They appear out of nowhere, initiating contact with calculated finesse, gradually earning your trust. Then, they subtly present an opportunity to participate in high-yield investments and lure you into the trap.

Once you realize that the gains and investments were fake, it’s already too late. Your money has vanished, along with the scammers.

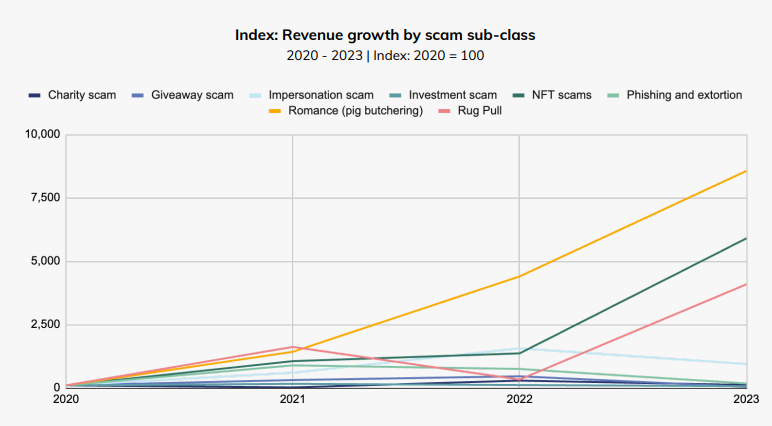

Pig butchering scams—the sinister mix of romance and investment frauds—rank among the most prevalent financial crimes, often involving digital currencies. They are also one of the toughest scams to prosecute.

Why is that, and what can be done to combat it? The crypto industry and law enforcement are actively discussing how to protect the digital financial system from scams.

Pig Butchering Scammers Thrive

The frequency of pig butchering scams is exploding with unprecedented numbers. Since its emergence during the start of the pandemic, this hybrid financial crime has skyrocketed from 3 to 255 cases per month worldwide. That’s about one scam report every three hours.

Today, pig butchering scams are one of the most profitable branches of organized crime. According to widely accepted data from Chainalysis’ 2024 crypto crime report, financial criminals received $24.4 billion in cryptocurrencies last year. Of this figure, $4.6 billion – almost a quarter – came from scams.

However, a recent analysis by John Griffin, finance professor at the University of Texas at Austin, and his graduate student Kevin Mei, suggests that the sum could be significantly larger. According to their data, criminal networks could have stolen a staggering $75 billion through pig butchering scams alone since the start of the pandemic.

Unfortunately, scammers have shown no indication of slowing down. Financial fraud starter kits are easily available on dark markets, offering pre-made setups to execute pig butchering scams, making the entire scam process simpler and more accessible.

Law Enforcement Struggles

Despite the growing number of pig butchering scam cases committed, the number of solved cases remains low.

According to Interpol reports, global law enforcement has seized only $500 million from cybercriminals since 2022. This amounts to a mere 10.8% of the total revenue generated from pig butchering scams alone.

Victims of this financial fraud believe that law enforcement’s blockchain skills and knowledge are lackluster and insufficient when compared to the capabilities of cybercriminals.

Marius, a Lithuanian businessman who lost nearly €150K to pig butchering fraudsters, says his case was quickly labeled unlikely to be investigated when he reported the crime to the local police.

The businessman thinks law enforcement’s lack of blockchain understanding could be causing cases to receive minimal attention and police resources.

“There are very few people in police departments who understand cryptocurrencies and blockchain. When I did the investigation myself and sent the material to the police investigator, she just didn’t know what to do with it.”

Factors Fueling Pig Butchering Scams

The reasons driving pig butchering scam numbers up are as complex as they are diverse.

Digging deeper into the issue reveals four main challenges that both law enforcement and the private cryptocurrency sector struggle to overcome.

1. Victims Feel Ashamed to Report Crime

One primary reason the investigation statistics for pig butchering scams significantly trail the number of actual crimes is that many scam victims hesitate to report their experience of being defrauded.

“In a Telegram group for scam victims [...] only about half reported the incidents to the police. The rest felt too ashamed to admit to anyone, including authorities, that they had been scammed,” admits Marius.

As scam victims cope with distressing psychological impacts and often blame themselves, they tend to keep their experiences private. This means the actual scale of the crime could be much larger than experts estimate. Without proper reporting, the police can’t fully grasp the problem’s scope or allocate resources appropriately.

Bolstering this point, blockchain intelligence firm Chainalysis also points to the private nature of pig butchering scams.

According to them, scammers reveal their wallet addresses directly to victims through private communication such as text messages, making it harder to spot fraudulent wallets.

