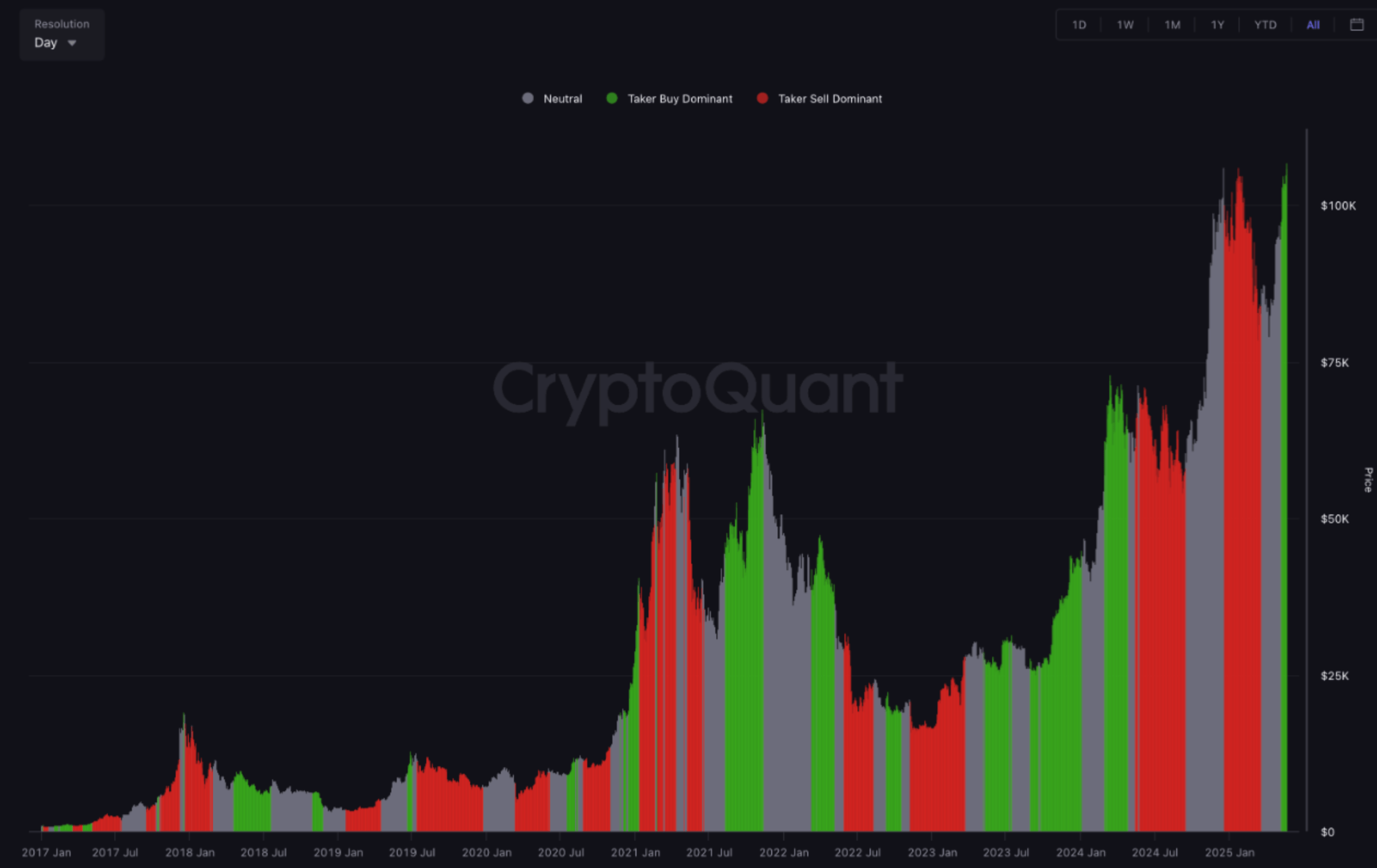

According to a recent CryptoQuant Quicktake post by crypto analyst ibrahimcosar, buyers appear to be dominating the BTC spot market. The analyst observed that the Bitcoin Spot Taker Cumulative Volume Delta (CVD) has shifted back into green territory.

