- Aave has declined in the last 48 hours.

- Despite the decline, it saw more cash inflow in over a year.

Aave [AAVE] has delivered an impressive performance over the past few weeks, outpacing both Ethereum [ETH] and Bitcoin [BTC] in terms of gains.

This price surge has attracted a significant inflow of funds into the platform.

However, in the past two days, Aave has experienced some declines, prompting analysts to examine its recent trends to predict where it might be headed next.

Aave nears a golden cross

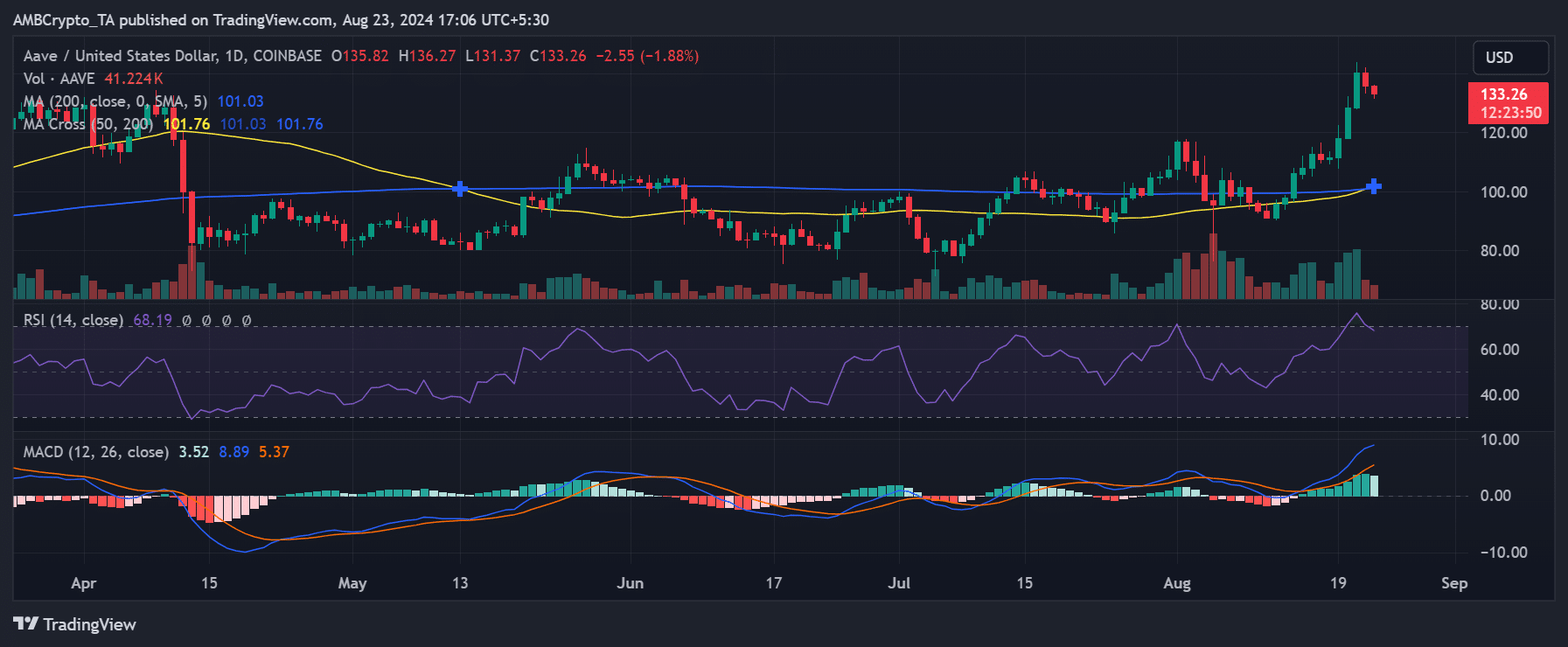

AMBCrypto’s analysis of Aave’s daily price trend revealed a significant increase over the past few weeks.

According to AMBCrypto, Aave started the month trading around $116, and as of this writing, it has risen to approximately $133. This price spike has occurred despite the recent declines witnessed in the last 48 hours.

