Recent bitcoin analysis and predictions from leading experts shed light on the potential trajectory of the top crypto asset’s price in the coming months, with a focus on 2024 and beyond.

Related Reading

Market Insights And Price Forecasts For Bitcoin

As the crypto community eagerly anticipates the future of Bitcoin, a diverse range of price predictions has emerged. Notable figures such as Arthur Hayes, Messari, Tim Draper, JP Morgan, Berenberg, and VanEck have weighed in with their forecasts, painting a varied picture of what lies ahead for the pioneering cryptocurrency.

While some experts project conservative estimates, suggesting a price range of around $45,000, others are more bullish, envisioning BTC soaring to over $600,000 by 2024.

These forecasts are underpinned by a nuanced understanding of market dynamics, including factors such as institutional interest, regulatory developments, and the impact of halving events on Bitcoin’s supply and demand dynamics.

Historical Analysis And Market Cycle Patterns

Drawing insights from historical data and market cycle patterns, analysts have identified intriguing parallels that could signal significant upside potential for Bitcoin. Previous market cycles have shown that after surpassing key all-time highs, Bitcoin prices have the propensity to double within a relatively short timeframe.

The analysis of past cycles, particularly the peaks in 2013, 2017, and 2021, suggests a pattern of rapid price appreciation following the breach of previous price records. If history is any indication, Bitcoin could be poised for a substantial move upwards, with projections indicating a potential doubling in price to around $140,000 in the near future.

Expert Opinions And Market Sentiment

Amidst the flurry of price predictions and market analyses, experts and analysts continue to offer valuable insights into the evolving landscape of cryptocurrency markets. Notable figures such as Alphanalysis and Will Woo have shared their perspectives on Bitcoin’s price trajectory, highlighting the importance of market corrections, accumulation phases, and the gradual build-up towards new all-time highs.

In 2017 the price of Bitcoin doubled in just 4 weeks after it established brand new all time highs.

In 2021 the price of Bitcoin doubled in just 4 weeks after it established brand new all time highs.

In 2024 the same action would imply a $138,000 price by the end of June. pic.twitter.com/4kOBPa6y11

— alphanalysis.io (@Sawcruhteez) May 22, 2024

Related Reading

While everyone was freaking out that #Bitcoin price was not rising the last 2 months, available BTC was quietly being scooped up, and importantly without paper BTC printed in its place.

Last time I’ll say it… It’s only a matter of time before BTC squeezes past all-time-highs. https://t.co/j2FJs7bSpc pic.twitter.com/HoPSSJfHqz

— Willy Woo (@woonomic) May 22, 2024

Bitcoin Price Prediction

Meanwhile, in the most recent estimate of CoinCodex for the price of Bitcoin, it shows the price will increase by 27% by June 22, 2024, to reach $88,997. This technical indicator indicates that the present mood is bullish, and the Fear & Greed Index is reading 76, which indicates extreme greed.

Over the previous 30 days, Bitcoin’s price fluctuated by 4.47%, with 12 out of 30 (or 40%) green days. The Bitcoin forecast indicates that this is a favorable moment to purchase Bitcoin.

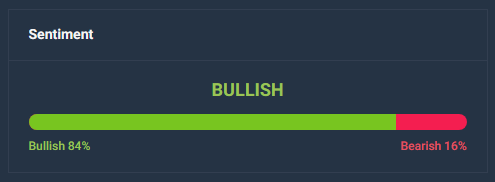

Latest data shows that there is a bullish general mood on Bitcoin price prediction, with 84% technical analysis indicators indicating optimistic signs and 16% indicating negative signals.

Featured image from NPR, chart from TradingView

Credit: Source link