- AVAX seemed to be consolidating around $38, despite mixed market signals

- Bullish sentiment on Binance and resistances at $50 and $55 could drive the price to $100

With the cryptocurrency market on fire over recent developments, Avalanche (AVAX) has caught the eye of many investors. Historically, AVAX has shown resilience, even when caught in the toughest bear markets.

At press time, AVAX was valued at $38.49 after appreciating by 2.5% in just 24 hours. While this didn’t amount to significant gains, AVAX seemed to be doing much better than many of the market’s other altcoin. What does this mean for AVAX’s price performance through the rest of the year?

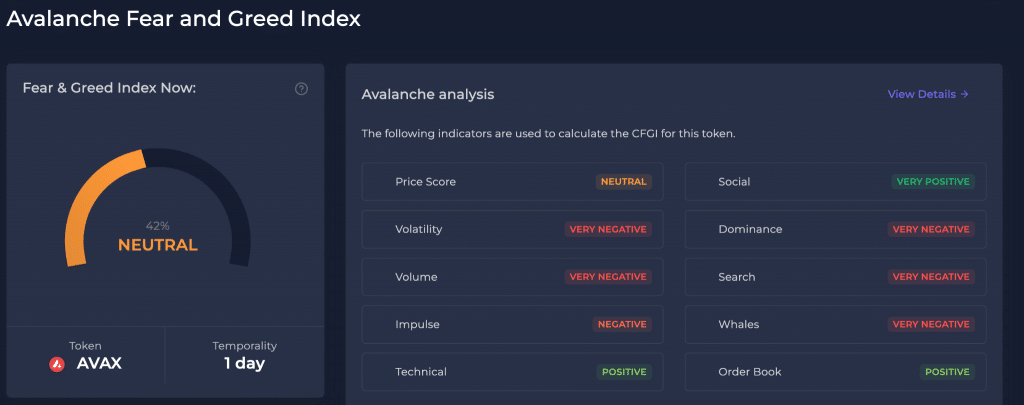

For starters, the current state of the AVAX market is marked by neutral sentiment, with a 42% rating on the Fear and Greed Index – A sign of balanced views among investors.

Source: CFGI

While social sentiment was very positive at press time, other indicators like volatility, volume, and whale activity were negative – A sign of market uncertainty and reduced trading activity. Additionally, the dominance and search interest for AVAX has been fairly negative too, highlighting a lack of market control and lower general interest.