Source: TradingView

Aave has outperformed major assets like Ethereum, with an impressive 90% increase over the past month.

Analyzing its short and long moving averages (yellow and blue lines), it appears that Aave is on the verge of forming a golden cross.

This bullish indicator occurs when the short-term moving average crosses above the long-term moving average. Thus, the altcoin could see further upward momentum, reinforcing a positive outlook soon.

Traders show more positive interest

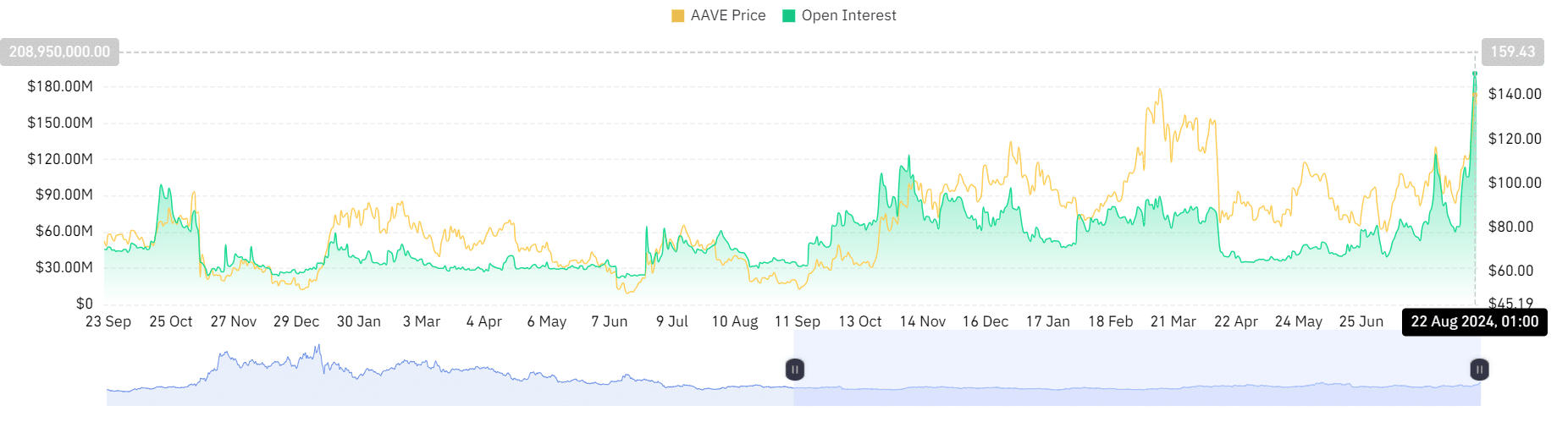

Analysis of Aave’s Open Interest on Coinglass revealed that it recently surged to its highest point in over a year, reaching approximately $191 million on the 22nd of August.

Although it has since declined slightly to around $177 million as of this writing, this level still represented one of the highest points Aave has seen in over a year.

This surge in Open Interest indicated a significant inflow of capital into Aave, driven by its press time price trend.

Source: Coinglass

Additionally, AMBCrypto’s look at Aave’s Funding Rate showed that it has consistently remained above zero, standing at around 0.0027% at press time.

This positive Funding Rate, despite the recent price declines, suggested that market sentiment towards Aave has remained bullish over the past few weeks.

Thus, AAVE saw strong and sustained positive sentiment, reflecting traders’ confidence in the altcoin’s continued performance.

