- Analysts expect Fed and U.S Treasury moves to affect the market in a slow, but positive way

- Hayes eyes Solana, “doggie coins” for momentum trading as liquidity improves

Market analysts expect a mild bullish impact on Bitcoin [BTC] and overall markets from the recent “dovish” Fed rate decision and the U.S Treasury QRA (Quarterly Refunding Announcement).

According to Singapore-based institutional crypto-trading firm QCP, the U.S Fed and QRA were “more dovish than expected.” It noted that,

‘At FOMC, Powell said that the Fed is not looking to hike rates and announced the slowing of Quantitative Tightening (QT) from $60bn monthly to $25bn. For QRA, the Treasury will keep issuances for longer maturities unchanged, reducing fears of a spike in longer-term yields. This should help push down the USD rally, which is positive for risk assets.”

BitMEX co-founder Arthur Hayes echoed similar sentiments, but underlined that the liquidity impact will be mild on the charts.

“The impact of this QRA is mildly dollar liquidity positive….But it will help pump our bags slowly over time.”

Hayes eyes Solana, “doggie coins” for momentum trading

Hayes added that the current negative price movement will dampen as liquidity slowly improves each month. In fact, he expects BTC to reclaim $60k and remain range-bound within $60k-70k until August.

That’s not all though, with the exec expecting other altcoins to perform better. For his part, Hayes is eyeing Solana [SOL], dogwifhat [WIF], Dogecoin [DOGE] for momentum trading. Part of his statement read,

“I’m buying Solana and doggie coins for momentum trading positions.”

Momentum trading is a technique that involves buying or selling an asset that moves extremely in one direction, followed by exits when price flash reversal signs. Asset manager Franklin Templeton also has a bullish inclination towards Solana.

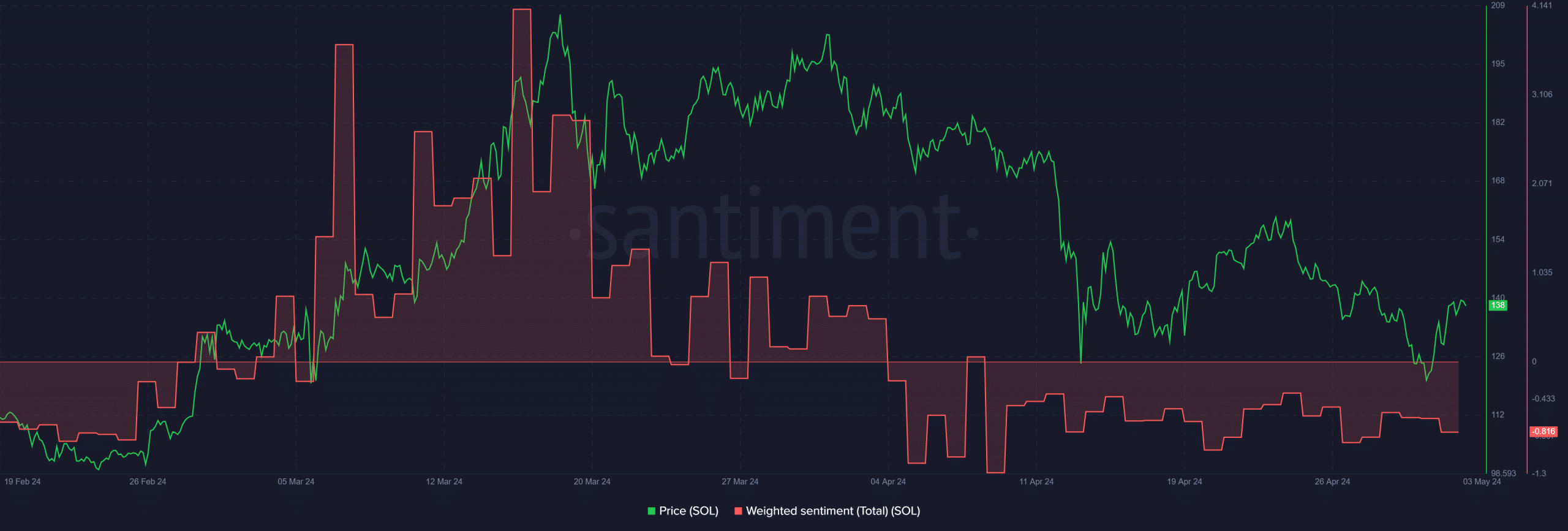

However, SOL’s latest price action chalked a downtrend and revealed that short traders have profited from the market dump. It was trading at $136 at press time, down 35% from its record high of $210 in mid-March.

However, bulls have defended the $126 short-term support twice, in mid-April and early May. Even so, a decisive trend reversal could materialize only if the price moves above the previous lower high of $160.

Additionally, Santiment data showed that overall market sentiment around SOL was still negative, as indicated by the weighted sentiment’s negative reading. So, a strong bullish reversal is unlikely in the short-term.

Source: Santiment

Credit: Source link