- Ethereum is nearing the realized cost zone of long-term accumulators, a level historically linked to renewed accumulation strength.

- On-chain data shows LTHs steadily increasing ETH balances despite macro volatility, reinforcing confidence in Ethereum’s long-term market structure.

Ethereum is in a phase that is once again attracting market attention. According to on-chain analyst Burak Kesmeci, the ETH price is now just a few steps away from reaching the long-term accumulation zone.

Market Eyes the “Sacred” Accumulation Zone

ETH is trading at about $3,150-$3,200 and has approximately $250-$300 left to reach the Accumulation Addresses Realized Price of $2,895. This level represents the average cost floor for loyal holders who have been steadily adding to their holdings for a long time.

In fact, some traders refer to this area as “sacred territory” because it often serves as a turning point where selling pressure gradually subsides.

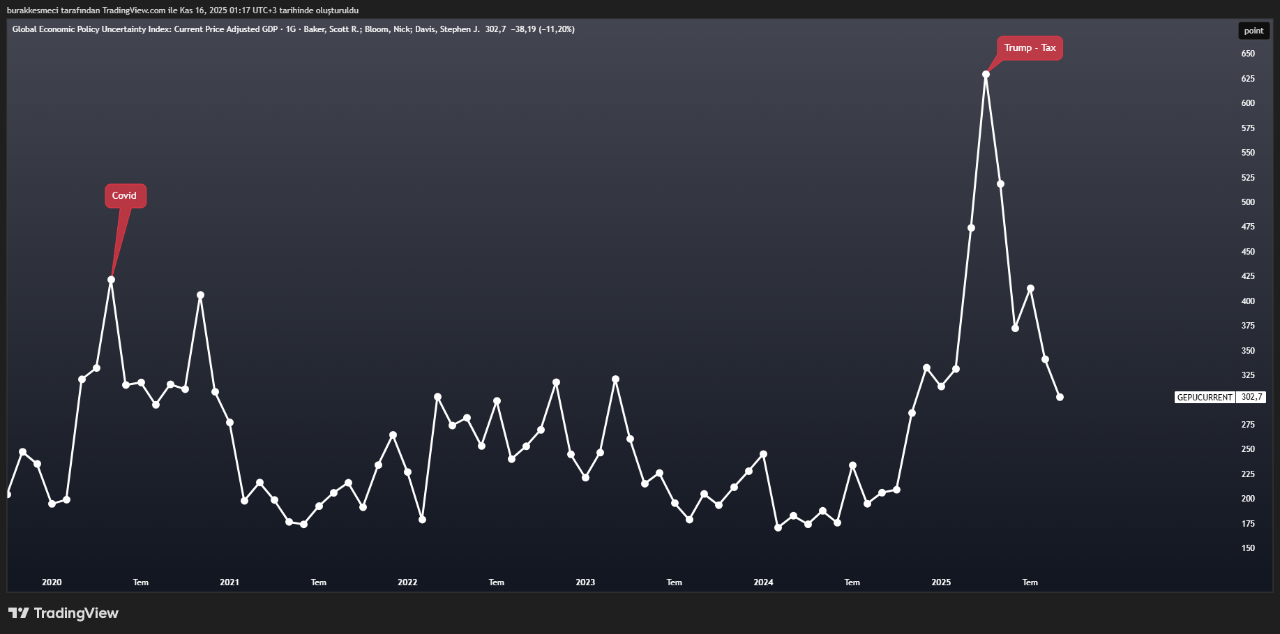

In retrospect, there has only been one instance when Ethereum actually fell below this level. That occurred in April 2025, when the Trump-era tariff crisis rocked nearly all global assets. At the same time, the global economic policy uncertainty index (GEPUCURRENT) soared to 629 points, a figure even higher than during the pandemic.

This situation made investors more wary of risky assets at the time, but interestingly, accumulator behavior actually moved against the trend. They ignored the turmoil and continued adding ETH, as if the storm had never happened.

Ethereum Sees a Surge in Long-Term Holder Inflows

On the other hand, the flow of ETH to accumulation addresses throughout 2025 was indeed striking. Around 17 million ETH flowed in steadily. The total balance of these addresses increased from 10 million ETH at the beginning of the year to over 27 million today.

This growth has many analysts wondering: what exactly are they targeting? Are they seeing an opportunity that retail investors haven’t yet realized, or are they simply pursuing a traditional long-term strategy?

Furthermore, this pattern often signals that the market is building a new foundation, although the movement isn’t always immediately noticeable.

Furthermore, the CNF previously reported that the upcoming Fusaka upgrade will bring several important improvements, such as increased scalability, strengthened security, and reduced hardware load on validators.

PeerDAS also plays a role by reducing data storage requirements, allowing for more efficient Layer 2 expansion.

These technical improvements typically contribute to investor confidence, as more and more parties perceive the network as better prepared to handle increased activity. Many believe that these side effects could help stabilize the ETH price, especially during times of volatile market sentiment.

A few days ago, we highlighted the launch of the Trustlessness Manifesto, a document reaffirming Ethereum’s commitment to trustless coordination, credible neutrality, and self-custody.

The Trustlessness Manifesto also introduces a pledge system that provides developers with a list of entities that adhere to these values without any financial reward. This approach demonstrates the community’s efforts to maintain the network’s direction despite occasional external pressures.

Meanwhile, as of press time, ETH is changing hands at about $3,165, down 1.48% over the last 4 hours, with $3.09 billion in daily trading volume.

Recommended for you:

Credit: Source link