Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

On-chain data shows Tron (TRX) observed a large profit-taking spike earlier in the month. Which type of holder was responsible for the move?

Tron SOPR Saw A Huge Spike Earlier In The Month

In a CryptoQuant Quicktake post, analyst Maartunn has talked about the recent trend in the Spent Output Profit Ratio (SOPR) of Tron. The SOPR refers to an on-chain indicator that tells us about whether the TRX investors are moving or selling their coins at a profit or loss.

The indicator works by going through the transfer history of each coin being moved to see what price it was last transacted at. Coins that have this cost basis above the current spot price are contributing to loss realization, while those with the opposite setup to profit realization.

Related Reading

The SOPR takes the ratio between the spent value and cost basis, and sums it up for all coins being sold on the blockchain to find a net situation for the market as a whole.

When the value of the indicator is greater than 1, it means the investors are, on average, realizing a profit through their transactions. On the other hand, the metric being under this threshold suggests the dominance of loss realization in the market.

Now, here is the chart shared by the quant that shows the trend in the Tron SOPR over the past year:

As displayed in the above graph, the Tron SOPR saw a huge spike above the 1 mark earlier in the month, implying investors took part in a significant amount of profit-taking.

From the chart, it’s also visible that there were other profit realization spikes during the past year, but the current one stands out for its scale. The latest peak in the metric saw its value go to 4.74, corresponding to a profit margin of 374%.

“With TRX priced at $0.268 at the time, the average acquisition price for those coins would have been around $0.0566,” explains Maartunn. Interestingly, Tron hasn’t seen extended periods around this price mark since late 2022, meaning that the tokens would have been held for a good while before being finally transacted this month.

Usually, when dormant hands break their silence, it’s likely to be for selling-related purposes. That said, it’s not the only reason they may do so. “The activity could be tied to early investors realizing gains, internal transfers, or reallocation decisions,” notes the analyst.

Related Reading

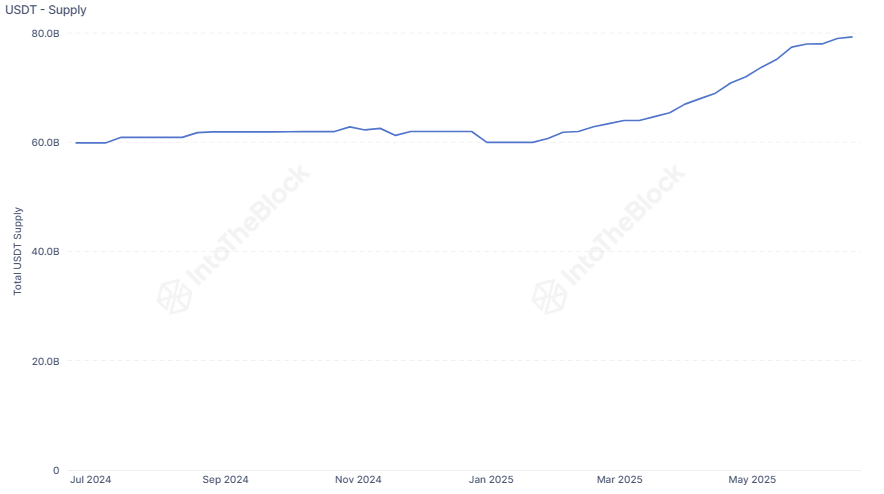

In some other news, the USDT supply on the Tron network has reached a new milestone, as institutional DeFi solutions provider Sentora (formerly IntoTheBlock) has pointed out in an X post.

There is now over $80 billion in USDT supply circulating on Tron, the second-most out of any cryptocurrency network.

TRX Price

At the time of writing, Tron is trading around $0.273, up 0.5% over the last 24 hours.

Featured image from Dall-E, IntoTheBlock.com, CryptoQuant.com, chart from TradingView.com

Credit: Source link