“Unless victims report their losses to the authorities — far from a guarantee — it can be difficult for blockchain analysts to identify those addresses as scam-related, especially as compared to the enormous crypto Ponzi schemes we’ve seen in years past, which go out of their way to advertise themselves to the masses,” Chainalysis stated in its 2024 crypto crime report.

2. Crypto Sector Does not Share Data

Fragmented data is the next major obstacle, making it harder to get a clear view of the scope of investment scams and, consequently, to combat them.

Interpol states that improved data collection and analysis are urgently needed if law enforcement wants to develop effective counterstrategies against financial organized crime.

Meanwhile, blockchain compliance firms say they share intelligence with global law enforcement, but note that things become much more complicated when working with the private sector.

“In 2023, our team worked hard to create the first shared intelligence network for law enforcement, exchanges, and blockchain analytic companies. It became clear during that effort that everyone from all three sides was interested in consuming the intelligence data from this effort, but no one wanted to contribute data to it,” states Guillermo Fernandes, co-founder and CEO of blockchain compliance firm Blockpliance.

According to Fernandez, crypto firms often cite “user privacy” policies as the primary obstacle to sharing client-related data, even when only asked to share blockchain addresses and risk categories.

“I believe the problem truly lies in the fact that attribution data has standalone value, and companies aren’t willing to share it—even when the benefits far outweigh the cost. To be fair, collecting those attributions is not cheap,” Fernandez says.

Companies like his employ full-time and highly skilled personnel to conduct investigations. Identifying the wallet owner or related service provider is a time-intensive process that requires sophisticated mathematical models and often – manual input. That still does not prevent compliance teams from contacting local police, says Fernandez.

Data sharing among private sector entities is a frequent topic at various levels of blockchain industry gatherings. Sector players agree that collaboration or a shared intelligence network would help make this new financial system safer.

Still, company policies that forbid sharing internal data and differing national laws regarding Virtual Asset Service Providers (VASPs) remain issues that need addressing.

3. VASPs Have Compliance Issues

“Financial institutions and VASPs are unwittingly used as a conduit to collect and transfer deposits from victims and are primarily used as the first intermediaries to launder money overseas,” says the US Homeland Security Investigations (HSI).

Criminals exploit global financial networks to launder money through correspondent banking connections and blockchains, which support various digital currencies.

Here, the key role of safeguarding the space comes to the Virtual Asset Service Providers (VASPs) and their compliance teams.

Like any other financial institution, VASPs are subject to the anti-money laundering and counter-terrorism financing (AML/CFT) framework, which requires them to apply “risk-mitigating” measures.

Crypto exchanges or brokers must adhere to anti-money laundering (AML) and counter-terrorism financing (CFT) regulations.

- This includes implementing standard Know-Your-Customer (KYC) procedures to verify customer identities.

- Crypto service providers are also obligated to report any suspicious transactions to local authorities.

However, not all VASPs are following these rules.

“Many crypto firms have excellent systems and controls in place for managing financial crime risks, and where funds remain ‘on-chain,’ firms can monitor and track payments. Sadly, some firms still pay lip service to compliance and AML requirements,” claims Lashvinder Kaur, VP of Global Strategic Communications at ACAMS, the largest international membership organization for Anti-Financial Crime professionals.

According to her, such firms may operate in jurisdictions with little regulatory oversight or promote their services as “KYC lite.”

“Financial Action Taskforce (FATF) recommendations require comprehensive control frameworks to tackle financial crime including customer due diligence (CDD) and the reporting of suspicious activity to local financial intelligence units (FIUs) but, sadly, sometimes these are still brushed over.”

For instance, in Lithuania, an EU member country, only a small fraction of suspicious transactions were reported to local authorities. As the Lithuanian Financial Crime Investigation Service (FNTT) told DailyCoin, only 63 out of 581 registered VASPs reported suspicious transfers in 2023.

“The low number of companies that provide suspicious transaction reports may reflect the low maturity of the virtual currency sector,” stated FNTT.

According to the institution, this explains why VASPs aren’t doing enough to stop money laundering and terrorist financing.

“The primary cause for this could be a shortage of human resources within these companies or a lack of expertise in AML enforcement functions.”

4. KYC Specialists in Demand

The need for financial crime compliance professionals is significant, as the global regulatory compliance market is projected to grow 6.03%, reaching $24.34 billion by 2031.

In the U.S. alone, the number of compliance officers surged by 75% over five years, reaching 360,000 in 2022, according to Statista.

Nevertheless, according to the latest survey from Alloy, 93% of compliance teams still struggle to meet compliance requirements, with over half (55%) citing the lack of automation as the primary barrier.

Strategies to Combat Pig Butchering Scams

As pig butchering scams increase, experts argue that depending solely on law enforcement to address them is no longer sufficient.

