- Ethereum ETF approval drives positive sentiment, but questions about S-1 registrations loom.

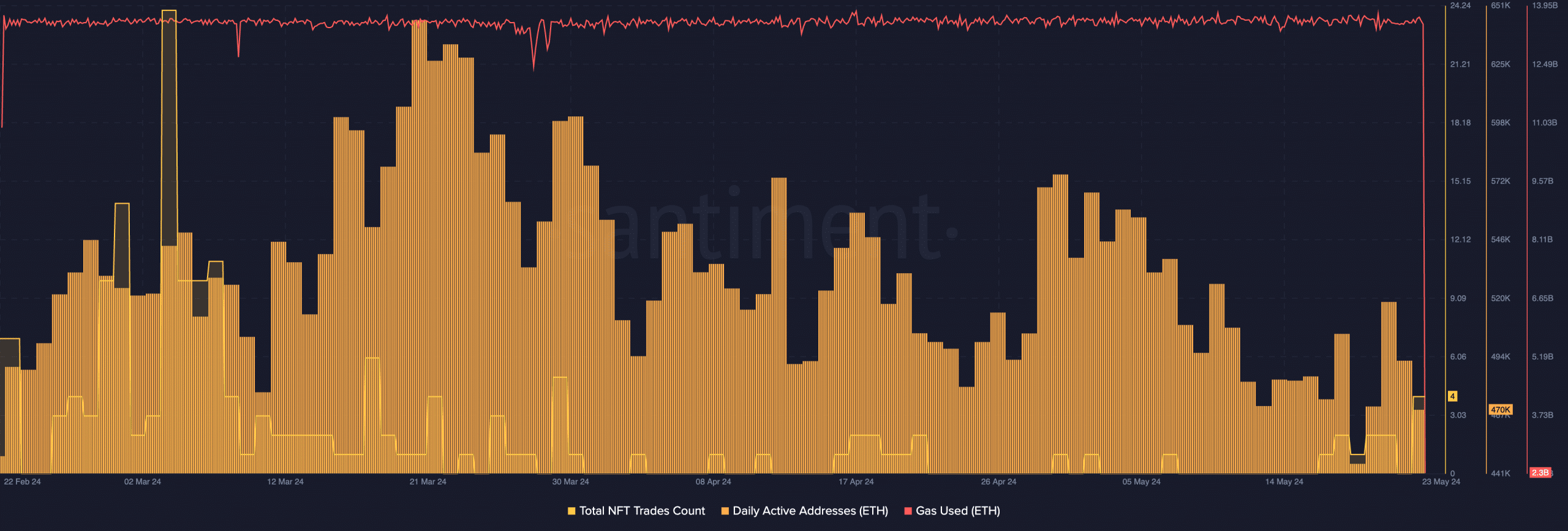

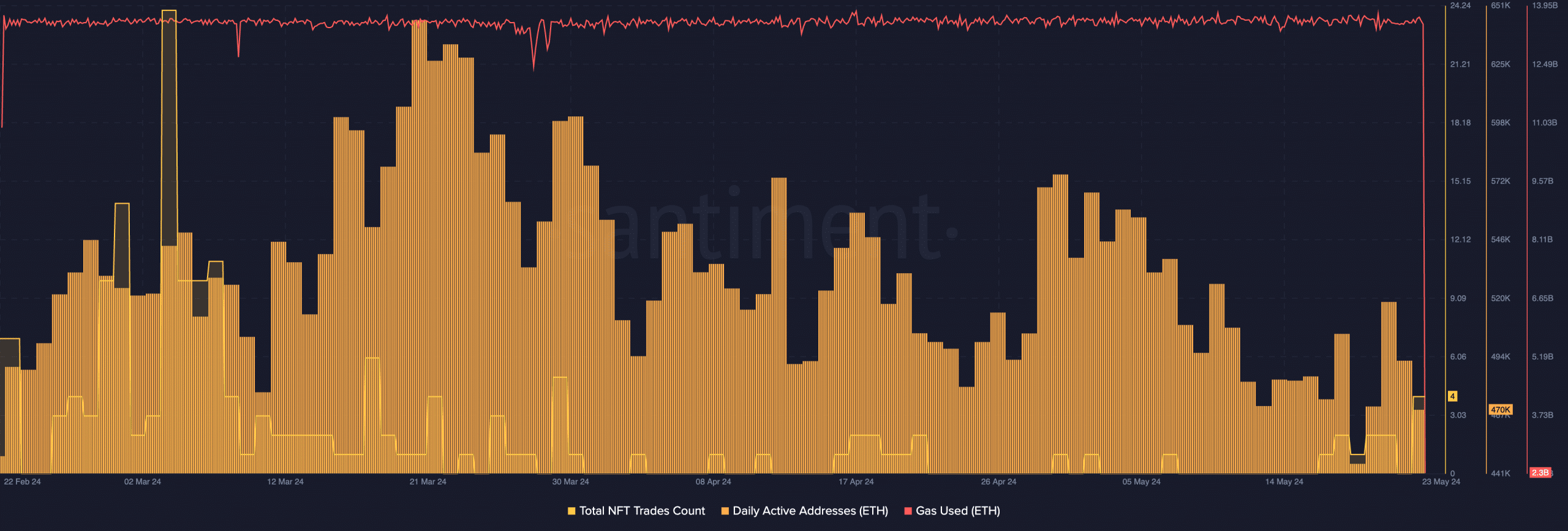

- Despite growing price, the overall activity on the Ethereum network declined.

Ethereum [ETH] witnessed a massive uptick in price due to the Ethereum ETF being approved. However, there could be some problems that ETH could face in the future.

Challenges ahead

According to Delphi Digital’s analysis, The SEC currently has only approved the 19b-4s listing requests for ETH ETFs, not the critical S-1 registration statements.

For context, S-1 is a key document for ETFs, acting like a prospectus, detailing investment strategy, risks, and financials. SEC approval of the S-1 is mandatory for an ETF to trade.

Source: X

The details

There are a couple of possible reasons for the SEC’s split approval. Delegated approval suggests potential political influence. This means that the approval may have been influenced by political considerations rather than by a careful review of the merits of the ETF proposals.

Some also believe that approval of 19b-4s might be a trade-off for passing ESG rules. ESG rules are environmental, social, and governance rules.

The SEC may have approved the 19b-4s listing requests in order to get approval for ESG rules. For clarification, 19b-4s is a form for rule changes by exchanges (like listing new products).

SEC approval allows the exchange to consider listing the new product (e.g., ETH ETF), but doesn’t directly authorize the ETF itself.

It is unlikely that the S-1s will be approved anytime soon. This is because there is still a lot of uncertainty about the regulation of cryptocurrency ETFs. The SEC may be waiting for more guidance from Congress or for the courts to weigh in on the issue.

Source: X

Even though there may be some time left for Ethereum ETFs to become fully operational in the open market, crypto traders have reacted extremely positively to this news.

The price of ETH grew by 22% over the last and the currency was trading at $3,691.32 at the time of writing. Apart from the hype that is driving the price of Ethereum, the overall state of the network will also play a crucial role in ETH’s long-term trajectory.

Is your portfolio green? Check out the ETH Profit Calculator

At press time, the number of daily active addresses on the Ethereum network had fallen significantly. Coupled with that the number of NFT trades occurring on the network had also fallen.

This declining interest in the network could impact ETH materially going forward.

Source: Santiment

Credit: Source link