The weeks-long dispute between Fetch.ai and the Ocean Protocol Foundation appears to be nearing resolution, as both sides move toward a settlement that could bring an end to one of the most publicized token controversies in the AI-blockchain space.

Fetch.ai CEO Humayun Sheikh said on Thursday that his company will drop all legal claims against Ocean Protocol if the latter agrees to return 286 million FET tokens, worth about $120 million at the time of the alleged transfer, to the Fetch community.

Peace or Persistence? Will Ocean Return the Tokens and End the Feud?

The announcement came during an X Spaces session, where Sheikh described the offer as a final attempt to settle the matter without a lengthy legal battle.

“They are expecting a legal proposal from us for the return of the tokens,” Sheikh said. “You can have my letter tomorrow. The offer is simple: give my community back the tokens. I will drop every legal claim.”

He added that Fetch.ai would cover any associated legal costs if the tokens are returned, calling the move “an effort to protect the community and move forward.”

GeoStaking, a Fetch.ai validator node that helped mediate the discussions, confirmed that Ocean Protocol is willing to return the tokens once a formal written proposal is submitted.

The proposal could be finalized as early as Friday, potentially putting an end to months of escalating tensions.

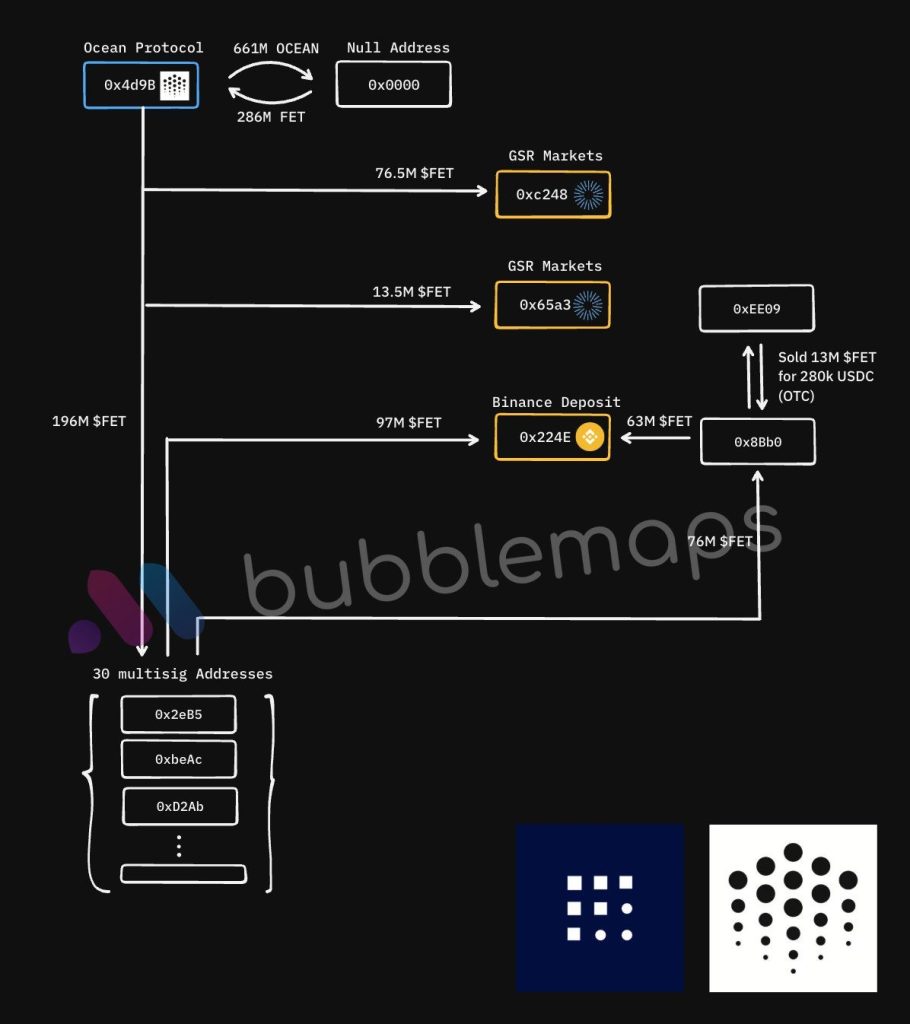

The dispute stems from Fetch.ai’s accusation that an Ocean Protocol-linked multisignature wallet converted 661 million OCEAN tokens into 286 million FET tokens and later transferred a large portion of them to centralized exchanges.

