A Shiba Inu whale transfer to Coinbase worth $36.6 million occurred on June 4th when 2.87 trillion SHIB tokens moved to Coinbase Prime. This Shiba Inu coin dump alert initially sparked concern, but investigation reveals the transaction involved Wintermute market maker moving funds from BitGo custody, not an anonymous whale dump amid cryptocurrency market volatility.

Also Read: SHIB Price Bullish: $5K Could Become $5M on 503% Rally

Analyzing Shiba Inu Whale Transfer, Market Volatility, and Security Risks

What Really Happened in This Shiba Inu Whale Transfer to Coinbase

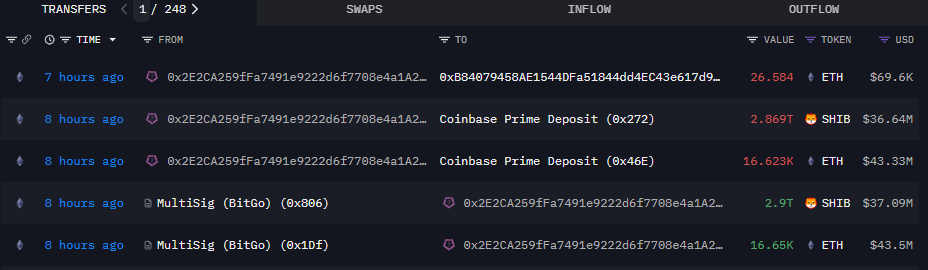

The transaction occurred Wednesday at 21:24 UTC from wallet “0x2e2c” to Coinbase Prime, and it wasn’t as mysterious as it first appeared. Whale Alert initially flagged this as an unknown whale movement, but research revealed the sending address belonged to Wintermute, a prominent market maker in the space.

This Shiba Inu coin dump alert wasn’t actually a dump at all. At 20:53 UTC, BitGo multisignature wallet “0x808” had transferred 2.9 trillion SHIB ($37 million) plus 16,650 ETH ($43.5 million) to Wintermute, which then moved the assets to Coinbase for trading operations and liquidity provision.

Why This Large Shiba Inu Wallet Movement Occurred

Market makers regularly move funds from custody platforms to exchanges for liquidity provision, and this is exactly what happened here. This Shiba Inu whale transfer to Coinbase represents routine operational movement rather than speculative selling that could trigger cryptocurrency market volatility.

Coinbase Prime serves institutional investors, not retail traders looking to make quick profits. The destination suggests sophisticated positioning rather than a simple Shiba Inu coin dump alert scenario that retail investors feared at the time of writing.

Market Impact and Security Implications

Despite the massive volume, SHIB price remained stable at $0.00001281 after this large Shiba Inu wallet movement. The token was already down 2.34% in 24 hours, and the transfer didn’t trigger additional selling pressure or panic among holders.

This demonstrates how crypto security risks are managed through institutional infrastructure. BitGo‘s custody services, Wintermute’s established operations, and Coinbase Prime’s security work together to prevent cryptocurrency market volatility from large movements like this one.

Also Read: SHIB ‘To Pump Like Crazy Next Week,’ Analyst Says $0.00004 Ahead

Historical Context of Similar Movements

Previous large SHIB transfers haven’t caused significant price impact, and this pattern continues. The Crypto Basic reported similar cases, including Crypto.com’s 32.47 trillion SHIB transfer that turned out to be internal shuffling rather than market-affecting moves.

The professional handling of this Shiba Inu whale transfer to Coinbase shows institutional involvement continues with SHIB. Rather than representing bearish sentiment, the transaction demonstrates how established players manage large Shiba Inu wallet movement without creating unnecessary crypto security risks or triggering harmful cryptocurrency market volatility through panic selling.

Credit: Source link