Ripple’s XRP token climbed to a new all-time high of $3.65 on July 18. The popular crypto hit a new peak after more than seven years. XRP’s price has fallen by more than 20% from its recent high. According to CoinGecko data, XRP is down 11% over the last week, 2.8% in the 14-day charts, and 16% over the previous month. Despite the correction, the asset has gained 0.7% in the past 24 hours and 387.7% since August 2024.

Will XRP Hit a New All-Time High After a Rate Cut in September?

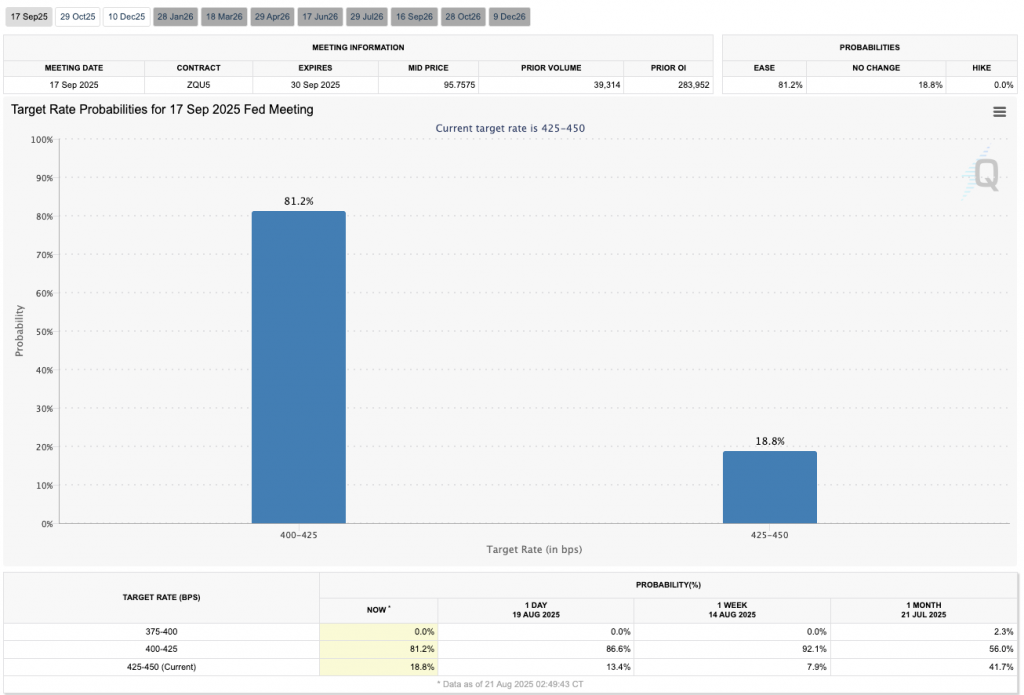

According to the CME FedWatch tool, there is an 81.2% chance that the Federal Reserve will cut interest rates by 25 basis points in September. A rate cut will likely lead to a surge in risky investments. Such a development could cause XRP’s price to surge.

While there is a high likelihood of an interest rate cut next month, it should be noted that the odds of a rate cut on CME’s FedWatch platform have significantly dipped over the last few days. The chances of a rate cut were around 96%. The figure dipped to 84% a few days ago. It has since fallen to the 81% mark. The number could continue to dip as we move closer to the Jackson Hole meeting.

XRP had struggled to gain momentum over the last few years due to the SEC’s lawsuit against Ripple. The lawsuit was completely ended earlier this month. With the lawsuit out of the way, XRP could continue to hit new all-time highs if market conditions are ripe.

XRP also has several spot ETF applications awaiting approval at the SEC. An ETF approval will likely cause the project to register massive institutional inflows. Bitcoin (BTC) has climbed to multiple all-time highs after its ETF approval. A similar pattern could emerge for XRP as well.

Credit: Source link