Institutional investors expect tokenized assets to take up a much larger role in global portfolios by the end of the decade, with private markets seen as the first to shift.

A State Street study published Thursday projects that by 2030, between 10% and 24% of institutional investments could be made through tokenized instruments.

Private equity and private fixed income are viewed as the most likely early candidates for tokenization. These markets have long struggled with illiquidity and high operational costs, making them prime targets for digital instruments designed to boost efficiency and unlock liquidity.

“The acceleration in adoption of emerging technologies is remarkable. Institutional investors are moving beyond experimentation, and digital assets are now a strategic lever for growth, efficiency, and innovation,” said Joerg Ambrosius, president of Investment Services at State Street.

He added that tokenization, artificial intelligence and quantum computing are converging to reshape the future of finance, with early adopters leading the charge.

Digital Assets Average 7% of Portfolios, Set to More Than Double in Three Years

The research also shows that while tokenization is gaining traction, many investors believe other technologies will have an even greater impact on operations.

More than half of respondents pointed to generative AI and quantum computing as more transformative than blockchain, though they see the technologies working in tandem.

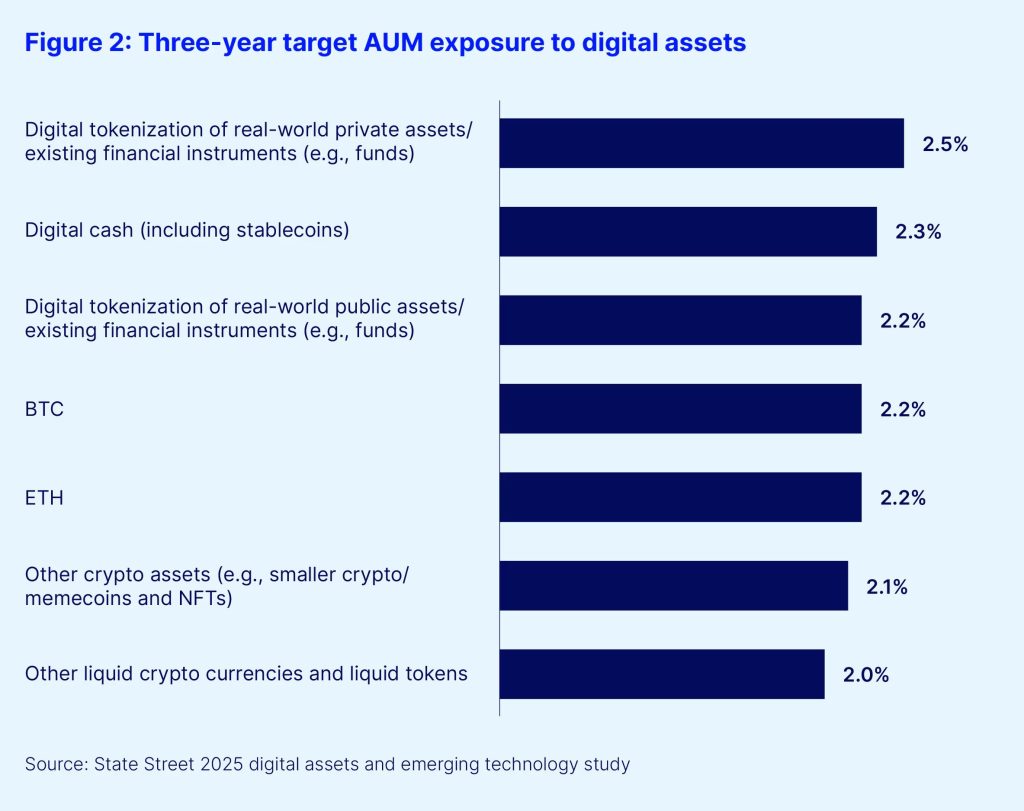

Currently, institutional portfolios hold an average of 7% in digital assets, according to the study. That figure is expected to rise to 16% within three years. The most common forms are digital cash, along with tokenized versions of listed equities and fixed income. On average, respondents hold 1% of their portfolios in each of these categories.

Asset Managers Outpace Owners in Bitcoin, Ethereum and Tokenized Assets

Asset managers reported higher exposure than asset owners across nearly every category. 14% of managers said they held 2% to 5% of portfolios in Bitcoin, compared with 7% of asset owners. A small share of managers also admitted to having at least 5% of assets in Ethereum, meme coins or NFTs, pointing to the broader range of risk appetite.

Tokenization of real-world assets is another area where managers are ahead. They reported greater exposure to tokenized public assets, tokenized private assets and digital cash than asset owners.

Even so, cryptocurrencies remain the biggest driver of returns within digital portfolios.

27% of respondents said Bitcoin is their strongest performer today. A quarter also expect it to remain the top performer in three years.

Meanwhile, Ethereum ranked second. 21% cited it as their biggest return generator now, and 22% expect that trend to continue.

By contrast, only 13% said tokenized public assets drive most of their digital returns. Just 10% pointed to private assets. These figures are expected to remain mostly unchanged over the next three years.

State Street Finds Confidence Growing That Tokenization Trend Is Durable

State Street’s study suggests that private assets could be the first major beneficiaries of tokenization. This would likely happen once infrastructure improves and investor confidence matures.

Moreover, institutions broadly expect digital assets to become mainstream within a decade. This reflects growing acceptance that the shift is structural rather than cyclical.

The findings add weight to the view that tokenization could transform capital markets. By digitizing ownership of assets such as real estate and private credit, institutions could cut settlement times, reduce costs, and expand access to investors who were previously excluded from private markets.

Credit: Source link