Blockchain analytics platform Bubblemaps reported that around 160 million FET were sent to Binance and another 109 million to GSR Markets, totaling roughly $120 million in transactions.

Ocean Protocol denied any misappropriation, calling the claims misleading and insisting that all token conversions were carried out transparently under its treasury management policies.

The foundation withdrew from the Artificial Superintelligence (ASI) Alliance on October 9, citing governance disagreements and legal constraints. The withdrawal statement confirmed the exit but did not address the disputed transfers.

What Went Wrong in the ASI Alliance? Fetch.ai and Ocean’s Feud Test AI Token Unity

The ASI Alliance, formed in 2024, merged Fetch.ai, Ocean Protocol, and SingularityNET under a unified token framework using FET as the central asset.

The collaboration was intended to advance decentralized artificial intelligence infrastructure by combining their respective data, compute, and model-sharing technologies.

Tensions, however, escalated in mid-2025 after Fetch.ai alleged that Ocean Protocol minted additional OCEAN tokens prior to the merger and later converted them into FET without proper disclosure.

Sheikh claimed that the transferred tokens were meant for “community incentives” but were instead distributed across multiple wallets and sold through exchanges.

On October 21, Sheikh offered a $250,000 bounty for information about the signatories of the OceanDAO multisignature wallet and their connection to the Ocean Protocol Foundation.

He also threatened to fund class-action lawsuits in multiple jurisdictions, urging affected holders to gather evidence of potential losses.

Ocean Protocol responded in a public statement denying all allegations and asserting that its treasury “remains intact.”

The foundation confirmed that the dispute had entered formal arbitration under the ASI merger framework and claimed that it had offered to waive confidentiality to ensure transparency.

The offer, Ocean said, was declined by Fetch.ai.

FET Token Down 93% as Fetch.ai–Ocean Rift Shakes AI Blockchain Sector

In a separate blog post, Ocean founder Bruce Pon argued that the steep decline in FET’s price, down over 93% from its 2024 peak of $3.22 to around $0.26, was unrelated to Ocean’s exit or any token conversions.

“The drop was due to broader market sentiment and volatility,” Pon wrote, blaming liquidity issues and large-scale FET sales by other alliance members for draining community trust.

Ocean’s statement also accused the ASI partners of disregarding decentralization principles by rushing the merger, ignoring audit recommendations, and pressuring members into decisions without consensus.

It said Ocean “maintained fiscal discipline” and “acted solely for the benefit of its community,” while accusing Fetch.ai and SingularityNET of executing poorly timed liquidity deals that amplified market instability.

Sheikh dismissed those claims, saying Ocean should have raised its concerns instead of liquidating community tokens. He reiterated that returning the 286 million FET would allow both sides to avoid protracted litigation and rebuild confidence among token holders.

The feud has had a severe impact on market sentiment. Fetch.ai’s FET token is currently trading at around $0.259, representing a 64% decline over the past three months and a drop of more than 92% from its all-time high.

Ocean Protocol’s OCEAN token has also fallen about 4% in the last 24 hours to $0.30, though it remains up 36% over the past week.

The settlement proposal marks a potential turning point for both AI-blockchain projects. If Ocean Protocol formally agrees to return the tokens, it could end one of the crypto industry’s most contentious disputes of 2025, a feud that not only rattled investors but also tested the credibility of decentralized governance within high-profile blockchain alliances.

Credit: Source link