Stripe officially launched Tempo, a payments-focused Layer 1 blockchain designed for high-throughput stablecoin transactions, with major financial institutions including Visa, Deutsche Bank, and Standard Chartered serving as initial design partners.

The blockchain enters private testnet following months of stealth development by the $92 billion payments giant.

Tempo addresses infrastructure limitations that Stripe encountered as stablecoin usage expanded across its platforms.

Existing blockchains process between 5 and 1,000 transactions per second, while Stripe handles peaks exceeding 10,000 TPS during high-volume periods and aims to bring even more than that with Tempo.

Built for “Real-World Financial Applications”

The blockchain features fiat-denominated fees rather than blockchain-specific tokens, which addresses a key friction point for traditional financial institutions.

Users can pay gas fees in any stablecoin through an enshrined automated market maker system.

Stripe incubated Tempo in partnership with crypto venture capital firm Paradigm, positioning it as an independent company.

Matt Huang, Paradigm’s co-founding managing partner and Stripe board member, leads Tempo as CEO while maintaining his venture capital role.

The design partner list extends beyond traditional finance to include technology companies such as Anthropic, OpenAI, DoorDash, and Shopify, as well as financial services firms like Mercury, Nubank, and Revolut.

This diverse coalition aims to ensure that Tempo serves a broad range of payment use cases, from microtransactions to enterprise payroll.

Tempo targets 100,000+ transactions per second with sub-second finality while maintaining Ethereum Virtual Machine compatibility.

The blockchain supports dedicated payment lanes, transaction memos, access lists, and opt-in privacy features, which are specifically designed for financial applications.

The launch follows Stripe’s methodical crypto expansion strategy. The company acquired stablecoin infrastructure firm Bridge for $1.1 billion and crypto wallet developer Privy, creating end-to-end payment solutions spanning wallets, stablecoins, and now blockchain processing infrastructure.

Stripe’s Crypto Stack Completion Strategy

Stripe’s blockchain development completes a comprehensive crypto infrastructure buildout that began with strategic acquisitions.

The Bridge acquisition provided stablecoin payment capabilities across 70 countries, while Privy added wallet infrastructure for seamless user onboarding.

The company initially supported Bitcoin transactions in 2014 before halting crypto services due to network inefficiencies.

Stripe rebuilt its blockchain team in 2021 and accelerated initiatives throughout 2024 following regulatory clarity brought by the Trump administration.

Stablecoin Financial Accounts launched across 101 countries, enabling companies to hold and transact digital dollars.

The platform currently supports Circle’s USDC and Bridge’s USDB tokens with plans for stablecoin neutrality across Tempo.

Earlier this year, Stripe partnered with Ramp to launch stablecoin-backed corporate cards, which aim to address cross-border payment delays and currency volatility.

The cards were initially deployed in Latin American markets before expanding to Europe, Africa, and Asia.

CEO Patrick Collison has previously testified to Congress that Stripe sees “meaningful business interest in stablecoins as the underlying technology has matured.”

The GENIUS Act’s federal regulatory framework spurred corporate adoption across the billion-dollar stablecoin sector.

Tempo enables Stripe to capture transaction processing revenue directly rather than paying fees to external networks.

Particularly, the company’s extensive merchant network spanning millions of businesses worldwide perfectly positions Tempo for rapid adoption through existing payment flows.

Financial Giants Race Into the Blockchain Industry

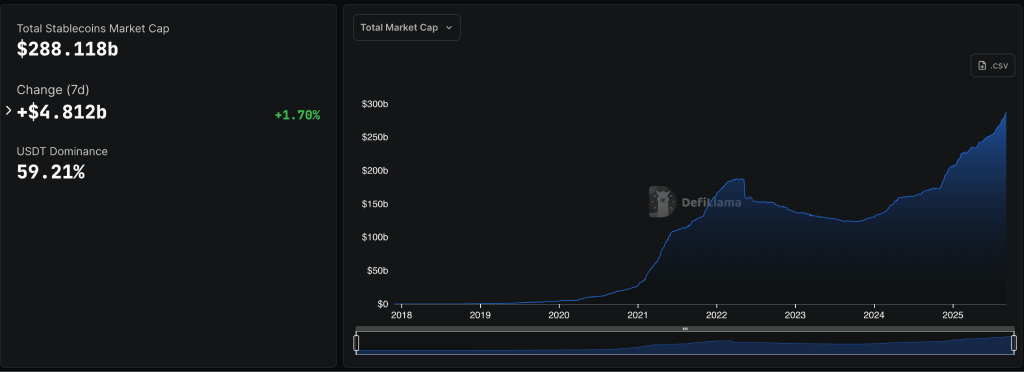

The stablecoin sector experienced explosive growth following regulatory clarity, with market capitalization exceeding $288 billion.

In fact, among many others, Ripple CEO Brad Garlinghouse projects the growth of the stablecoin market to around $1-2 trillion.

Amid the corporate adoption race, MetaMask announced plans earlier last month to launch “MetaMask USD” through Stripe’s payment infrastructure.

The proposal builds on the M⁰ network, which has regulatory backing and fiat reserves.

Western Union has also announced pilot programs in South America and Africa for stablecoin-powered remittances.

Just yesterday, Ripple announced its extension of its US dollar-backed stablecoin, Ripple USD (RLUSD), into Africa.

Approximately 20 million addresses now transact stablecoins on public blockchains.

Recognizing this massive growth potential, Federal Reserve Governor Christopher Waller noted that 99% of stablecoin market capitalization is tied to the US dollar.

He believes “stablecoins can keep the dollar the world’s reserve currency” by increasing global accessibility.

Looking forward, Tempo’s validator set will begin with independent, diverse participants before transitioning toward permissionless validation.

The blockchain maintains neutrality regarding stablecoin issuers, allowing any compliant stablecoin to be used for payments and gas fees.

Credit: Source link