- Litecoin has consolidated for 1,127 days—over five times longer than before its 2020 1,623% surge.

- With the EMA55 breakout confirmed and ETF access growing, Litecoin targets $1,000 in this bullish cycle.

Litecoin (LTC) has once again captured attention after posting gains of more than 10% in the past 7 days. At the time of writing, LTC was trading around $101.75. However, what has analysts growing in confidence is not just its price movement, but also its long-term consolidation pattern, which is considered mature.

According to Master Ananda, Litecoin’s consolidation since 2022 has now lasted 1,127 days. Compare this to 2020, when a mere 210-day consolidation triggered a price surge of up to 1,623%.

Tracing the weekly technical analysis, Litecoin has broken through the 55-EMA and 200-EMA—two indicators often used by medium-term traders. Even more interestingly, when similar conditions emerged in 2020, LTC immediately surged without much interruption for over 200 days.

Now, the situation appears to be a repeat of that pattern. After being rejected from the 55-EMA in May, Litecoin rebounded and has now broken through that resistance again in July. “This second period is usually a golden opportunity,” said Master Ananda.

Whales Move In as Retail Pulls Back, Bullish Sentiment Grows

On the other hand, signals from large players are also increasingly apparent. CNF reported that in the past few days, whales have accumulated around 360,000 LTC while retail investors have begun selling.

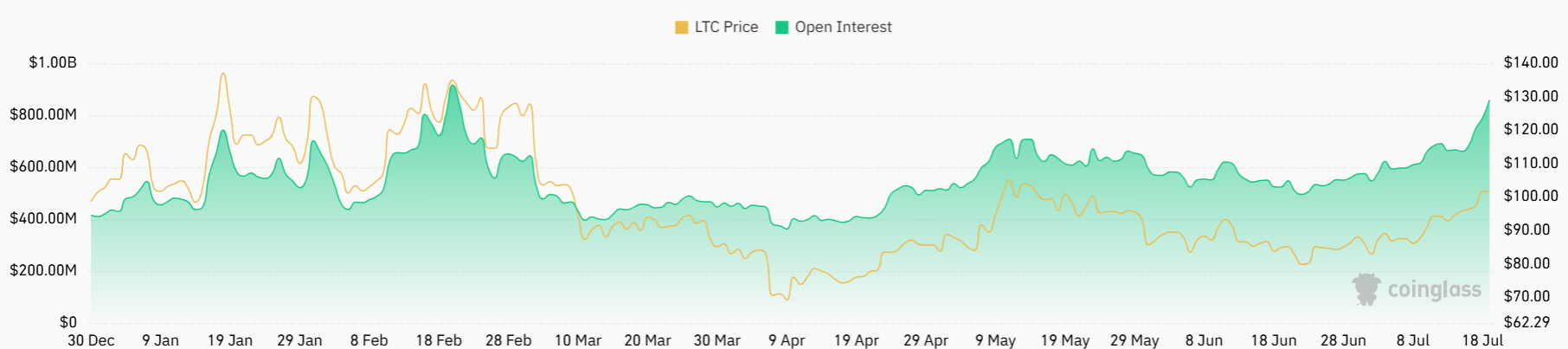

This trend could signal that long-term confidence is shifting. Open interest in the derivatives market also increased by more than 8%, with the funding rate tilting toward long positions—a sign of a strong bullish bias among experienced traders.

However, daily trading volume has fallen quite sharply. According to CoinGlass data, volume shrank by almost 49% to $1.57 billion. Meanwhile, open interest fell slightly to $895 million.

The long/short ratio on Binance for the LTC/USDT pair remains at a high level: 2,758. This indicates that the majority of accounts are maintaining long positions rather than selling. So, despite the weakening volume, optimistic sentiment has not completely faded.

Litecoin Gains Institutional Backing and a Bold Price Target

Furthermore, institutional support is starting to emerge. One surprising example comes from MEI Pharma. The company allocated $100 million in treasury funds to Litecoin, a move similar to Strategy’s approach to Bitcoin. This could pave the way for other companies to begin viewing Litecoin not just as a speculative asset, but as part of their balance sheets.

Furthermore, the Litecoin development project itself is not yet at a standstill. The full implementation of the MimbleWimble privacy feature is said to be nearing completion, although the timeline remains uncertain. If successfully adopted, this feature could attract privacy-conscious users and open up a new segment previously closer to Monero or Zcash.

Given all these drivers, Master Ananda’s price target seems reasonable. He projects LTC price could reach $644 this cycle and even opens up the possibility of reaching $1,000, or a 900% increase.

“After the new all-time high is hit, it is normal to see a correction or even a bear market. This one should be short and small compared to previous ones. See you at 1K,” he wrote in the latest analysis on TradingView.

Recommended for you:

Credit: Source link