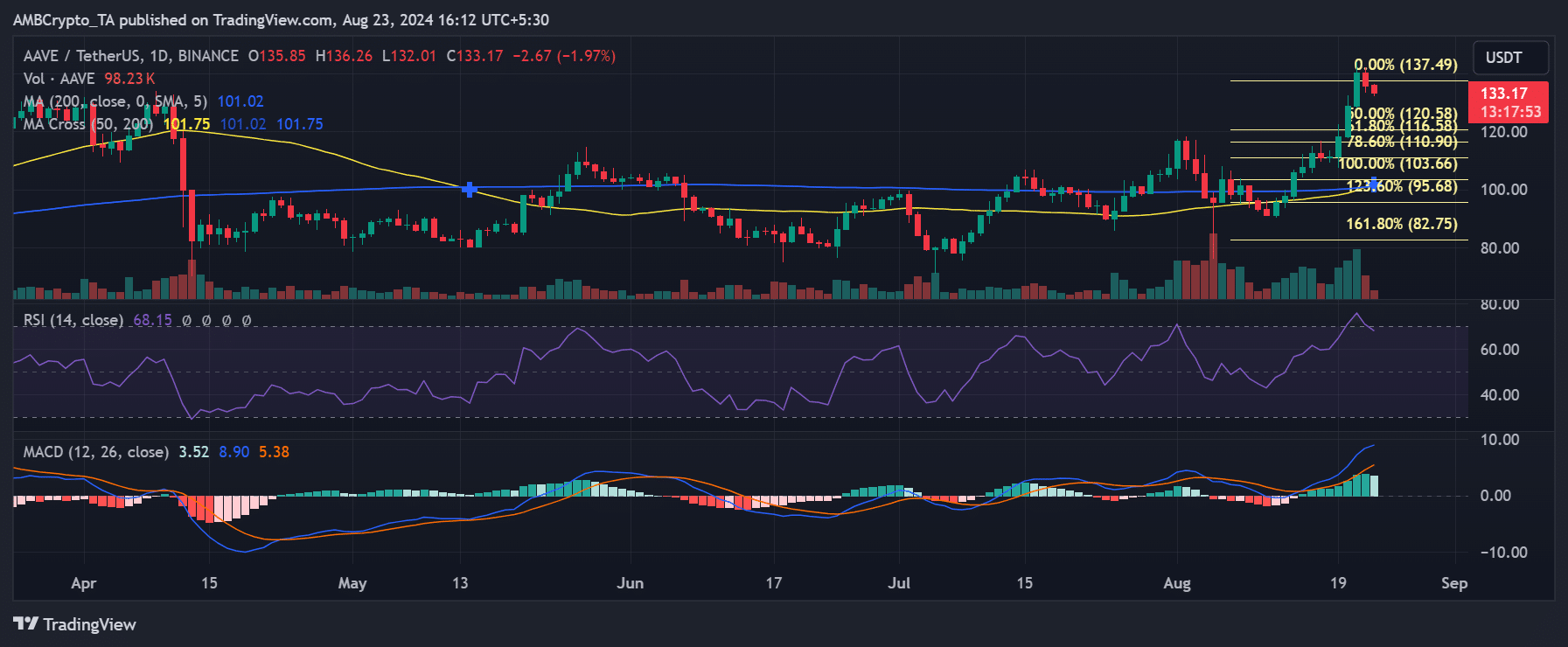

Aave’s trend remains volatile

The Fibonacci retracement levels on the chart indicated that the 0% level, near $137.49, marks the recent high and served as immediate resistance.

Meanwhile, the 38.2% level, around $120.58, stood as a crucial support point.

Suppose AAVE sustains its price above the 23.6% Fibonacci level at $129.68, and the RSI remains under 70, avoiding the overbought zone.

In that case, the price may consolidate before attempting to surpass the recent high of $137.49.

Successfully breaking above $137.49 could propel AAVE to target higher Fibonacci extension levels, potentially reaching $150 or beyond, depending on market conditions and overall sentiment.

Source: TradingView

However, if the RSI enters the overbought zone and then reverses, coupled with a weakening MACD, AAVE might experience a pullback to the 38.2% Fibonacci level at $120.58.

A break below $120.58 could trigger a deeper correction, with the price possibly testing the 50.0% Fibonacci level at $116.58 or even the 61.8% Fibonacci level at $110.96.

Realistic or not, here’s AAVE’s market cap in BTC’s terms

Should bearish momentum increase, a retest of the 200-day and 50-day moving averages around $101 could occur.

A break below this critical support zone may signal a trend reversal, leading to further declines toward the 100% Fibonacci level at $103.66 or potentially lower.

Credit: Source link