- XRP has relied on whale support twice post-election, making it a crucial metric to watch.

- Is the $2 support level hanging by a thread?

Ripple [XRP] plunged to $2.10 amid the recent market downturn, recording an 8.06% single-day drop – one of the steepest among high-cap assets.

Following the election, XRP twice closed below $2, within the $1.95–$1.98 range, which triggered significant rallies of 71% and 53%, respectively.

These rebounds were not coincidental—they were driven by whale wallets injecting billions into the XRP Ledger. Each dip coincided with a surge in institutional inflows.

Now, as Ripple revisits this critical support zone, the question arises: is another breakout imminent?

Key threat to its $2 support

In a recent analysis, a market strategist warned that a breach of XRP’s $2 support could trigger its “end game,” signaling a deeper breakdown.

This prompted AMBCrypto to dive deeper into the possible factors at play.

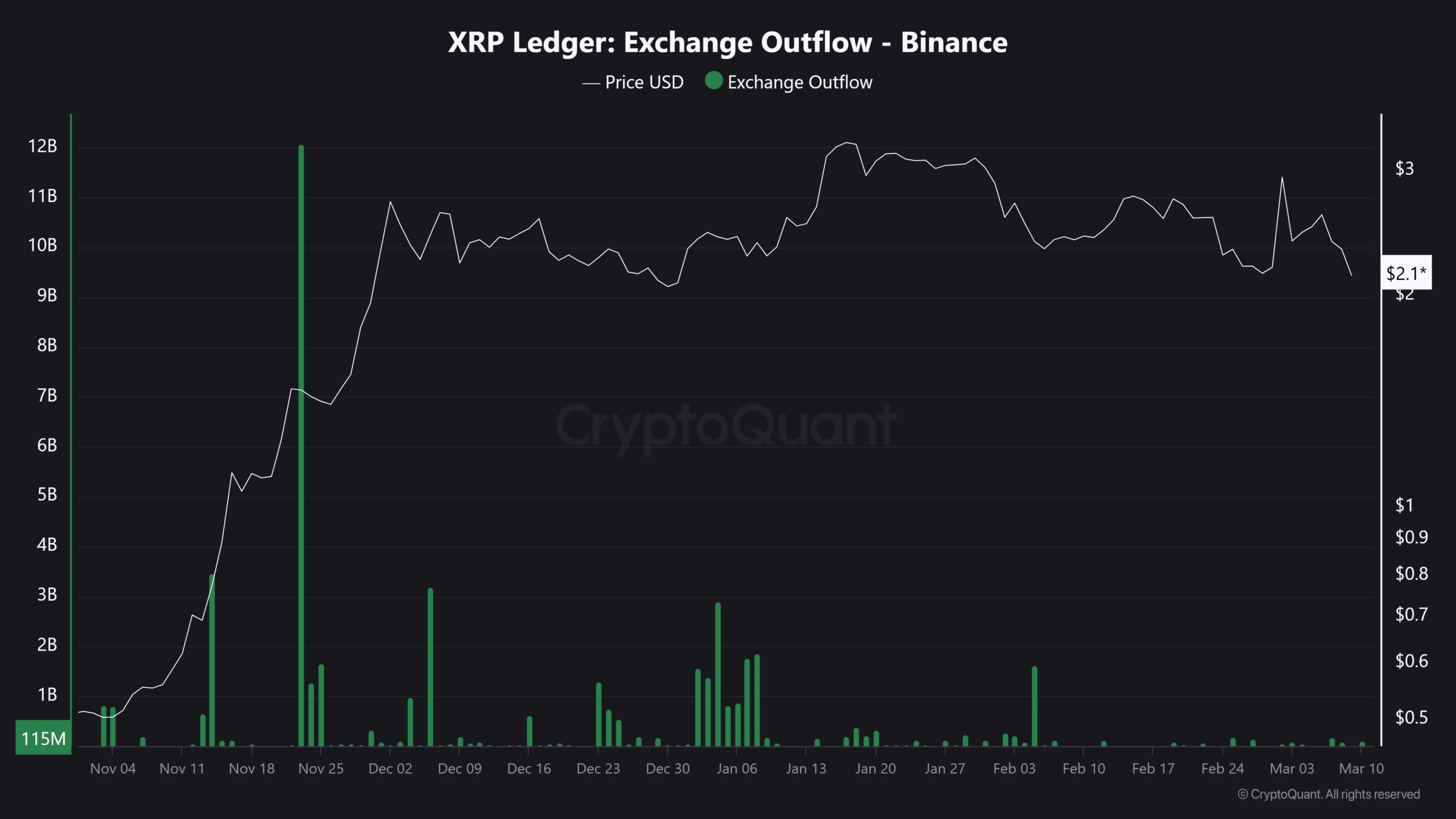

Retail-driven FOMO, a key liquidity driver, has been absent since the election rally. Binance outflows, which previously surged to 12 billion XRP, have now dropped to 115 million.

Source: CryptoQuant

Adding to the concern, during XRP’s two previous dips below $2, outflows dropped to just 10 million XRP, indicating that small retail investors were reluctant to buy the dip.

At the same time, futures traders are pulling back as well. XRP’s Open Interest (OI) has fallen by 6.38% to $3.17 billion—a sharp decline from the $7.80 billion OI peak during its mid-January rally.

With shrinking liquidity and waning FOMO, the possibility of reclaiming $3 seems increasingly slim, heightening fears that Ripple’s $2 support level remains unstable.

Is XRP losing its grip on the market?

Less than two weeks after talk of XRP’s ‘potential’ inclusion in the Strategic Reserve sparked backlash, the market’s response was decisive.

Within a day, Ripple plunged 18.79%, suffering a far steeper decline than Bitcoin’s 8.10% drop.

