- Optimism Superchain collected massive amounts of revenue for the protocol over the last few weeks

- Despite the protocol’s performance, interest in the OP token tanked

Despite the growing competition in the Layer 2 sector, Optimism[OP] has continued to exhibit growth across various fronts.

Super chain brings in the dough

One of the reasons for the same is the Optimism Superchain. Optimism Superchain recently become a magnet for capital, attracting over $6 billion in deposits from Ethereum L1. This surge in popularity can be further underlined by the fact that assets bridged to the Superchain account for a significant portion – 25%, of the total value locked (TVL) bridged from Ethereum L1.

For context, the Optimism Superchain is like a collection of L2s. It bundles multiple L2s together, both technologically and economically. This combined approach offers several advantages, including streamlined operations and potential cost efficiencies.

As an incentive for participating in the Superchain, Optimism furnishes developers with access to a valuable toolkit, the OP Stack & Governance framework. This common set of tools simplifies development and streamlines governance processes for L2s within the Superchain.

In April 2024, Base demonstrated its commitment to the Superchain by paying $1.86 million in Superchain membership fees to Optimism. This financial contribution helps to ensure the ongoing development and maintenance of the Superchain.

Source: X

However, there were some concerns that arose when it was seen that Base had a higher number of monthly active users than the OP mainnet. In fact, Token Terminal’s data indicated that despite having a higher number of monthly active users, Base doesn’t necessarily undermine OP Mainnet’s position within the Optimism Superchain.

OP Mainnet can retain its role as the Superchain’s Hub by providing a shared governance framework for all member chains. Strong performance by individual member chains, like Base, can be beneficial for the entire ecosystem. This, because high-performing chains contribute more fees back to OP, further supporting the Superchain’s development.

How is OP doing?

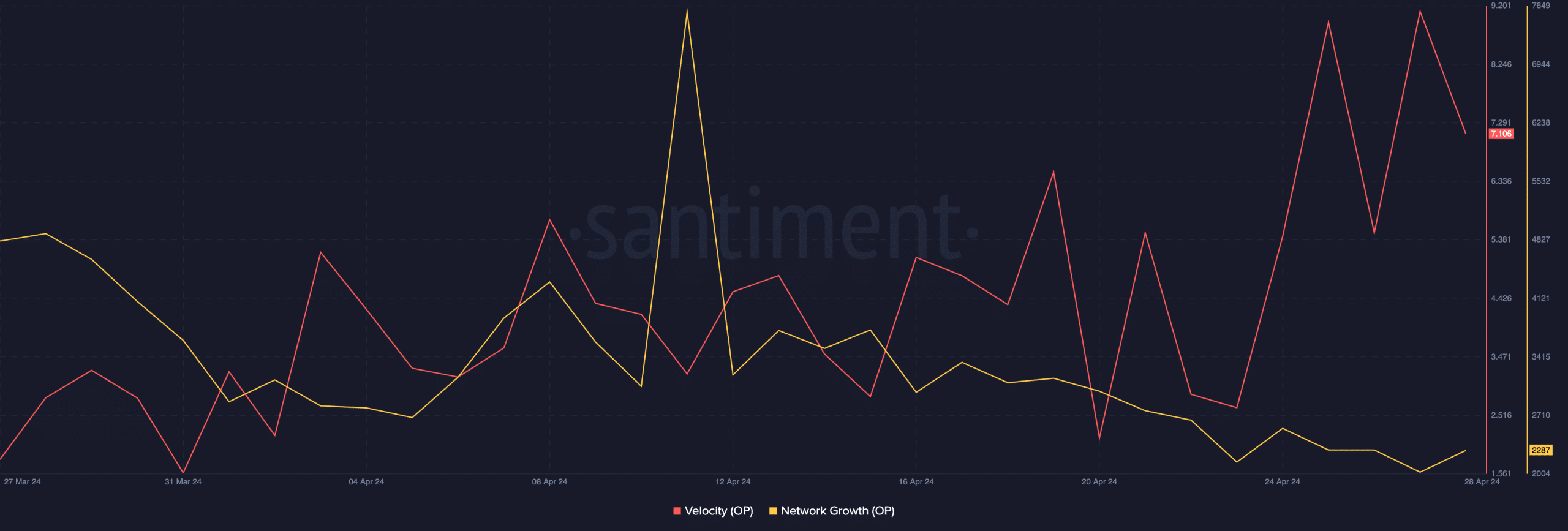

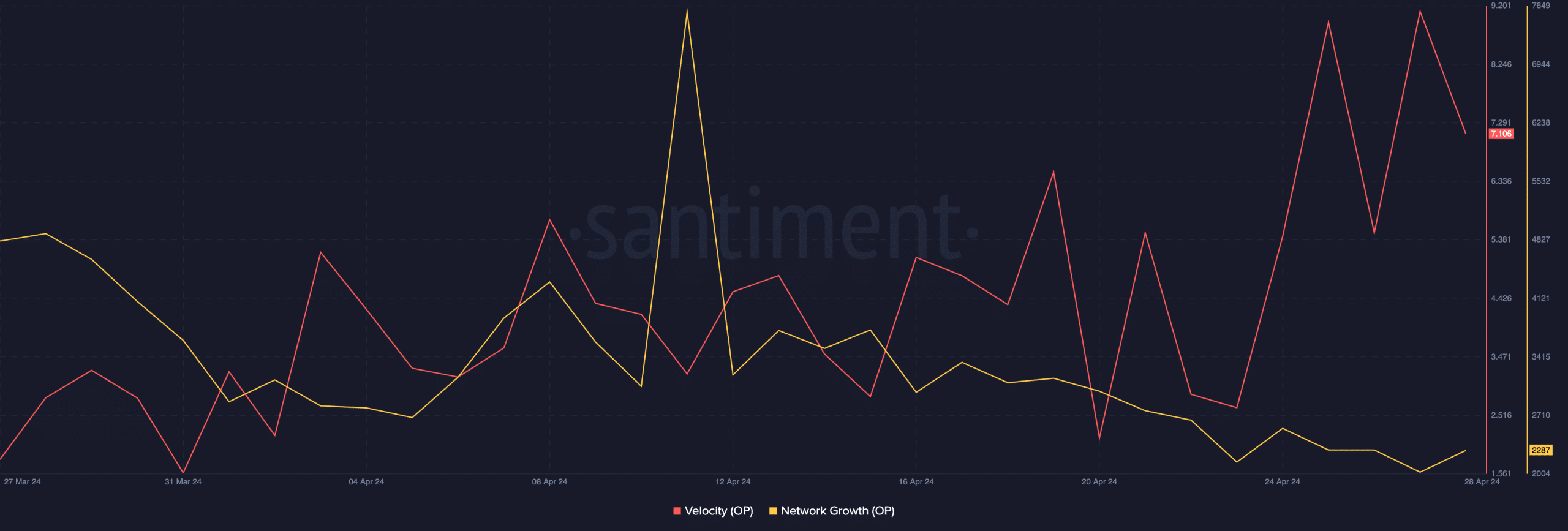

Despite Optimism network’s progress, overall interest in the OP token declined. Additionally, the price of OP has fallen by 5.59% in just 24 hours. At press time, OP was trading at $2.96. The volume at which OP was trading also fell by 22.75%.

Realistic or not, here’s OP market cap in BTC’s terms

Also, network growth around the OP token declined significantly, indicating that the number of new addresses showing interest in OP fell.

If the waning interest from new addresses continues, the price of OP could see a correction in the near future.

Source: Santiment

Credit: Source link