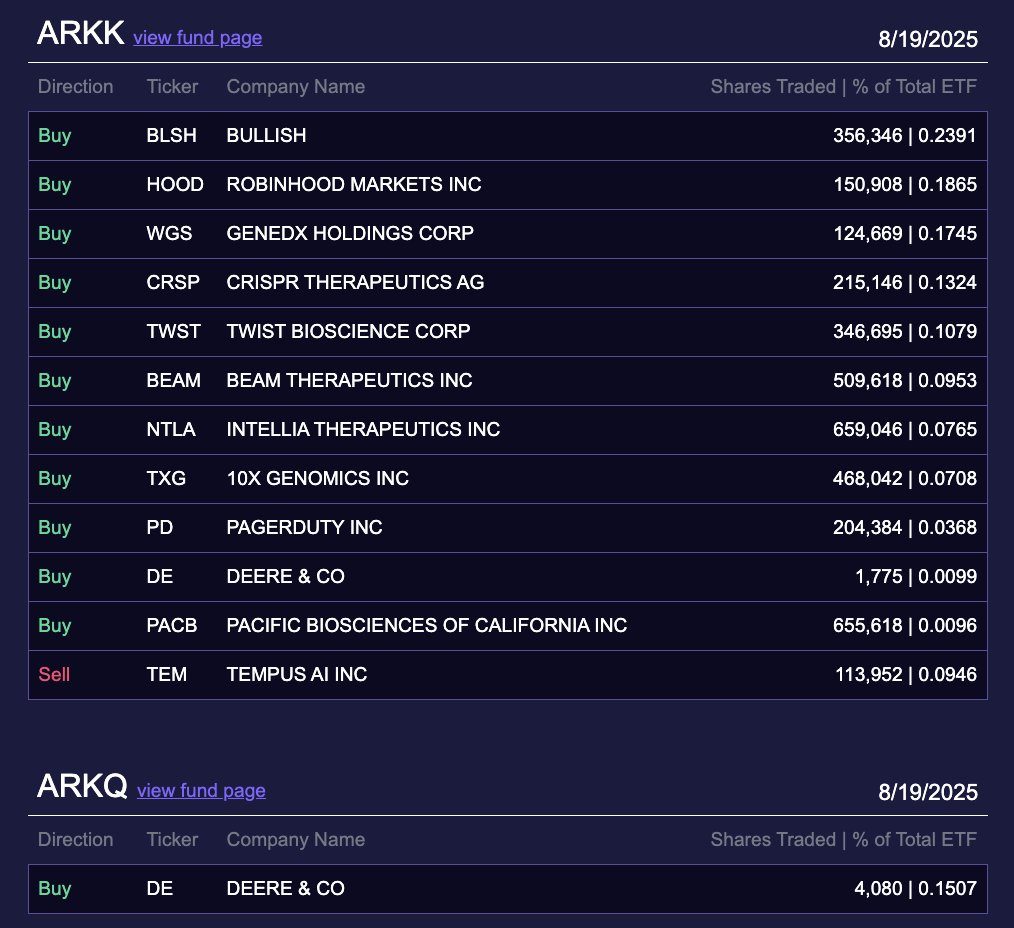

Cathie Wood’s ARK Invest has purchased 356,346 shares of Bullish Holdings valued at $21.2 million, along with 150,908 shares of Robinhood Markets worth $16.2 million, during what ARK describes as strategic accumulation. These purchases came amid market-wide selling pressure that saw millions liquidated in long positions.

The purchases also extend ARK’s three-session Robinhood buying streak, adding to Monday’s $14 million acquisition and Friday’s $9 million buy, bringing recent Robinhood investments to $39 million across the period.

ARK’s commitment to Bullish now totals $209 million following last week’s initial $172 million purchase of 2.53 million shares across three ETFs after the Peter Thiel-backed crypto exchange’s NYSE debut at $37 per share.

ARK’s Strategic Reentry Following Regulatory Compliance

The Robinhood accumulation marks a dramatic reversal from ARK’s forced selling throughout 2024 to comply with Rule 12d3-1, which restricts ETF holdings in registered broker-dealer securities to 5% of total assets.

This regulatory-driven selling, followed by Robinhood’s European expansion through Bitstamp and new product launches like the USDG stablecoin, creates additional revenue streams that might have driven the recent accumulations.

Notably, ARK’s current buying spree also coincides with Robinhood’s exceptional Q2 performance, where crypto revenue surged 98% to $160 million and customer accounts reached 26.5 million, with platform assets nearly doubling to $279 billion year-over-year.

Meanwhile, Bullish’s explosive trading debut saw shares surge over 200% intraday before settling at $68, representing an 84% premium that validated ARK’s timing on the initial investment.

The firm’s aggressive positioning reflects its mid-year 2025 recovery narrative, where ARKK posted a 73.54% gain between April 8 and June 24 compared to the Nasdaq 100’s 29.74% recovery over the same period.

ARK attributed this outperformance to active portfolio rebalancing during the recovery, exiting three securities while entering five new positions, including high-profile IPO additions that drove massive turnover rates.

The Pattern Behind ARK’s Crypto Equity Dance

ARK’s trading patterns across crypto equities have drawn scrutiny as the firm purchases at exact timing that consistently maximizes returns across multiple positions.

The firm’s rapid $52 million Circle disposal just 11 days post-IPO captured peak valuations before shares retreated, its July decision to sell $6.5 million in Coinbase and $5.8 million in Robinhood occurred precisely as both stocks reached local highs during Bitcoin’s rally above $118,000.

This pattern of exiting at apparent peaks before re-entering during subsequent weakness raises questions about whether such consistent timing resulted from analytical superiority or informational advantages that retail investors lack.

ARK’s current Robinhood reaccumulation buying $39 million after regulatory compliance forced previous sales follows an eerily similar trajectory to its Circle strategy, where profit-taking preceded renewed accumulation during market softness.

The firm’s mid-year justification that traditional technical indicators “don’t account for active portfolio management” conveniently preceded perfectly-timed exits across crypto positions, including the controversial Circle sale that occurred as momentum began faltering.

Additionally, ARK’s simultaneous partnerships with crypto infrastructure providers, such as the recent SOL Strategies staking arrangement, may create potential information advantages that could inform trading decisions across related equity positions.

The consistency of ARK’s profit maximization across volatile crypto equities continues to be a point of attention, particularly as the firm has consistently demonstrated an unusual ability to buy dips and sell peaks with remarkable precision.

What remains unclear is whether ARK’s latest Bullish and Robinhood purchases indicate confidence in these specific companies’ execution capabilities or are a short-term bet that will still be offloaded as seen previously.

Credit: Source link