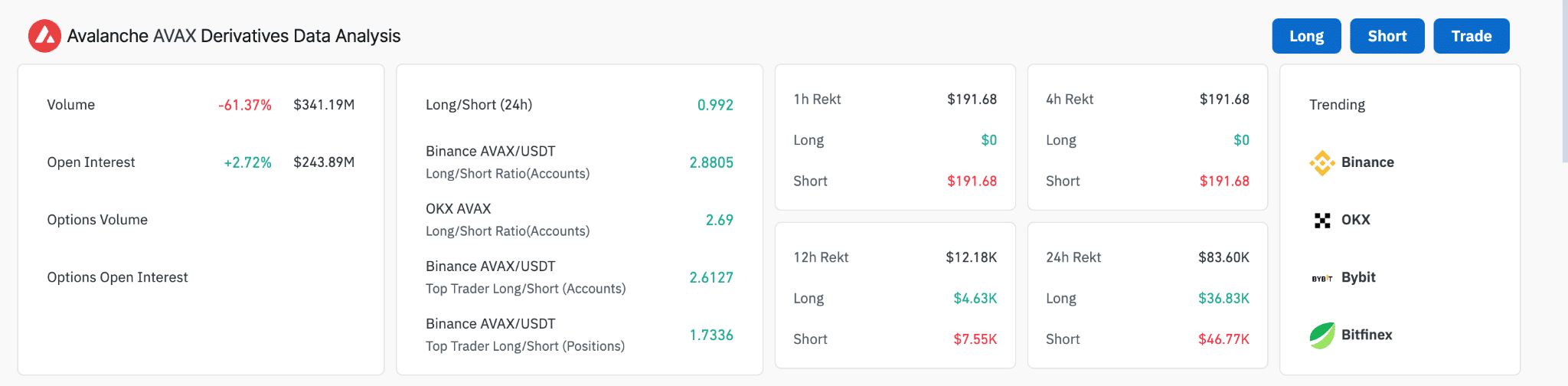

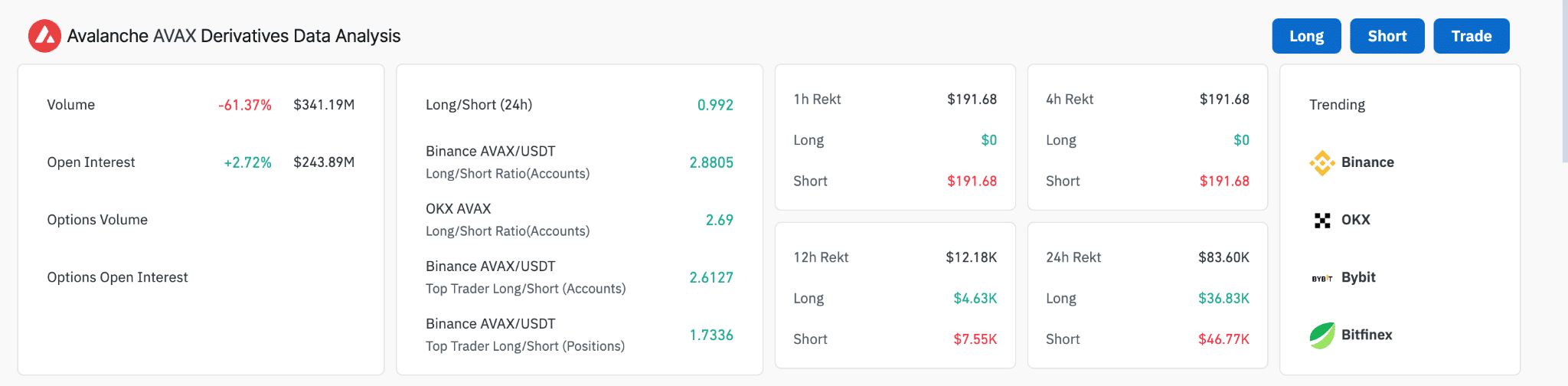

In fact, Coinglass’ data revealed a massive fall in trading volume by 61.37%, with the same recording figures of $341.19 million at the time of writing. On the trading side, the long/short ratio seemed relatively balanced across different platforms. This means traders aren’t sure what to do with AVAX right now.

Source: Coinglass

Interestingly, however, the long/short ratio on Binance seemed to be considerably high at 2.8805. This could indicate a more bullish sentiment among individual traders on this one exchange.

