Coinbase is bringing back U.S. token sales for the first time in six years, reopening the door for American retail investors to directly participate in early-stage crypto projects.

The exchange announced on Nov. 10 that it will debut a dedicated token sales platform, starting with the layer-1 blockchain Monad, whose sale is scheduled to run from Nov. 17 to 22, offering 7.5% of its total supply.

The move marks Coinbase’s first public token sale since 2018 and indicates a broader shift in how projects distribute their tokens.

Coinbase’s New Token Sales Put Structure Over Speed

According to the company, the initiative is an effort to set “a new standard” for sustainable and transparent token launches.

Under the new framework, Coinbase plans to host around one token sale per month, each governed by an allocation algorithm designed to ensure broader participation and fairness.

Unlike the chaotic “first-come, first-served” sales that dominated the 2017–2018 ICO boom, Coinbase’s model gives investors a one-week window to submit purchase bids in USD Coin (USDC).

When the window closes, an algorithm determines allocations, favoring smaller orders to promote wider token distribution.

Coinbase also added a rule to curb speculative flipping: users selling within 30 days of listing may receive smaller allocations in future sales, rewarding long-term supporters.

Only verified and compliant Coinbase users will be eligible to participate, while issuers will undergo vetting based on team credentials, token economics, and vesting structures.

Projects launching through the platform will be required to lock their tokens for at least six months, with any over-the-counter or secondary sales needing Coinbase’s approval and public disclosure.

The exchange said there will be no participation fees for users, with issuers paying a percentage fee on the funds raised.

For Coinbase, the new platform extends a string of major product rollouts in recent weeks as the company deepens its on-chain and retail services.

Earlier this month, Coinbase introduced DEX trading within its mobile app for U.S. users (excluding New York), allowing access to Base-native tokens before formal listings.

It also activated staking for New York residents and applied for a National Trust Company Charter with the U.S. Comptroller of the Currency.

Coinbase Launches Token Sales Platform After $375M Echo Acquisition

The token sales platform comes shortly after Coinbase’s $375 million acquisition of Echo, an on-chain capital-raising startup founded by crypto trader Cobie.

Echo’s infrastructure now forms the foundation of Coinbase’s new system, allowing direct project-to-community fundraising. The company said the integration will “create more accessible, efficient, and transparent capital markets” for crypto issuers.

The timing coincides with a resurgence of public token offerings in the broader market. Last month, rival project MegaETH raised $50 million in five minutes through a sale hosted on Echo’s Sonar platform, attracting more than $300 million in pledges.

Kraken and Andre Cronje’s Flying Tulip have also entered the new generation of ICOs, with compliant, regulated models.

Unlike the 2017 ICO frenzy, when lax oversight led to widespread fraud, today’s market is marked by tighter regulation, institutional participation, and increased transparency.

Coinbase’s initiative represents a bid to revive the spirit of community-driven fundraising while aligning it with compliance standards that were absent in the past.

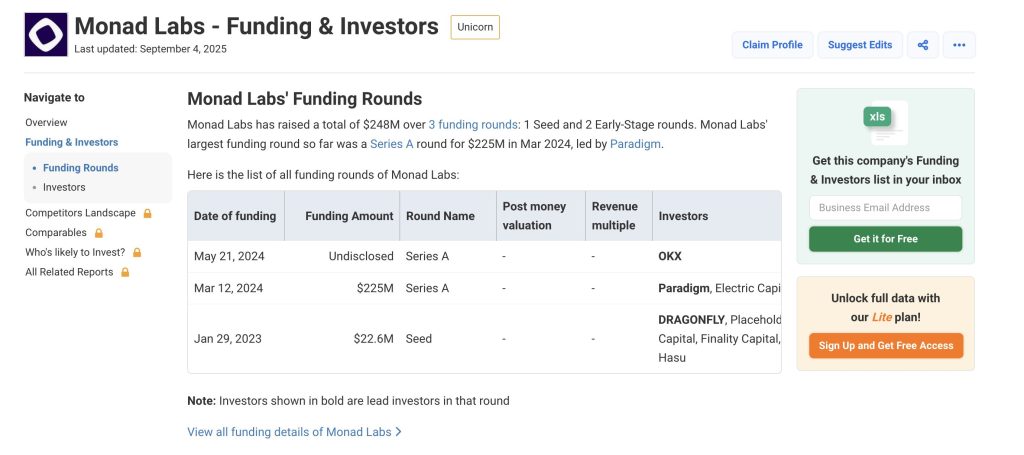

Monad, which has raised $248 million across prior funding rounds, including a $225 million Series A in 2024, will become the first project to sell tokens directly to U.S. retail investors in more than seven years.

Coinbase has confirmed that tokens launched through its sales platform will later be listed on its exchange, offering a seamless bridge from early access to secondary trading.

The launch also follows Coinbase’s strong Q3 2025 earnings, reporting $432.6 million in net income, a fivefold increase from the same quarter last year.

CEO Brian Armstrong said the company’s recent moves advance its “Everything Exchange” vision, one platform for every part of the crypto economy.

Credit: Source link