- The large exchange transfers caused SOL’s price to decrease to $143.86.

- If SOL bounces, a sell wall at $160 could trigger another decline.

On 25th April, a whale sent 179,999 Solana [SOL] tokens to crypto exchange Binance. Moments later, the price of the token fell below $145 which it has been holding on to for some time.

According to blockchain transactions analyzer Whale Alert, the transaction was worth $26.14 million at the time of the transfer. From AMBCrypto’s findings, the movement of tokens of this kind comes intention to sell.

Source: X

No way out yet depsite rising optimism

If the same goes through, the price of the token involved suffers the brunt as its value decreases. For SOL, undergoing selling pressure was not new.

This was because many large holders of the token have booked profits in the last 30 days, leading SOL’s price to register a 24.03% decline while trading at $143.86.

Should more transfers to exchanges occur, the price of the cryptocurrency might slide further. On the other hand, a decrease in these transactions might stabilize, and the value, and the potential for a bounce might increase.

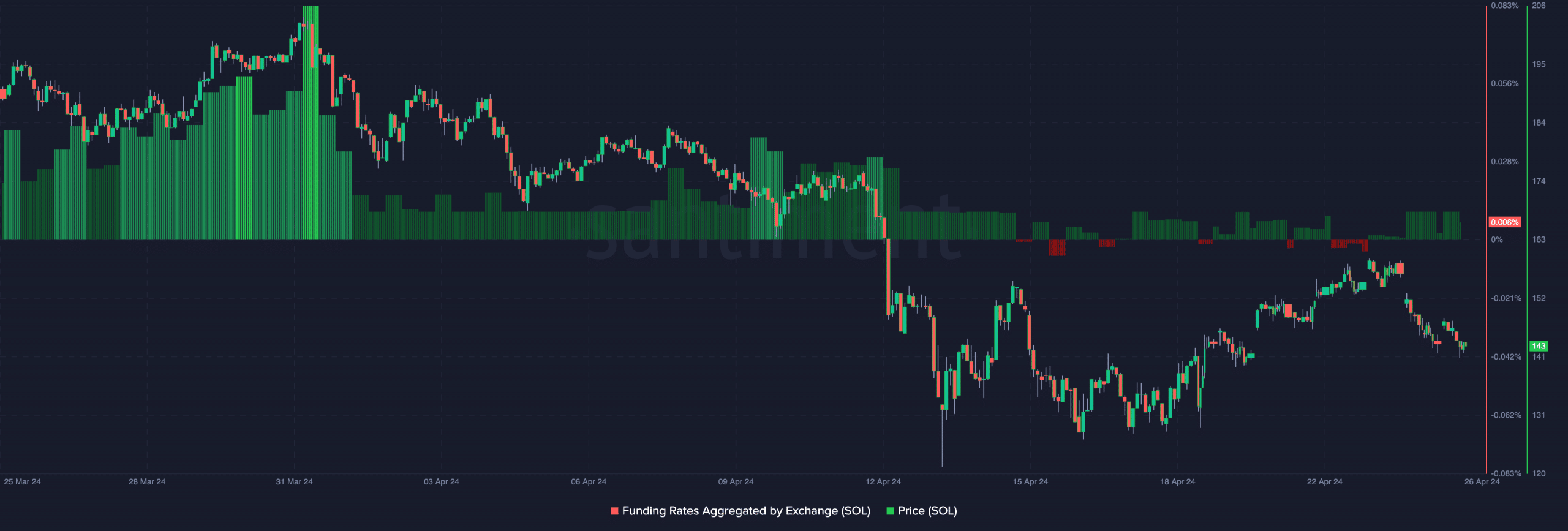

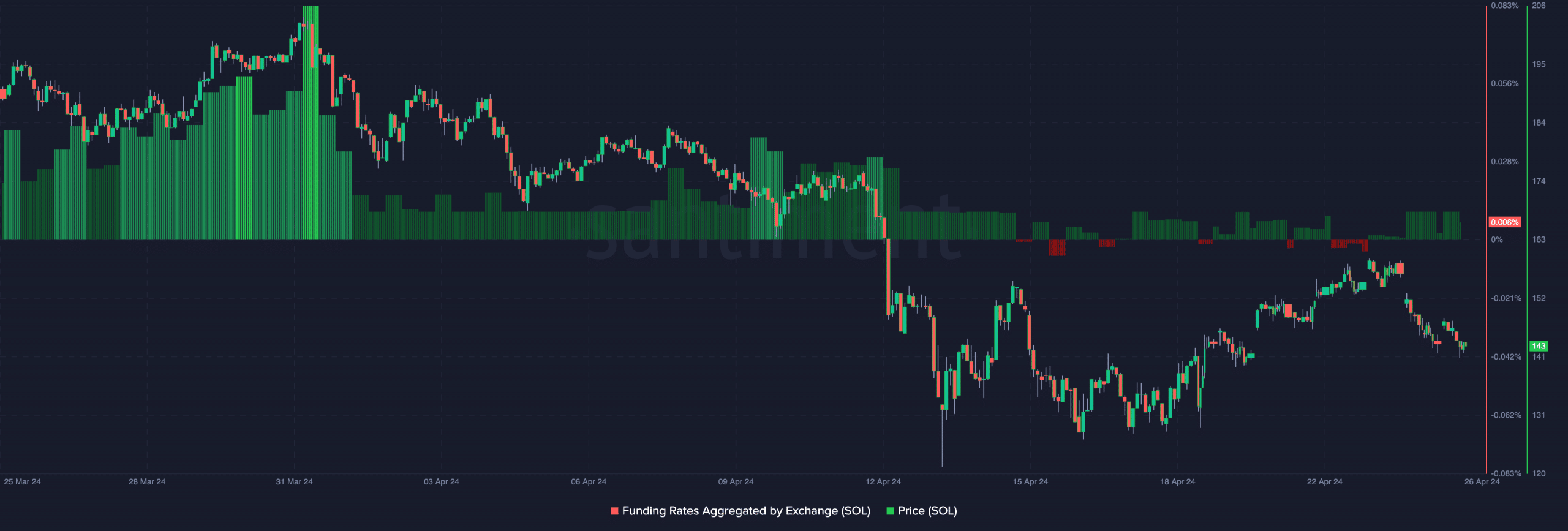

At press time, SOL’s aggregated Funding Rate was 0.0006%. As of 24th April, the metric was in the negative region, implying that shorts had been paying a recurring fee to long positions.

However the recent switch to the green area suggest otherwise. Despite the upward movement in funding, the continuous price decrease is potentially bearish for the token.

Source: Santiment

This is because spot traders are aggressively selling, leaving perp buyers in disbelief. Should funding go higher while SOL dips, the value of the token might to slip below $140 over the next few days.

However, a bounce off the current lows might change the condition for the better. But what does signals from the technical perspective say?

