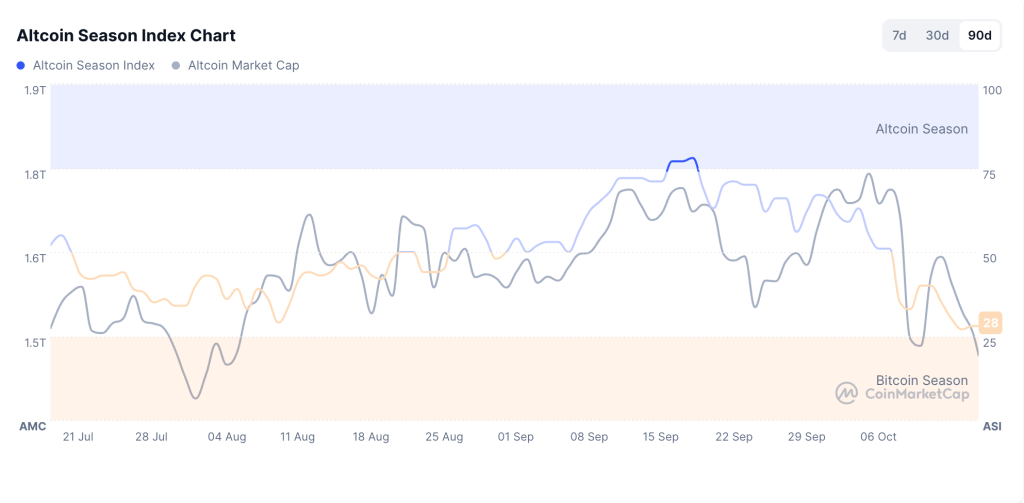

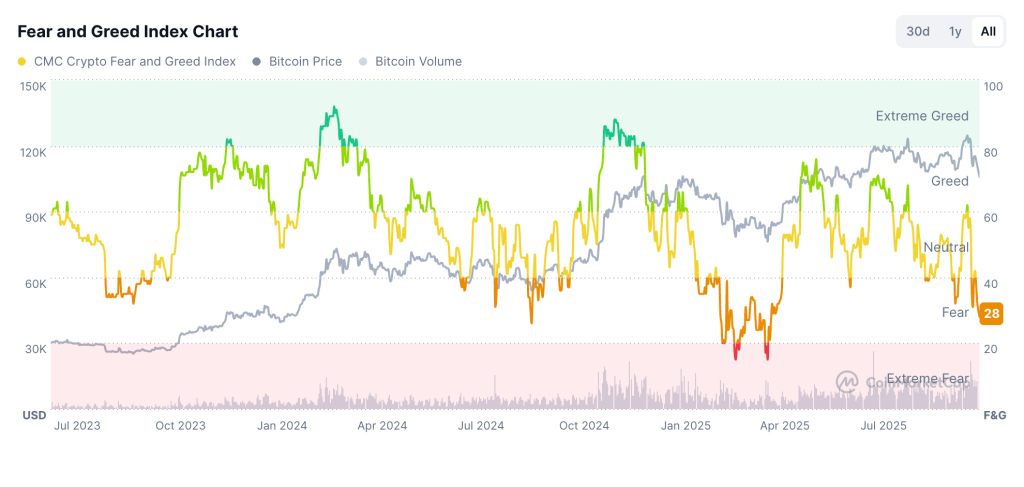

October often carries a hopeful tone for crypto. Today’s tape feels different. Both the Altcoin Season Index and the Fear and Greed Index hover at 25, a reading that tilts toward Bitcoin season, yet Bitcoin itself trades only slightly above $105,000 after sliding 13% in a week. That combination leaves altcoin holdings exposed while liquidity rotates quickly between books.

Depth did not disappear but migrated. Sellers met bids at lower marks, and volumes jumped where participation concentrates during stress.

Data shows BNB near $1,067, down 10% in 24 hours, with a volume of $7.1 billion, up 33%. Sui sits near $2.38, down 11% with $2.35 billion in volume, up 80%. Solana trades near $179, down by 7% with $12 billion in volume, up by 30%.

Altcoin Season Index (Source: CoinMarketCap)

BNB: Heavy Turnover Into Layered Bids

BNB price slipped while volume expanded, a pattern that often represents larger orders executed into resting demand. Reports point to funding turning negative on several venues and basis compressing, two markers of forced positioning rather than steady accumulation.

Short-term traders will watch spreads during the next session. Tighter spreads with calmer funding often precede stabilization. Persistent negative funding with fading spot leadership can extend pressure.

Sui: Fastest Volume Growth and Sharpest Reset

Sui’s largest volume jump of 80% is an outlier in this group. Data indicates rapid repositioning from short-horizon accounts after crowded longs earlier in the week.

Intraday ranges widened, then narrowed during the final hours, which suggests early attempts at absorption. A practical approach favors patience near yesterday’s low. The market is looking for smaller wicks, balanced funding, and a session that holds above its own volume-weighted average price before sizing into weakness.

Solana: Rotation, Not Strength

Solana’s price drop alongside higher trading volume points to risk rotation rather than renewed interest. Data shows that much of the recent activity came from traders unwinding leveraged positions and shifting exposure into more liquid assets.

This is a flow-driven session with most movement confined to intraday trading ranges. Large transfers between spot and derivatives venues suggest rebalancing across accounts rather than new accumulation. Until volume normalizes and volatility narrows, Solana’s price action reflects redistribution of positions, not directional conviction.

How to Approach This Phase Without Forcing Trades

Start with liquidity, not predictions. Identify where depth clusters on books and stage entries near those bands rather than reaching for mid-range quotes. Ladder orders to reduce slippage when conditions are thin.

Fear and Greed Index (Source: CoinMarketCap)

Let volatility cool before leaning in. A session that holds above its own volume-weighted benchmark with declining realized volatility offers cleaner entries than a chase into expanding ranges. Many desks wait for that setup during heavy weeks.

Use position sizing that respects uncertain breadth. The index of 25 implies narrow participation. That favors scaling rather than all-or-nothing bets. Concentrate on pairs showing stable spreads and consistent depth. Avoid thin offshoots until funding normalizes.

Track rotation indicates instead of headlines. If Bitcoin steadies and the index remains in the high 20s, selective bids often appear in liquid DeFi or exchange-linked names first. If Bitcoin loses nearby support, defense takes priority, and rallies often fade at prior intraday highs.

Bottom Line for a Dark Day

This sell-off carries high participation, not apathy. BNB shows heavy turnover into layered bids. Sui registers the fastest reset with signs of early absorption. Solana prints large tickets without a major collapse in price.

None of that cancels the risk message from the index, yet it outlines a playbook: wait for stabilization markers, respect depth, and let funding tell the story before committing fresh risk.

Credit: Source link