- Ethereum’s supply held by top addresses increased sharply.

- Metrics suggested that buying pressure on XRP was high.

The latest market crash caused most cryptos prices to drop, including Ethereum [ETH] and Ripple [XRP]. While these tokens’ value dropped, whales tapped the opportunity to increase their holdings.

This might have a positive impact on ETH and XRP though, as it can trigger a trend reversal.

Ethereum whales are stepping up

As per CoinMarketCap, ETH’s price fell by more than 5.2% in the last 24 hours. At press time, it was trading at $3,084.60, with a market capitalization of over $370 billion.

AMBCrypto reported earlier the possible reasons behind the dip. As the price of Ethereum plummeted, four whales—notable institutional investors among them—participated in a sell-off.

However, over the next few hours, things changed. Lookonchain recently posted a tweet highlighting that a whale spent 70 million USDC to buy 23,790 ETH at $2,942 from the bottom again after ETH dropped.

This whale historically has bought ETH at lower prices, after which ETH’s value has surged.

AMBCrypto checked Santiment’s data to find whether buying sentiment was dominant among whales. We found that whale activity around the token surged substantially as its Whale Transaction Count increased.

Source: Santiment

Its supply held by top addresses also increased, hinting that whales were actively buying the token.

A large accumulation from whales could be a positive signal for ETH, as it can help turn the token’s price charts green.