Despite being 2024’s top-performing high-cap asset by YTD growth, a repeat rally in 2025 remains uncertain.

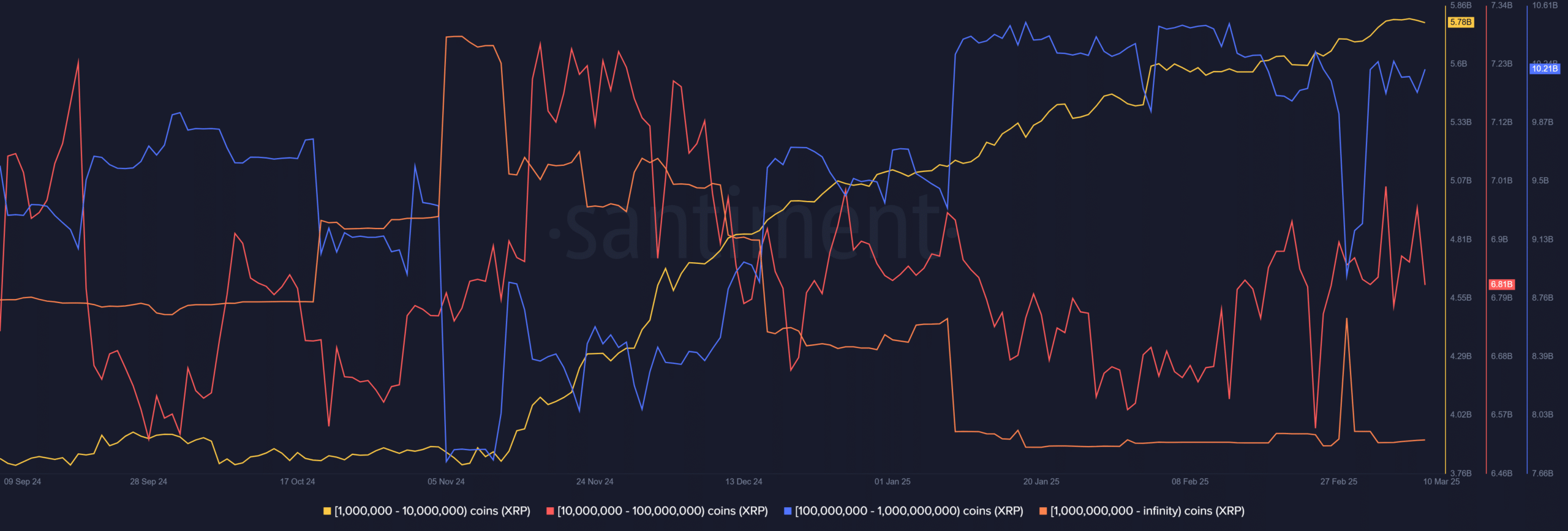

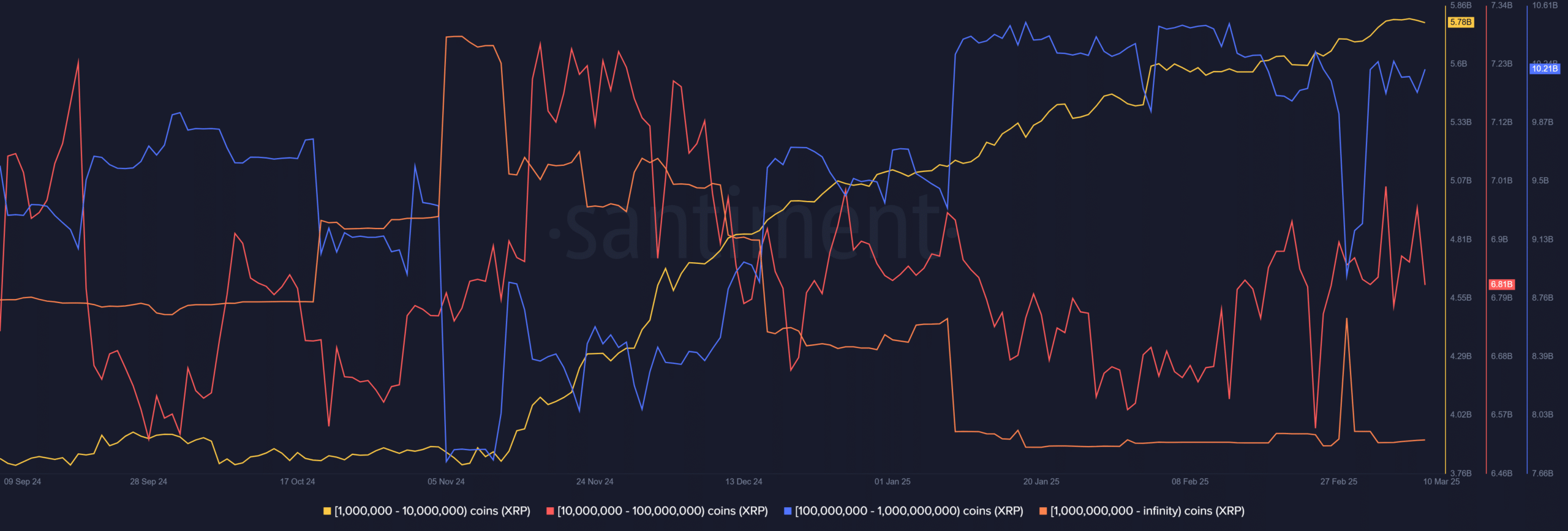

The key now lies with major holders, whose accumulation has defended the $2 level so far.

Source: Santiment

With rising volatility, retail demand is diminishing, and futures liquidity is drying up. There is no institutional support for an XRP reserve.

The $2 support level now faces increasing pressure. Major holders remain the last line of defense for maintaining this critical support zone.

Credit: Source link