Nine global Wall Street banking giants have announced plans to develop a jointly backed stablecoin focused on G7 currencies.

The consortium includes Goldman Sachs, Deutsche Bank, Bank of America, Banco Santander, BNP Paribas, Citigroup, MUFG Bank, TD Bank Group, and UBS, according to a Bloomberg report published Friday.

Banks said they will explore issuing a reserve-backed digital payment asset available on public blockchains, with each unit pegged one-to-one against traditional fiat currency.

The coalition has confirmed it is already in contact with regulators and supervisors across relevant markets as it evaluates whether the initiative could enhance competition in the digital payments space.

Banks Target $50 Trillion Payment Opportunity

Traditional financial institutions are accelerating blockchain experimentation following clearer regulatory frameworks in the United States and the European Union.

Stablecoins have emerged as a faster and cheaper alternative to legacy payment rails, with Bloomberg Intelligence projecting that the technology could process more than $50 trillion in annual payments by 2030.

The business model has proven extraordinarily lucrative for existing issuers, who earn substantial yields on the Treasury securities and cash equivalents backing their tokens.

Tether Holdings, which operates the largest stablecoin by circulation, generates billions of dollars annually from reserve assets and is currently raising as much as $20 billion in a funding round that could rank it among the world’s most valuable private companies.

The banking consortium’s entry follows several parallel blockchain payment initiatives across the industry, including Bank of New York Mellon’s exploration of tokenized deposits and JPMorgan’s June pilot of JPMD, a token representing dollar deposits at the institution.

HSBC also launched a tokenized deposit service for corporate clients in late September, allowing secure cross-border currency transfers through blockchain infrastructure.

Financial firms view these blockchain-based payment systems as essential infrastructure for their broader ambitions to tokenize traditional assets, including stocks, bonds, and investment funds.

Earlier this year, several major U.S. banks, including JPMorgan, Bank of America, Citigroup, and Wells Fargo, reportedly held exploratory discussions about a potential shared stablecoin venture, though those talks remained conceptual.

Traditional Banks Race to Capture Digital Dollar Migration

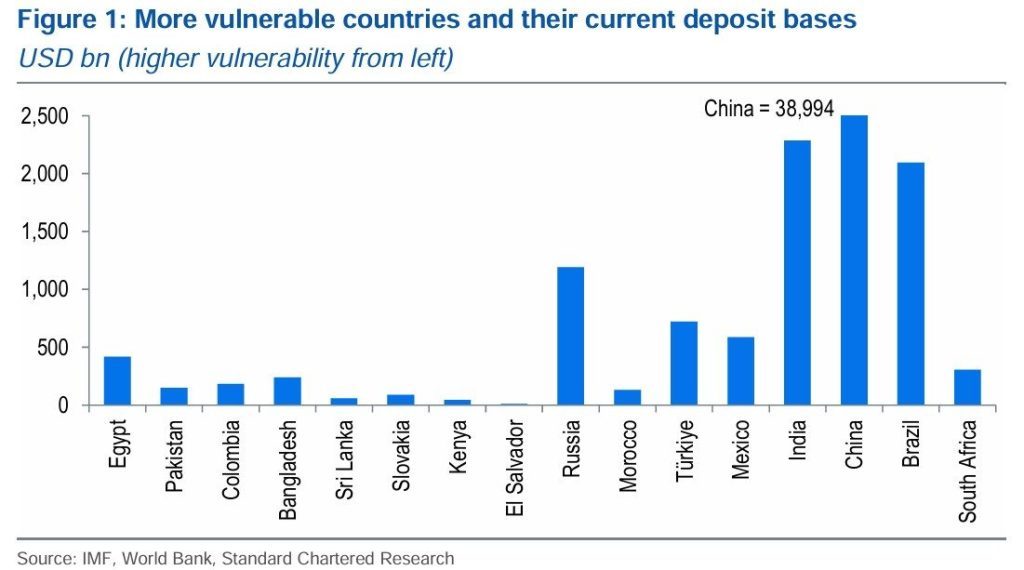

Standard Chartered warned earlier this month that stablecoin adoption could drain more than $1 trillion from emerging market banks by 2028, as users in high-inflation economies increasingly treat tokens like Tether’s USDT as de facto dollar bank accounts.

The threat has prompted regulatory responses across major financial centers, with British regulators initially proposing ownership caps between £10,000 and £20,000 for retail customers to slow potential deposit flight.

However, recent reports have confirmed that the Bank of England is preparing to allow exemptions to these limits for firms such as crypto exchanges that require large stablecoin holdings for liquidity and settlement.

In recent weeks, Stripe CEO Patrick Collison also argued that stablecoins will inevitably force banks to offer competitive deposit yields, noting that U.S. savings accounts currently pay just 0.40% while banks earn $176 billion annually by parking reserves at the Federal Reserve.

Competition is intensifying beyond traditional banking circles, with major technology companies exploring stablecoin integration, with Apple, Airbnb, Uber, and X reportedly holding preliminary discussions about incorporating the tokens into their payment systems.

SWIFT, a global banking giant, has also begun testing stablecoin-like settlement on Ethereum’s Linea Layer 2 network with over a dozen global banks, including BNP Paribas and BNY Mellon.

European banks have moved aggressively into the space, with nine major lenders, including ING, UniCredit, and Deutsche Bank, forming a separate consortium to launch a MiCA-regulated euro stablecoin by mid-2026.

In a recently released report, Coinbase forecast that the stablecoin market could reach $1.2 trillion by 2028, and published research has challenged the banking industry’s claims that stablecoins threaten traditional financial stability.

As it stands now, the global banking industry faces a strategic choice between partnering with established stablecoin issuers, like the recent backing from Citi to BVNK, building proprietary tokens, or watching payment revenues migrate entirely to crypto-native competitors and technology giants.

Credit: Source link