Ripple’s native token XRP is caught in limbo and remains stagnant at the $2.2 to $2.3 price range. The leading altcoin has barely moved up the charts in two months and is trading sideways testing the patience of investors. Money is not being made in these conditions and is catching dust in the wallets.

In this article, we will highlight what technical pointers say about Ripple’s XRP. This could make you make a sound decision whether to buy the leading altcoin or to sell it and book profits. Also, we will explain if you should hold the altcoin expecting better gains in the future.

Also Read: Ripple Price Prediction: $589 XRP in Focus After 21 EMA Retest

XRP: What Do Technical Pointers Say?

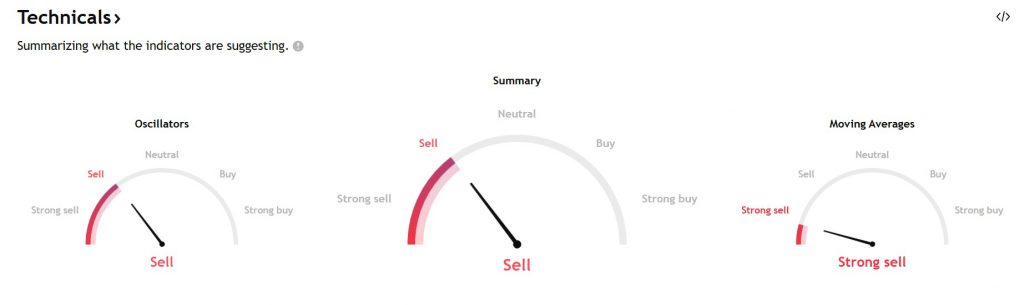

The technical pointers on TradingView point toward the ‘sell’ option for Ripple’s native token XRP. Summarizing the technicals, the Oscillators point towards a sell, while the Moving Averages show ‘strong sell’. Therefore, all pointers lead to the same direction which is a ‘sell’ and ‘strong sell’.

Also Read: Ripple & Solana Deals Solidify UAE as Global Force of Crypto Adoption

The poor price movements are a recurring trend suggesting that a downward movement is on the cards. The estimates suggest that it is best to sell XRP now and book profits and not hold on to it as there are more chances of losing the money. Book profits and wait for further decline to take an entry position in the altcoin.

In addition, accumulating XRP at the $2.2 range would be a wrong decision as stagnation would make investments standstill. The best time to load up on XRP could be when it falls below the $2 price level next. Anything below the $1.8 to $1.7 level would be a perfect buy as it could bottom out in price.

Despite finding new partnerships and providing fintech solutions to governments, banks, and other financial institutions, XRP failed to rally in the charts this quarter. So the chances of soaring here on remain slim.

Credit: Source link