According to data from Coinglass, the crypto market saw liquidations worth more than $1.6 billion over the past 24 hours, with the majority of them being long positions. Elevated exchange inflows threaten to crash Bitcoin (BTC) further below the important support level at $112,000.

Bitcoin Tumbles, Will It Lose $112,000?

Bitcoin fell from around $116,000 to as low as $111,800 earlier today, as the broader cryptocurrency market experienced volatility amid concerns about the US government shutdown. Prediction markets on Kalshi are currently giving a 70% chance of a shutdown in 2025.

Related Reading

Commenting on today’s BTC price action, CryptoQuant contributor PelinayPA remarked that at the end of August and early September, almost 65,000 BTC were withdrawn from exchanges, which coincided with a price recovery in the digital asset.

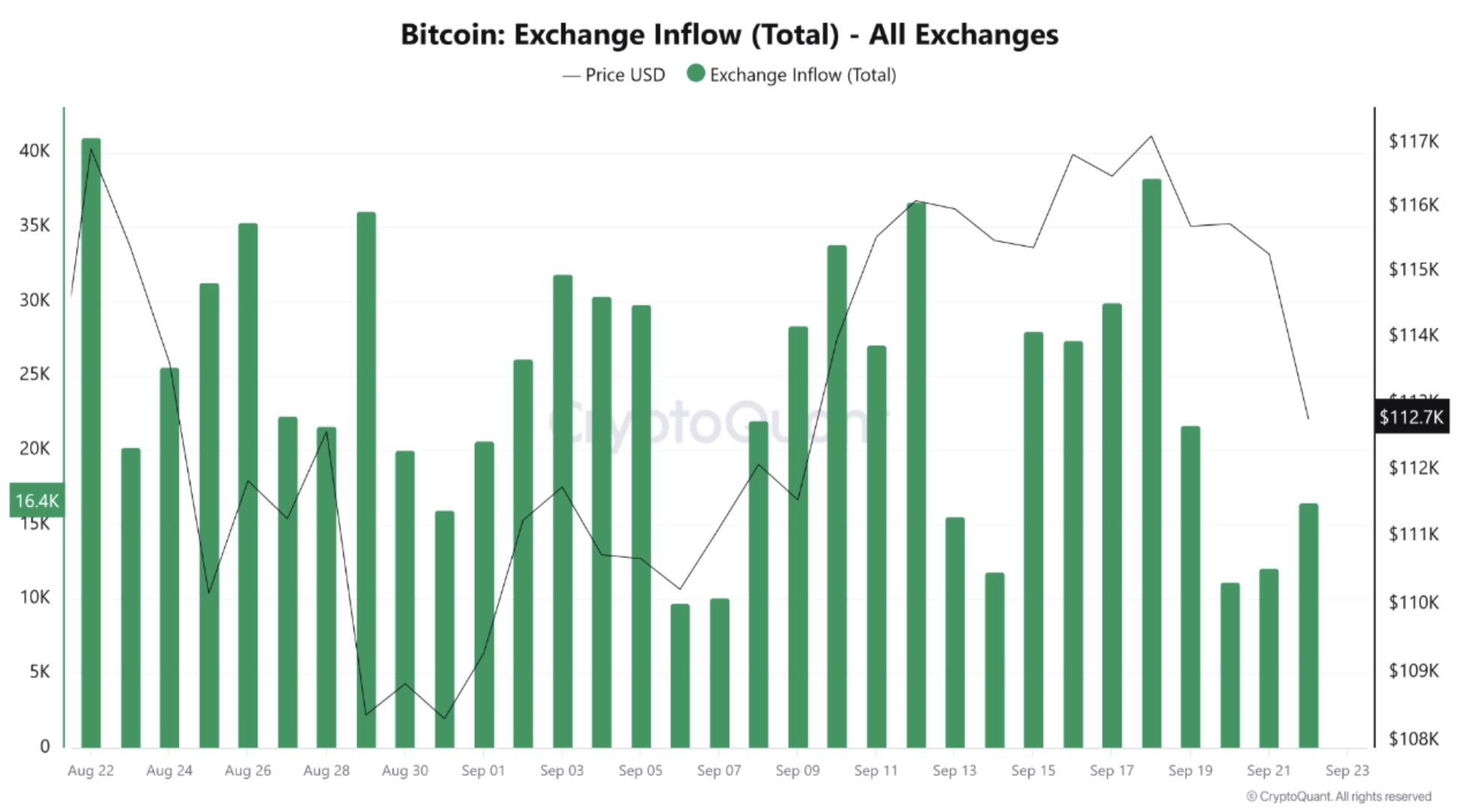

The analyst shared the following chart, which shows BTC withdrawals from exchanges. Typically, large outflows from trading platforms indicate that investors are moving their holdings to personal wallets – reducing immediate selling pressure and signaling a bullish trend.

That said, recent trends suggest that such outflows have weakened. Specifically, since September 20, exchange data shows that more investors are choosing to keep their coins on exchanges.

PelinayPA shared another chart which shows BTC deposits to exchanges. Notably, between September 17 and 19, Bitcoin inflows to exchanges surged to nearly 40,000, while the price tumbled to $117,000.

For the uninitiated, high BTC inflows to exchanges usually imply that investors are moving their coins from private wallets to platforms where they can be sold, signaling increased selling intent. This creates short-term bearish pressure on price, as higher supply on exchanges can outweigh demand.

The CryptoQuant analyst added that during the rally between September 7 and 15, BTC outflows from exchanges exceeded inflows, supporting bullish momentum. However, inflows surpassed outflows after September 17, triggering strong selling pressure and pushing BTC down to $112,700. She concluded:

Inflows remain high while outflows are relatively weak, indicating short-term downside pressure. If outflows increase again, signaling accumulation, BTC could rebound strongly from the $112K zone. Otherwise, further downside risk remains.

Should BTC Holders Be Worried?

Bitcoin’s fall to $112,000 should not come as a surprise. Recent on-chain data had already hinted that BTC could be in trouble due to a lack of whale participation in the recent rally.

Related Reading

It is worth highlighting that BTC’s latest fall in price came shortly after the US Federal Reserve (Fed) cut interest rates by 25 basis points. Although the flagship cryptocurrency fell, experts believe that it is still far from a real capitulation.

CryptoQuant CEO Ki Young Ju recently predicted that BTC could top out at $208,000 during the ongoing market cycle. At press time, BTC trades at $113,175, down 2.1% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com

Credit: Source link