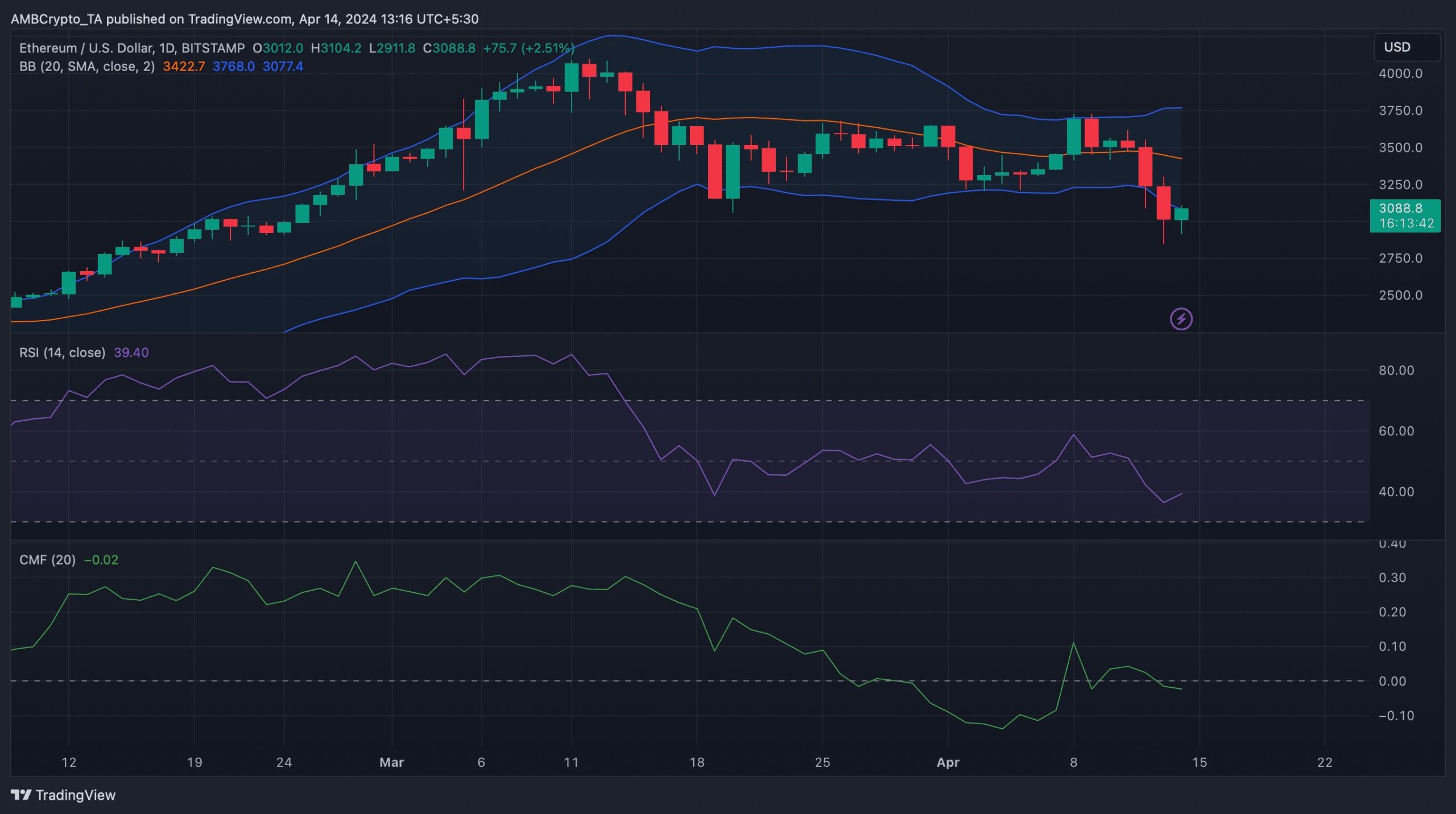

Therefore, AMBCrypto took a look at ETH’s daily chart to see whether it was preparing for a trend reversal.

We found that ETH’s price had touched the lower limit of the Bollinger Bands, hinting at a rebound. Its Relative Strength Index (RSI) also registered an uptick.

However, the Chaikin Money Flow (CMF) remained bearish.

Source: TradingView

XRP whales are following the trend

Like ETH, XRP’s price also dropped during the market crash. To be precise, the token’s value plummeted by over 8% in the last 24 hours.

At the time of writing, it was trading at $0.4959 with a market cap of $27.3 billion.

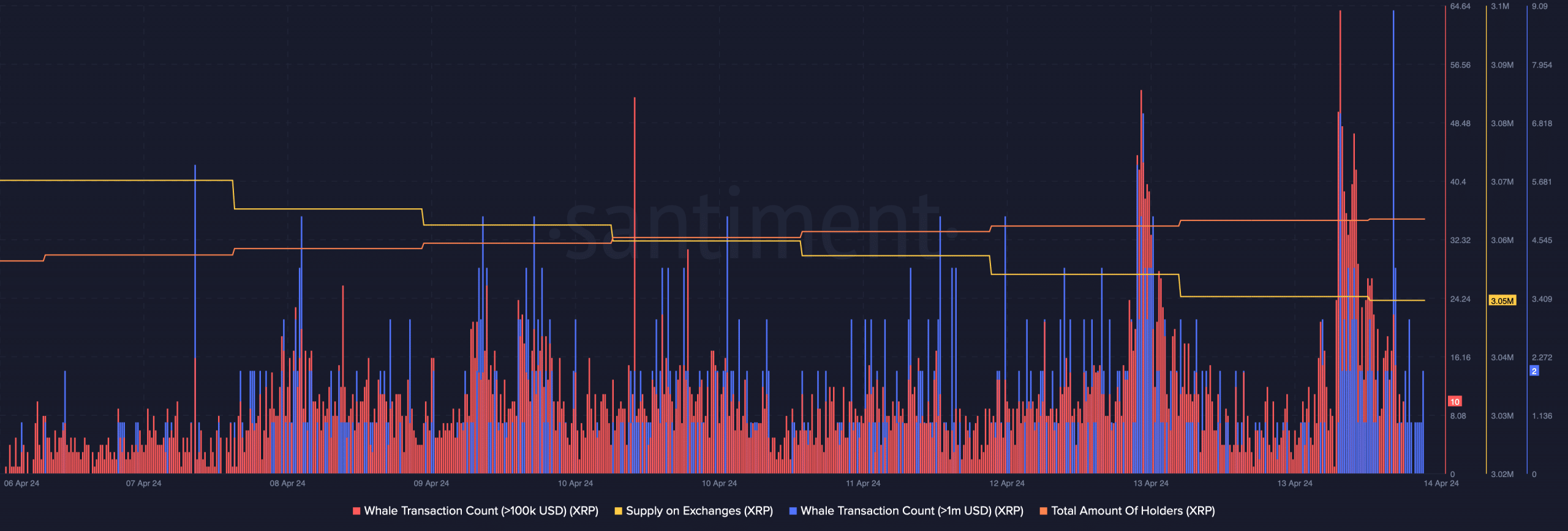

Similar to that of ETH, whale activity around XRP also increased, which was evident from the rise in the number of whale transaction counts.

Source: Santiment

Buying sentiment overall was also dominant in the market as XRP’s total amount of holders increased over the last week.

Is your portfolio green? Check the ETH Profit Calculator

Additionally, its Supply on Exchanges dropped, further suggesting that investors were buying the token.

This newfound interest in XRP and Ethereum might translate into a bull rally soon, which might allow these tokens to recapture their lost market caps in the coming weeks.

Credit: Source link