They emphasize the necessity for strategic collaboration within the crypto industry and a multi-faceted approach to enhance the safety of financial systems against criminal actors.

1. Shared Intelligence Network for the Private Sector

The question of collaboration is increasingly relevant, as both VASPs and blockchain forensic companies maintain their own separate databases of identified fraudsters’ addresses and networks.

The problem lies in the fragmented nature of such databases, as each entity possesses only a fraction of the data and can only see their piece of the puzzle, rather than the overall bigger picture.

Seeing the bigger picture, however, requires a unified effort and collaboration, says Blockpliance CEO Guillermo Fernandes. He envisions a shared intelligence network as a solution for quicker and more effective crypto industry defense against scammers.

According to Fernandez, shared databases that employ zero-knowledge proof technologies make data sharing available among the private sector without revealing user data or sensitive information to competitors.

“This way [adopting zero-knowledge proofs], data firms could add data to the system and consume binary confirmation of whether their intelligence matches another firm’s without disclosing the other firm’s intelligence.

Basically, it’s all about keeping secrets between competitors while allowing law enforcement and government agencies to consume those secrets.”

A shared intelligence network offers promise in strengthening security within the crypto financial system, but its success hinges on the proactive engagement and dedication of industry players.

“We can’t expect the government to take on this complex and challenging technical development on themselves - it’s also not the government’s role to do so.”

Blockpliance CEO emphasizes that there is little benefit for a single company to go it alone; instead, industry-wide collaboration is essential for meaningful progress. He suggests that initially, the involvement of just a few market players joining the initiative would be sufficient.

“We only need 2 or 3 companies to really make this a standard going forward, and it could be an opportunity to reshape how financial crime is tackled worldwide.”

2. Strengthening KYC Teams

Financial criminals move money swiftly, immediately transferring funds to other wallet addresses once they receive them from victims. They hop among blockchain networks and utilize mixing services to conceal the flow of funds.

Financial crime investigators cite the speed of transactions as one of the main hurdles in combating crypto-related crimes.

“The advent of faster payments between financial intermediaries, and by moving money via the blockchain, means that it can be difficult to identify, escalate and, in some cases, block payments before money has been transferred beyond recovery,” noted Lashvinder Kaur from ACAMS.

Meanwhile, compliance teams working inside crypto service providers are the first to notice monetary transactions. Equipped with the skills to identify suspicious transfers, they become critical in determining whether criminal activity can be thwarted in time.

“Crypto firms can do a variety of things to improve the effectiveness of their control frameworks. First and foremost, they need a culture of compliance where rules and regulations aren’t seen as a barrier to business. This needs to be instilled from the top of a company.”

According to the head of communication at ACAMS, VASPs could contribute by participating in local public-private information-sharing initiatives and conducting staff training to improve awareness and identify potentially suspicious payments.

ACAMS also views collaborating with local regulators to implement a risk-based approach and assisting law enforcement in understanding CASP business models as potential solutions.

3. Whistleblower Reward Programs

Another method to encourage the crypto sector to play a bigger role in fighting financial crimes could involve public monetary reward initiatives.

In major jurisdictions such as the U.S. and the European Union, whistleblowing laws are implemented to offer protection for individuals who are the first to uncover unlawful activities and report cases of legal violations within the public or private sector.

In 2021, the United States launched the Anti-Money Laundering and Sanctions Whistleblower Program, granting rewards to individuals who report violations of the Bank Secrecy Act (BSA) or sanctions evasion. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) also run programs that reward reporting violations of federal securities laws or violations of the Commodity Exchange Act.

Such programs already enable reporting on a range of securities fraud within the crypto space, including price manipulation, rug pulling, pre-arranged or wash trading of cryptocurrencies, insider trading, and supervisory failures or fraudulent conduct by virtual currency exchanges.

According to the SEC, such reward programs contribute to the better reporting of wrongdoing and play a critical role in protecting investors and the marketplace. The Commission has paid more than $1.3 billion in 328 rewards since the beginning of the program to individuals who have provided data that led to successful enforcement actions by the SEC and other agencies.

Joint Forces Needed

Pig butchering scams are a form of organized crime that has already developed into a highly profitable, industrialized criminal business. Within a few years of its emergence, they are now established as a significantly dangerous activity at a global scale.

Industry experts agree that unifying different market players is crucial in combating organized crime. Joint action is considered essential for creating robust defense strategies and strengthening the security of the blockchain-based financial system.

Find out more about how pig butchering scammers work:

Pig Butchering Scam Trails Blend with Russian Intelligence

Learn how to identify warning signs of pig butchering scams:

Pig Butchering Scams: Beware of These Red Flags

Credit: Source link