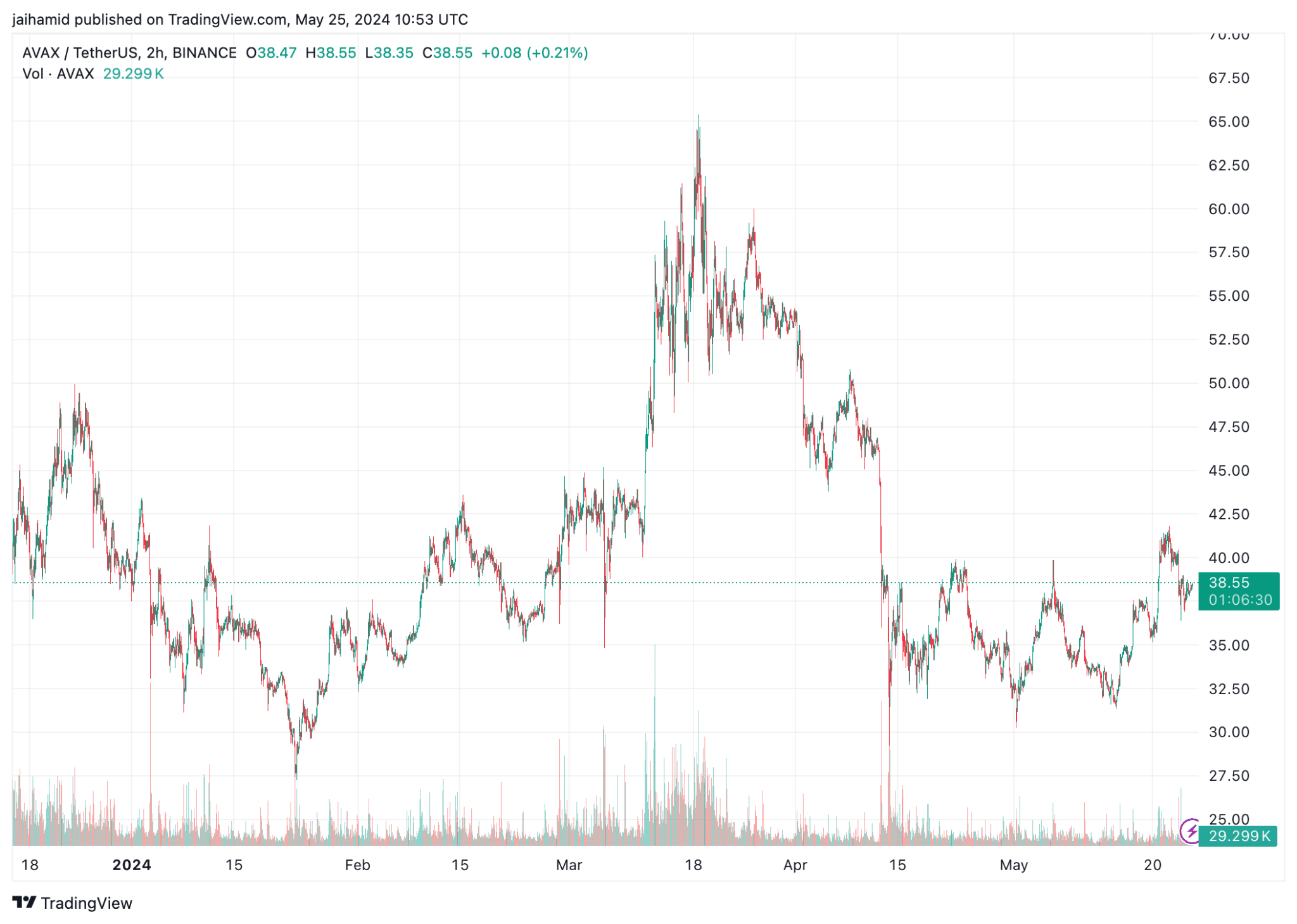

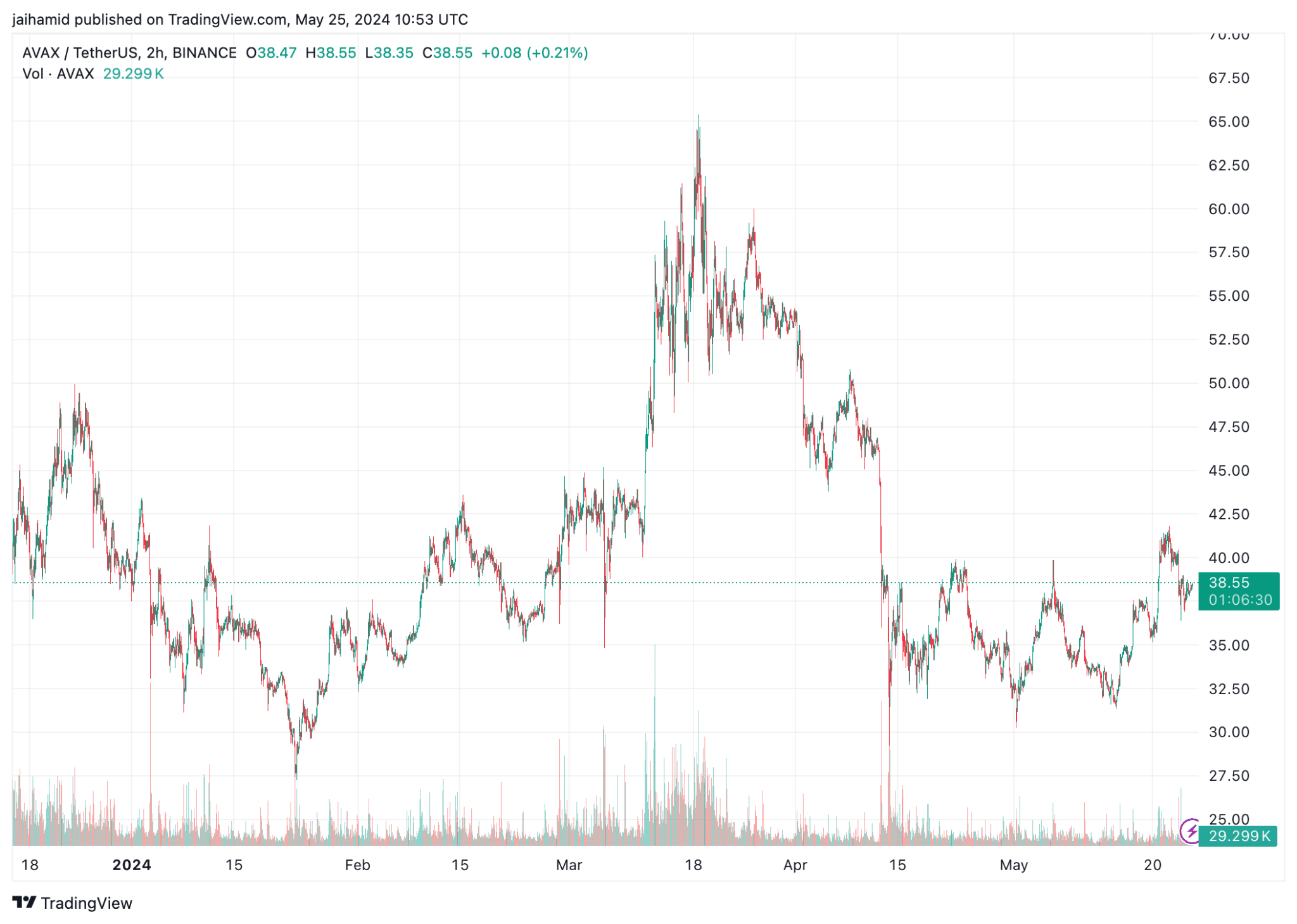

It’s also worth noting that the six-month Avalanche chart highlighted a volatile trading pattern with several peaks and troughs. Simply put, a market responsive to broader market trends and specific ecosystem developments.

Over the past few months, AVAX has noted many price spikes followed by sharp corrections on the charts. Right now, the altcoin seems to be consolidating around the $38-level after a recent downtrend from higher levels seen in April.

Source: TradingView

If AVAX maintains support around the $35-level, there could be potential for northbound movement, especially when the bull run starts. Key resistance levels to watch would be around $50 and $55, levels that AVAX has tested multiple times in the past few months.

A sustained break above these levels could signal strong bullish momentum, possibly driving the price towards the $80-mark or even $100 in the year’s third quarter.

Credit: Source link