For the uninitiated, Bitcoin Spot Taker CVD measures the difference between taker buy and taker sell volumes on spot exchanges over time. A rising Spot Taker CVD indicates that aggressive buyers are dominating the market, signalling potential bullish momentum.

Related Reading

BTC Spot Taker CVD turning green is signficant. Most notably, it means buy orders have regained dominance after an extended period in which sell orders led the market. A higher volume of buy orders over time suggests that Bitcoin’s current bullish momentum may persist.

As shown in the chart shared by ibrahimcosar, the CVD remained mostly red for the majority of Q1 2025 – indicating strong selling pressure. This selling behavior aligned with BTC’s price action, which saw the asset fall from its previous ATH in January to a low of around $76,000 in April.

The fact that BTC’s Spot Taker CVD has turned green while the asset is setting fresh ATHs makes this trend especially noteworthy. It indicates that buyers are willing to accumulate BTC even at historically high prices, likely in anticipation of continued upside.

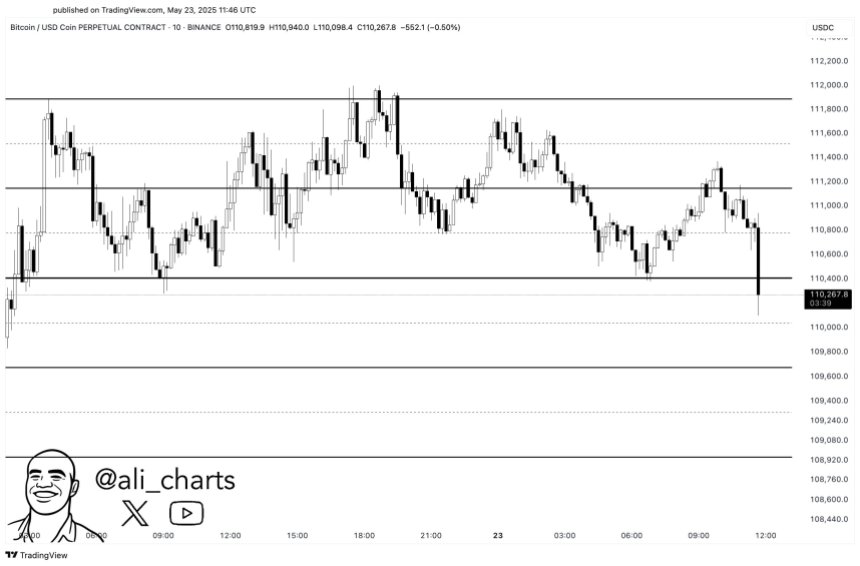

That said, recent price action might temporarily interrupt BTC’s momentum. In an X post, crypto analyst Ali Martinez suggested that BTC could soon break down from its current range of $110,400 to $111,100.

A Different Kind Of Rally

Typically, BTC hitting a new ATH is usually met with wider market euphoria, leading to a sharp price decline that catches most investors off-guard. However, experts opine that the current rally is different from previous cycles.

Related Reading

Recent analysis by CryptoQuant contributor Crazzyblockk suggests that new and short-term BTC investors are sitting on substantial unrealized profits, and not showing any signs of panic selling amid the cryptocurrency’s price surge to new highs.

Similarly, whale reaction to BTC’s bullish price trajectory has been mixed. While new whales have been taking major profits during the ongoing rally, old whales have resisted selling their holdings, showing minimal selling activity.

Finally, the neutral funding rates in the BTC futures market reinforce the idea that the current rally is more organic and less driven by speculation than those in the past. At press time, BTC trades at $108,553, down 2.6% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and Tradingview.com

Credit: Source link