- On-chain volume and transaction activity have reached new highs, but SOL price continues to decline.

- Both spot and futures market participants are still active, buying more SOL.

Over the past 24 hours, Solana [SOL] dropped 3.5% to $150.67, marking a reversal from its 6.15% weekly rally, at press time.

Market analysis reveals a divergence between on-chain sentiment and off-chain activity. While one segment leans bearish, the other is driving buy pressure.

AMBCrypto examines this divide.

On-chain activity soars—Is this good?

On-chain activity has seen a significant uptick, with more users interacting on the network.

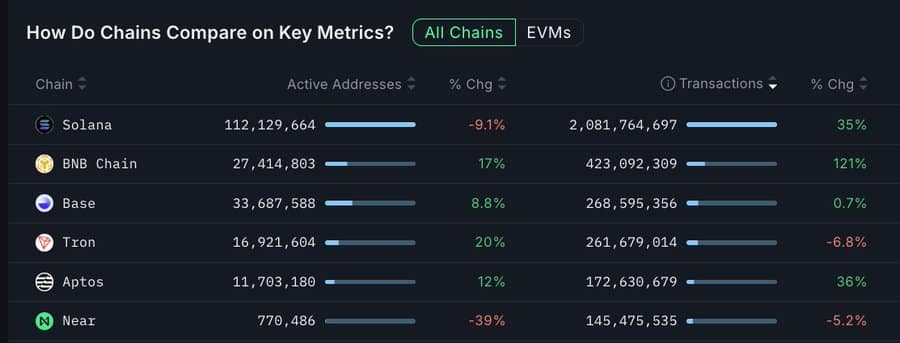

According to Nansen, Total Transactions on the Solana blockchain in the past 30 days surged by 35%, reaching approximately 2 billion.

Source: Nansen

This increase in transaction count was matched by a notable rise in On-chain Volume.

Data from DeFiLlama shows that the total volume traded hit $61.513 billion over the past month. In just the last 24 hours, Trading Volume stood at $2.078 billion.

With this performance, Solana currently ranks second in trading volume—behind Binance Smart Chain—surpassing Ethereum, Base, and Sui.

Typically, high volume and increased transactions reflect strong market interest and buying sentiment. But in this case, the trend doesn’t match expectations.

Users exit, adding to the price slump

Despite the surge in activity, Solana’s weekly active users have dropped. According to Artemis, the number of active users fell to 22 million—matching a low last seen in early May.

Source: Artemis

This user decline, occurring alongside falling prices and rising volume, suggests that a portion of the market is selling.

Such behavior indicates declining confidence in SOL’s potential for a rebound. The downtrend had already started before the latest price drop.

Others see an opportunity in SOL’s dip

While on-chain data suggests some are selling, off-chain indicators in the spot and futures markets reflect a growing bullish sentiment.

At press time, investors are either buying SOL or taking long positions in anticipation of a rally.

Source: CoinGlass

Over the past two days, buyers have re-entered the market after a period of selling, according to CoinGlass data.

In the last 24 hours alone, $27.5 million worth of SOL moved from exchanges to private wallets.

If this trend continues, it could reduce exchange reserves and increase demand—potentially pushing SOL’s price higher.

Likewise, derivative activity has surged over the same period. Open Interest Weighted Funding Rate—a metric that reflects a market bias in perpetual futures, signaled a buyer-dominated trend at the time of writing.

Source: CoinGlass

The rate stood at a positive 0.0025%, indicating that long contracts outnumber shorts and suggesting the market could favor buyers.

Credit: Source link