Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) enters the third quarter (Q3) of 2025, bullish sentiment is growing, fueled by historical post-halving patterns that have repeatedly marked the beginning of explosive market moves. A crypto analyst now points to recurring trends observed in past cycles, where Q3 has often acted as a launchpad for significant price rallies in BTC following each halving year.

Bitcoin Post-Halving Years Point To Explosive Q3

Luca, a crypto market expert on X (formerly Twitter), has doubled down on expectations for a major Bitcoin price rally in the coming quarter. He argues that expectations of an extended consolidation in Bitcoin, based on the fractals and market behavior seen in 2023 and early 2024, fail to account for a critical factor: 2025 is a post-halving year.

Related Reading

The analyst points to a consistent pattern observed in every post-halving year throughout Bitcoin’s history. In his chart analysis published on June 26, Luca notes that Q3 in these years have consistently demonstrated strength, with no historical precedent for weakness, reinforcing the case for a bullish breakout.

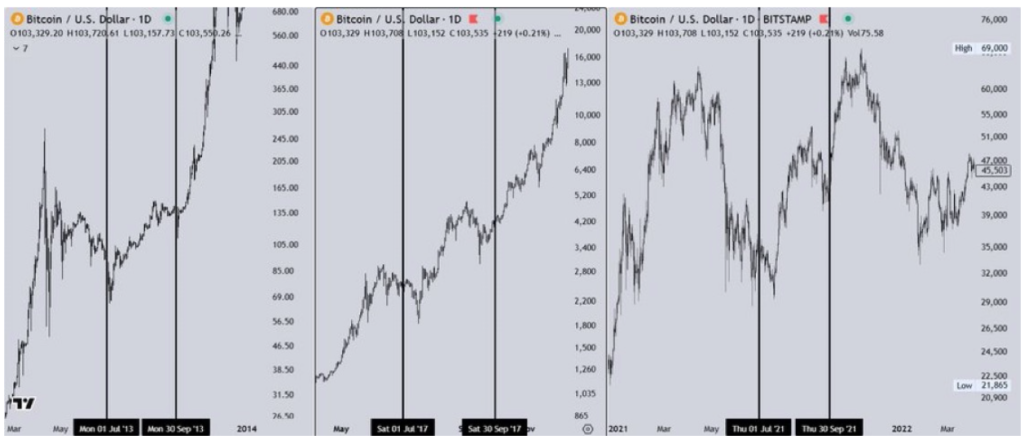

The chart compares Q3 performance during the post-halving years of 2013, 2017, and 2021. In each case, Bitcoin entered the third quarter with moderate or corrective price action, only to rally significantly in the weeks that followed.

The left panel of the chart shows the 2013 post-halving year, where Bitcoin went from under $100 in July to over $680 in November. In 2017, the middle panel highlighted a similar trajectory, where BTC broke out from under $2,800 in early Q3 to over $16,000 by year-end.

The most recent cycle in 2021, shown in the right panel of the chart, saw a Q3 recovery rally that took Bitcoin from under $39,000 in July to a former all-time high above $69,000 in November.

Notably, Luca maintains that this consistent historical behavior is not coincidental, predicting that a similar rally could unfold in the current cycle, within the next few months. While he acknowledges the possibility of a short-term pullback, he emphasizes that Bitcoin’s broader market structure remains firmly bullish, with momentum still favoring further upside.

Analyst Predicts $140,000 – $160,000 Bitcoin Cycle Top

Moving forward, Luca’s chart reveals technical factors that align with his bullish thesis. Based on key Fibonacci Extension levels, the analyst projects that BTC’s next cycle top falls between $140,000 and $160,000, a target he believes could be attained toward the end of Q3.

Related Reading

While acknowledging that the exact target could shift depending on how technical confluences evolve, the expectation remains that a Bitcoin rally is imminent. With BTC now trading around $107,423 after rebounding from a previous dip below $100,000, a potential move to $140,000 or even $160,000 would mark a substantial gain of approximately 30.35% and 48.97%, respectively.

Featured image from Unsplash, chart from TradingView

Credit: Source link