Chris Larsen’s XRP holdings have been making headlines right now after massive $175 million transfers were detected during XRP’s recent price surge, and this has actually sparked intense debate across the XRP rich list community. The Ripple co-founder still controls around 2.6 billion XRP tokens worth over $8 billion, which represents about 4.39% of the total supply.

This XRP price surge to $3.66 before falling to current Ripple XRP current price levels around $3.14 has reignited some centralization concerns. Even with all this volatility, XRP price prediction models are maintaining bullish targets toward $6.00 based on technical breakout patterns.

XRP Rich List Shock: Chris Larsen Sale Triggers Price Surge Reversal

The blockchain data actually exposes systematic selling from Chris Larsen XRP wallets throughout 2025. Since January, Larsen has transferred over 167 million XRP worth $344 million to exchanges, and the recent $175 million move occurred during XRP’s strongest rally in years.

Technical Breakout Was Confirmed Despite All The Selling

XRP completed a six-year symmetrical triangle breakout with a massive 158 million volume spike, which confirmed bullish momentum despite Chris Larsen XRP distribution. The breakout actually projects Fibonacci targets near $6.00, representing potential doubling from current levels.

Analyst Ali Martinez stated:

“If XRP closes above $3, it could kick off a rally to $6 or even higher.”

Also Read: $3,000 for 1,000 XRP? It’s ‘Crazy’, but Experts Say It’s Just Starting

Regulatory Momentum Is Supporting XRP Rich List Growth

The XRP price surge coincided with positive regulatory developments right now. U.S. lawmakers advanced the GENIUS and CLARITY Acts while ProShares launched the first XRP futures ETF. These developments are supporting long-term XRP price prediction models despite short-term Chris Larsen XRP selling pressure.

Market Impact Analysis

The Ripple XRP current price correction from $3.66 to $3.14 represents normal pullback behavior following the triangle breakout. Technical analysis suggests XRP remains in Elliott Wave 3, which is historically the strongest bullish phase, supporting optimistic XRP price prediction scenarios.

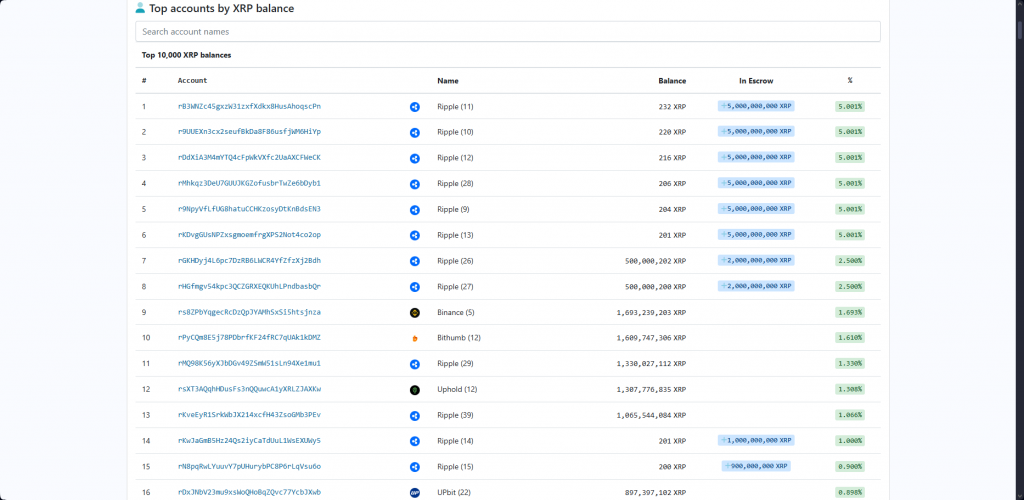

The XRP rich list concentration among early stakeholders creates both risks and opportunities. While Chris Larsen XRP selling adds supply pressure, whale accumulation data shows institutional buyers are absorbing tokens, which supports future price stability.

Future Outlook Right Now

Current support at $3.10-$3.15 remains crucial for maintaining the breakout structure. A sustained hold above these levels could actually trigger moves toward the $6.00 target, while failure below $3.00 might bring retracement to $2.75-$2.85.

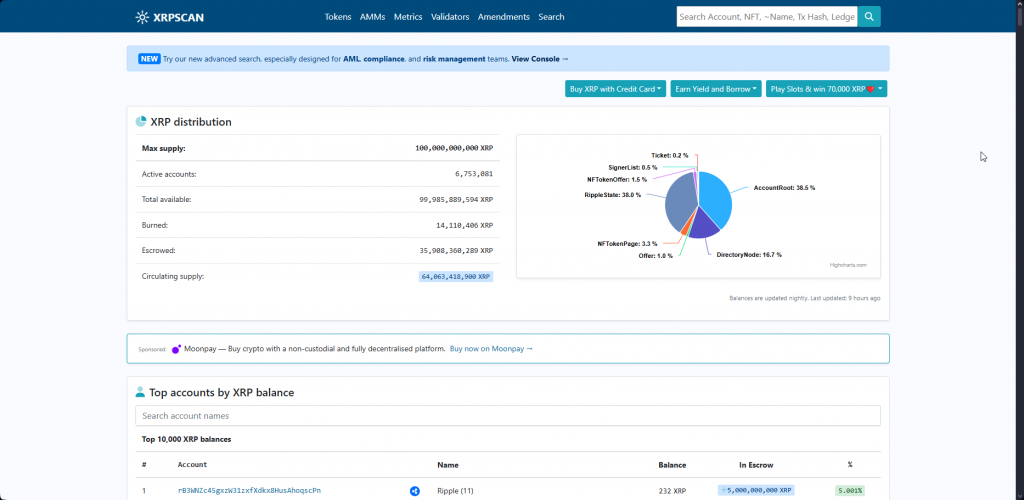

The XRP rich list changes keep on occurring as initial players disperse them to other markets. 99.92 percent of the TOTAL global population hold 0 XRP, which means that, in the long-term, Ripple XRP adoption potential is still enormous despite the volatility of XRP that is currently being exploited by whales in influencing the current price levels of XRP.

Also Read: Ripple Co-Founder Moves $175 Million XRP Amid 11% Price Crash

Credit: Source link