Brazil has emerged as Latin America’s undisputed crypto leader, fueled by a combination of financial pragmatism, regulatory clarity, and the rapid rise of stablecoins as practical financial tools.

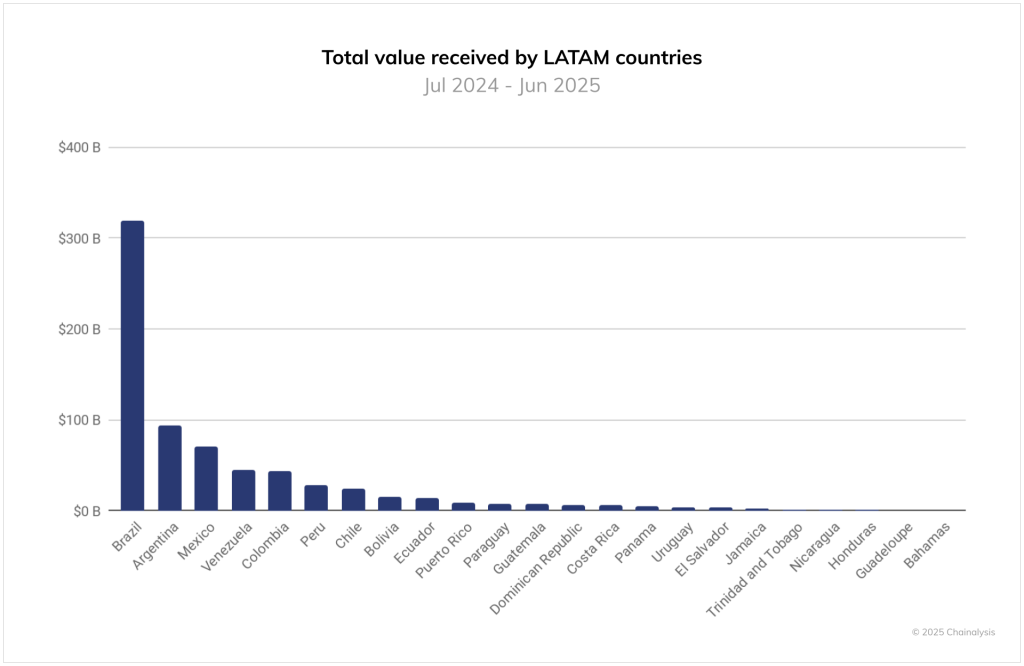

A report from Chainalysis shows that between July 2024 and June 2025, Brazilian users received an estimated $318.8 billion in digital assets, nearly one-third of all crypto transactions across Latin America.

Across the region, cumulative crypto transaction volume reached nearly $1.5 trillion during the same period, with monthly trading activity climbing from $20.8 billion in mid-2022 to a record $87.7 billion in December 2024.

Brazil Captures One-Third of LATAM’s $1.5T Crypto Market — Stablecoins Lead the Charge

Brazil’s dominance lies in its embrace of stablecoins. Officials estimate that over 90% of the country’s crypto transaction volume involves stablecoins such as USDT and USDC, used for remittances, merchant payments, payroll, and cross-border settlements.

In a nation long accustomed to inflation and currency volatility, stablecoins have become a financial lifeline, offering stability and liquidity that the real often lacks.

Notably, institutional transactions have more than doubled year-on-year, according to Chainalysis, while retail activity remains strong. Major financial institutions, including Itaú Unibanco, Mercado Pago, and Nubank, now integrate crypto into their platforms, bridging the gap between traditional finance and digital assets.

Local exchanges like Mercado Bitcoin, Foxbit, and BitPreço have also strengthened Brazil’s position by providing secure, regulated access to crypto markets while aligning with domestic banking infrastructure.

Brazil’s $318.8 billion in crypto activity dwarfs the rest of Latin America. Argentina followed with $93.9 billion amid soaring inflation, while Mexico ($71.2 billion), Venezuela ($44.6 billion), and Colombia ($44.2 billion) rounded out the top five.

Smaller but fast-growing markets like Peru ($28 billion) and Chile ($23.8 billion) are increasingly driven by remittance flows and DeFi experimentation.

Despite its leading Bitcoin-legal-tender status, El Salvador contributed a modest $3.5 billion in activity, showing that bold policy moves don’t always translate to market adoption.

Across Latin America, 64% of crypto activity takes place on centralized exchanges (CEXs), a higher ratio than in North America or Europe. This preference reflects regional realities, where CEXs offer straightforward access to crypto, fiat conversion, and cross-border remittances.

Platforms like Bitso (Mexico and Colombia) and Ripio (Argentina) have localized their services to integrate with national payment systems, reinforcing user trust and accessibility.

Brazil Tightens Crypto Oversight as BCB Eyes Forex Rules and $19B Bitcoin Reserve

Brazil’s regulatory momentum in the crypto sector is accelerating as authorities move to refine both virtual asset and forex oversight. The Virtual Assets Law (BVAL) of 2022–2023 remains the foundation of Brazil’s crypto regulation, assigning supervision to the Banco Central do Brasil (BCB) and embedding AML/KYC compliance standards that balance innovation with consumer protection.

Following the BVAL, the government launched further regulatory consultations—Nos. 109, 110, and 111/2024—to address emerging areas such as DeFi protocols, custodians, and stablecoin issuers.

These new guidelines, expected by late 2025, are intended to provide clarity and strengthen Brazil’s position as a leader in digital finance.

At the same time, Brazil is advancing a bold proposal to create a $19 billion Bitcoin strategic reserve, known as RESBit, under Bill 4501/24. Debated during an August 20 hearing before the Chamber of Deputies’ Economic Development Commission, the plan would integrate Bitcoin into Brazil’s treasury management strategy.

If approved, the country would join others such as El Salvador, the United States, China, and the European Union in formally incorporating digital assets into national economic frameworks.

Parallel to these developments, the BCB is moving to expand its regulatory reach into the foreign exchange (Forex) sector, a move that could indirectly affect crypto exchanges. According to a report, the central bank released a public consultation paper proposing tighter supervision over electronic Forex (eFX) platforms.

While the proposals make no explicit mention of crypto exchanges, their scope would likely impact platforms that facilitate international transfers or crypto-to-fiat conversions involving currencies other than the Brazilian real.

Credit: Source link