Bears are not done

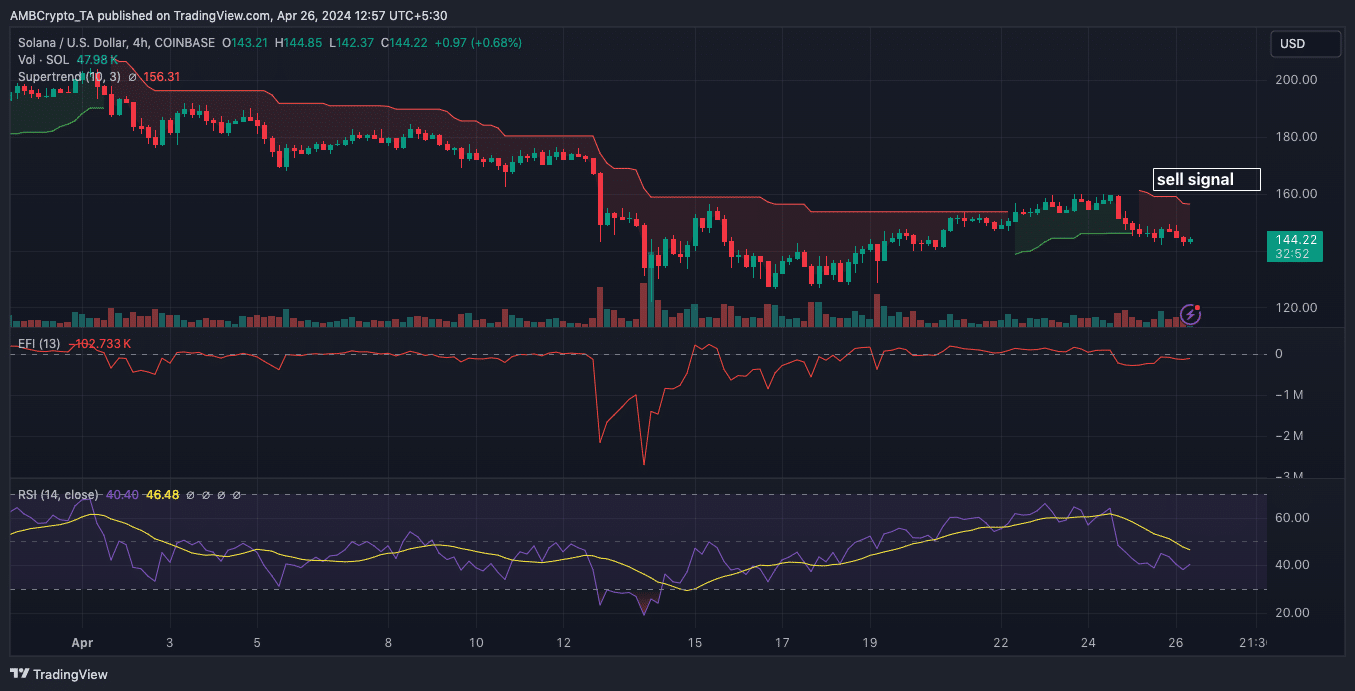

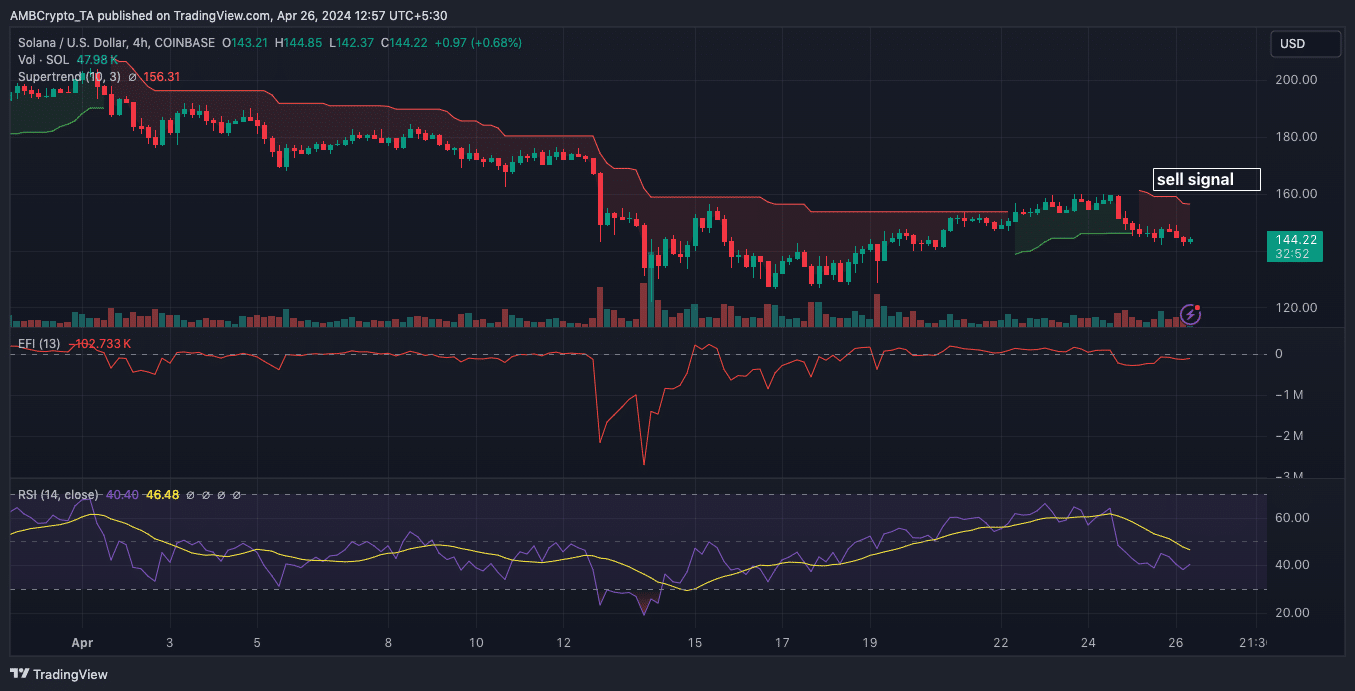

According to the SOL/USD 4-hour chart, the Elder Force Index (EFI) had dropped into the negative region. The negative reading of the EFI implied that bears are dominating that market. Hence, SOL might find it challenging to exit the selling pressure state.

For the Relative Strength Index (RSI), data from the chart showed that it was close to the oversold region. If the RSI reading hits approaches 30.00, SOL’s price might fall alongside it.

But if the indicator goes below the region, the price might rebound. However, the Supertrend indicator flashed a sell signal around $162.

Source: TradingView

Therefore, if the Solana native token rises toward the region, it could face a rejection that could send the price down again. A successful close above this point might help the value reviist $175.

Read Solana’s [SOL] Price Prediction 2023-2024

However, that would take a substantial level of buying pressure which the token currently lacked.

For the time being, SOL’s price might keep hovering betweein $137.66 and $147.57 unless the sentiment in the market changes.

Credit: Source link