Digital asset investment products recorded another week of inflows as improving sentiment around major cryptocurrencies continues to draw capital back into the market, according to the latest data from CoinShares.

Weekly inflows into digital asset exchange-traded products (ETPs) reached $716 million, pushing total assets under management (AuM) to $180 billion.

While still well below the $264 billion all-time high the steady inflows suggest investor confidence is gradually rebuilding after a volatile period for crypto markets.

Investor Confidence Gradually Improves

CoinShares noted that digital asset funds have now posted their third consecutive week of modest inflows showibg what it described as a “cautious yet increasingly optimistic” investor base.

This comes despite mixed price performance following the US Federal Reserve’s recent interest rate cut, with post-decision trading marked by uneven flows and divergent sentiment across assets.

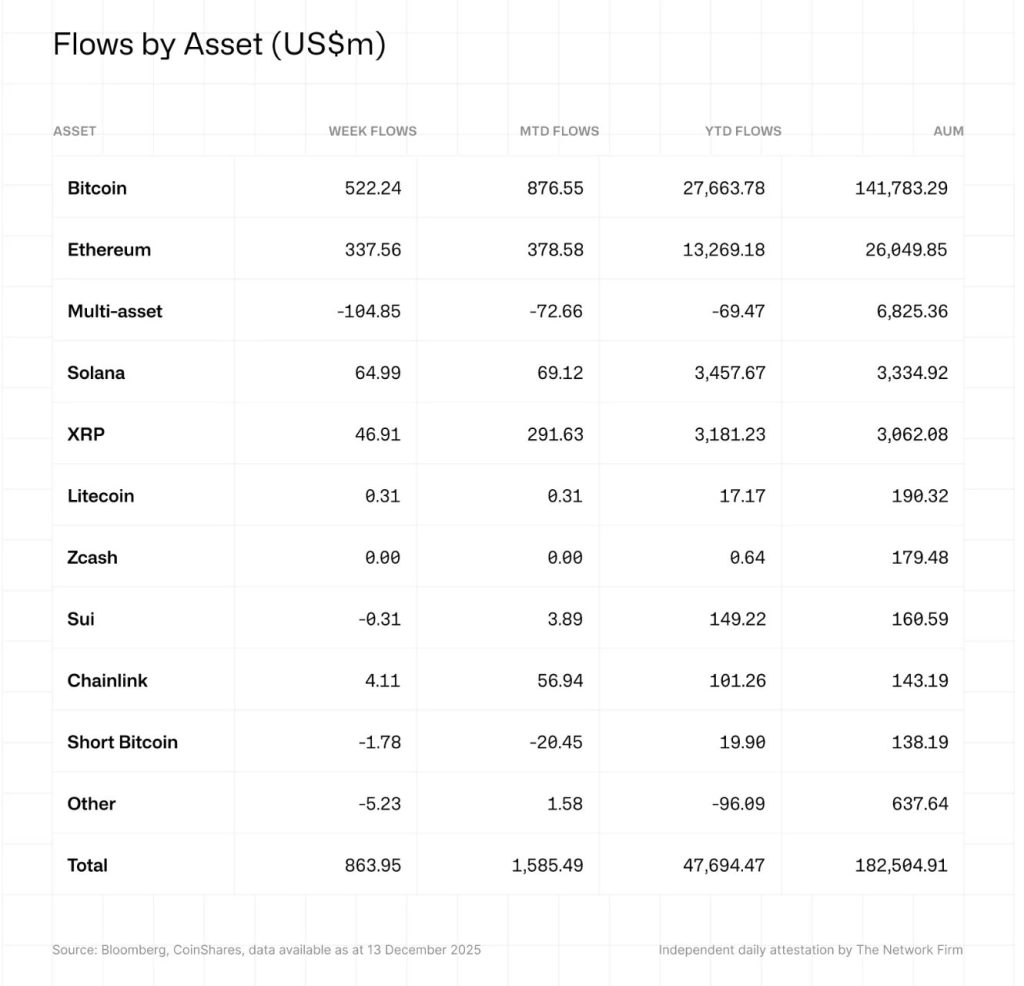

Total inflows across digital asset investment products reached $864 million over the broader reporting period, underscoring continued demand even as macro uncertainty persists. CoinShares said the data also suggests investors are increasing exposure rather than making broad risk-on bets.

US Dominates Regional Inflows

Inflows were broad-based geographically but heavily concentrated in a handful of markets. The US led by a wide margin accounting for $483 million of weekly inflows followed by Germany with $96.9 million and Canada with $80.7 million.

Looking at a longer timeframe, the US also continues to dominate sentiment posting $796 million of inflows last week alone. Germany and Canada also remained net positive, with inflows of $68.6 million and $26.8 million respectively. CoinShares said these three countries have driven the bulk of demand in 2025.

Bitcoin, Ethereum and XRP Lead Demand

Bitcoin remained the largest beneficiary in absolute terms, attracting $352 million in weekly inflows. Notably, short-Bitcoin investment products recorded outflows of $1.8 million, signalling a further easing of negative sentiment toward the asset.

Despite thje renewed interest CoinShares highlights that Bitcoin has been a relative laggard this year, with year-to-date inflows of $27.7 billion compared to $41 billion over the same period in 2024.

Ethereum continues to close the gap recording $338 million in weekly inflows and lifting year-to-date inflows to $13.3 billion. That figure is a 148% increase compared to 2024 also reflecting growing institutional engagement with Ethereum-based products.

XRP also stood out – drawing $245 million in inflows while Chainlink posted a record $52.8 million weekly inflow — equivalent to 54% of its total AuM.

Altcoins Show Selective Strength

Beyond the major cryptos Solana’s year-to-date inflows reached $3.5 billion, a tenfold increase compared to 2024, even though recent weekly flows were more muted.

Aave and Chainlink recorded smaller weekly inflows of $5.9 million and $4.1 million respectively.

Not all assets benefited – Hyperliquid saw weekly outflows of $14.1 million, highlighting that investor appetite remains selective rather than indiscriminate.

Overall CoinShares said the data points to a market that is stabilising, with capital gravitating toward large-cap and established digital assets as confidence slowly returns.

Credit: Source link