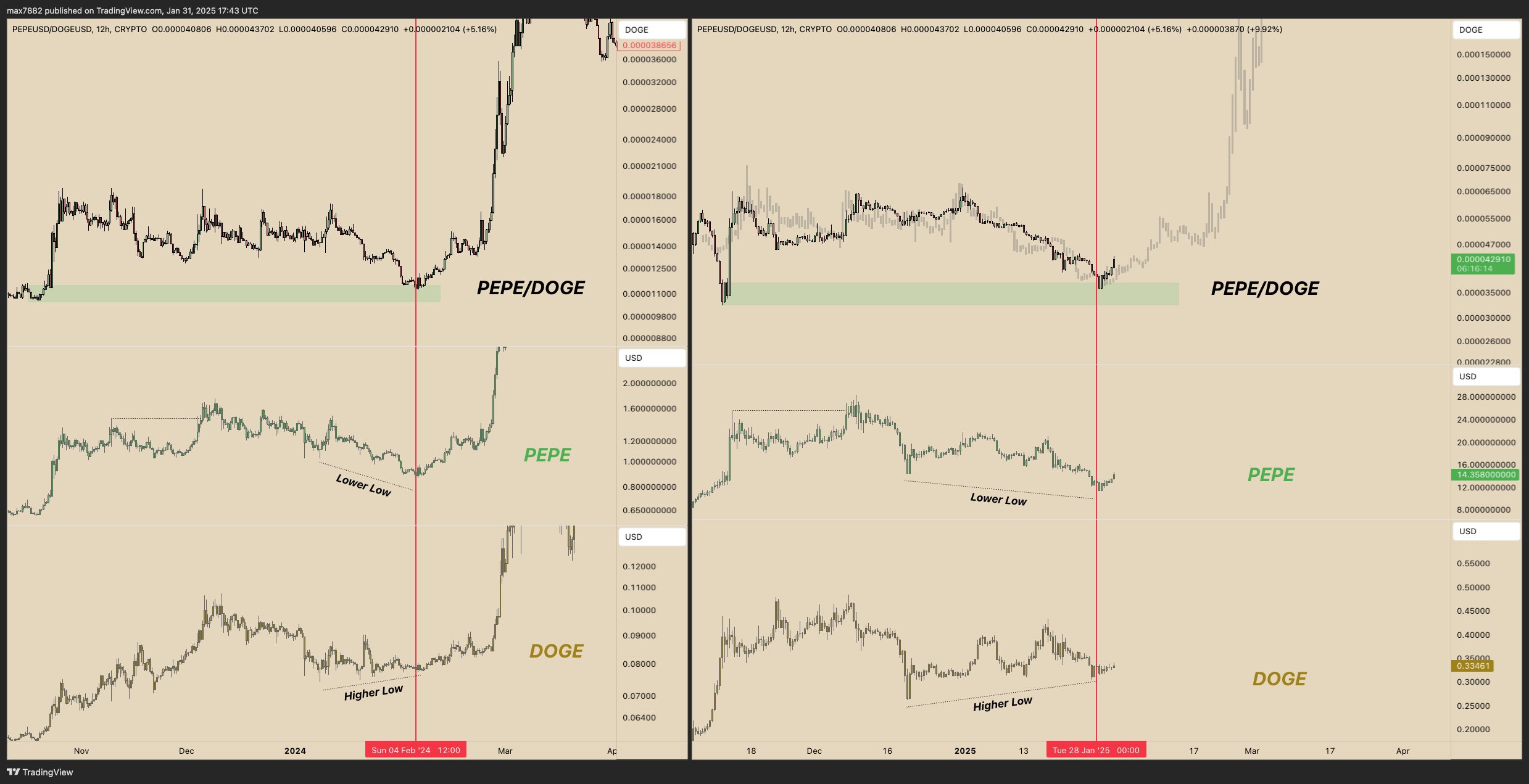

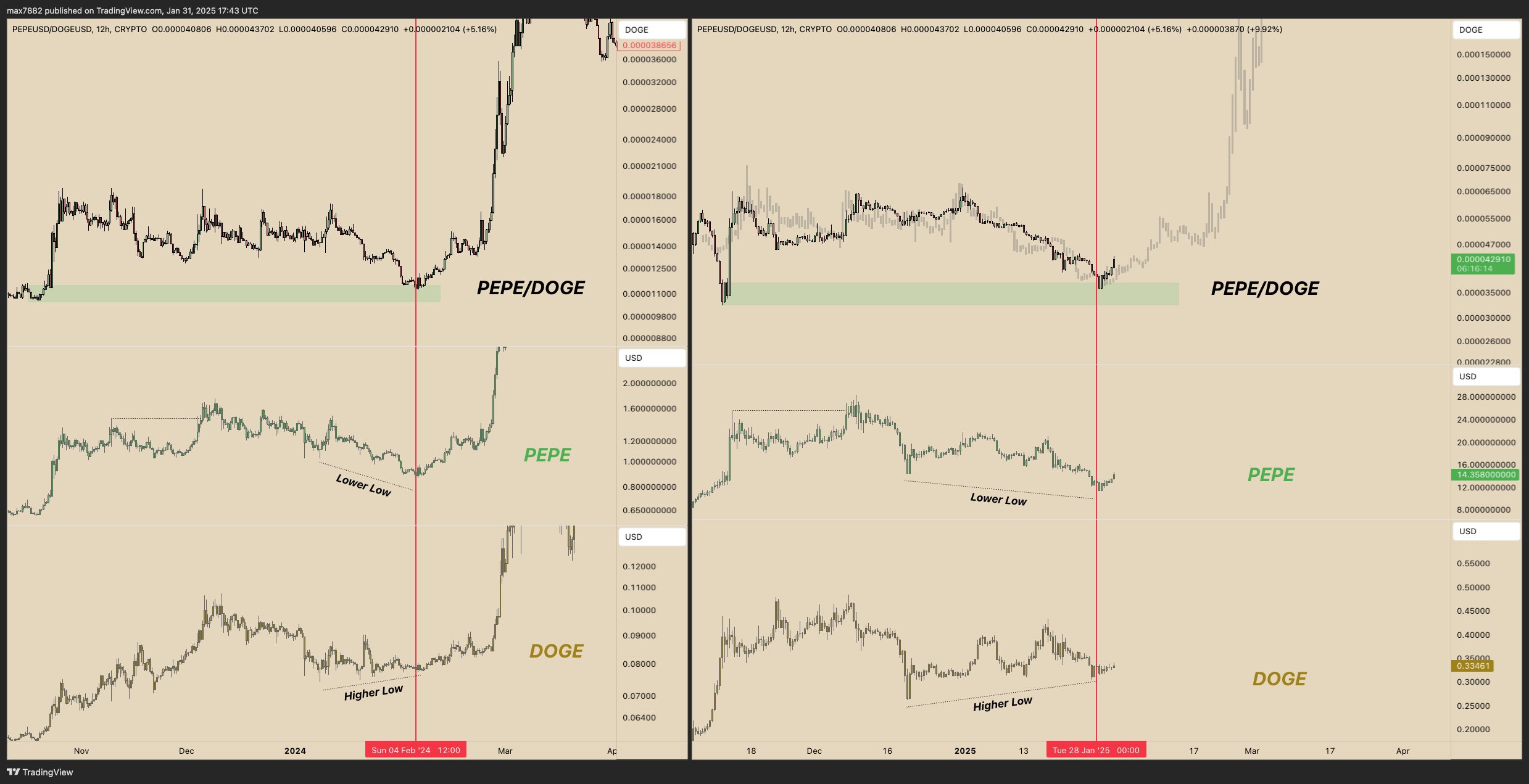

- The PEPE/DOGE pair offered interesting insights compared to the same time last year.

- The altcoin market was weak- but this could be a great time to buy.

The crypto market cap has fallen 12.3% from $3.73 trillion to $3.42 trillion in six weeks. The bullish conviction in November and December when Bitcoin [BTC] raced toward and broke past the $100k mark has evaporated.

Source: TOTAL on TradingView

With this loss of confidence, BTC formed a range around the $100k level, but altcoins have shed a large percentage in the past six weeks.

Pepe [PEPE] was down 57.8% from its all-time high in the second week of December- but there’s a chance that the memecoin has formed a bottom.

Pepe vs. Dogecoin- 2024’s February could be repeating itself

Source: Max on X

In a post on X (formerly Twitter), founder of BecauseBitcoin Max Schwartzman noted that in 2024, the PEPE/DOGE pair retested a key support level before zooming higher.

Essentially, PEPE/DOGE rising higher implies PEPE performing better than Dogecoin [DOGE].

In February 2024, a retest of the level that saw a strong pump in November saw PEPE outperform DOGE wildly in February and March.

Schwartzman observed that such a scenario was playing out once again, and this could lead to Pepe making extraordinary gains in the coming weeks.

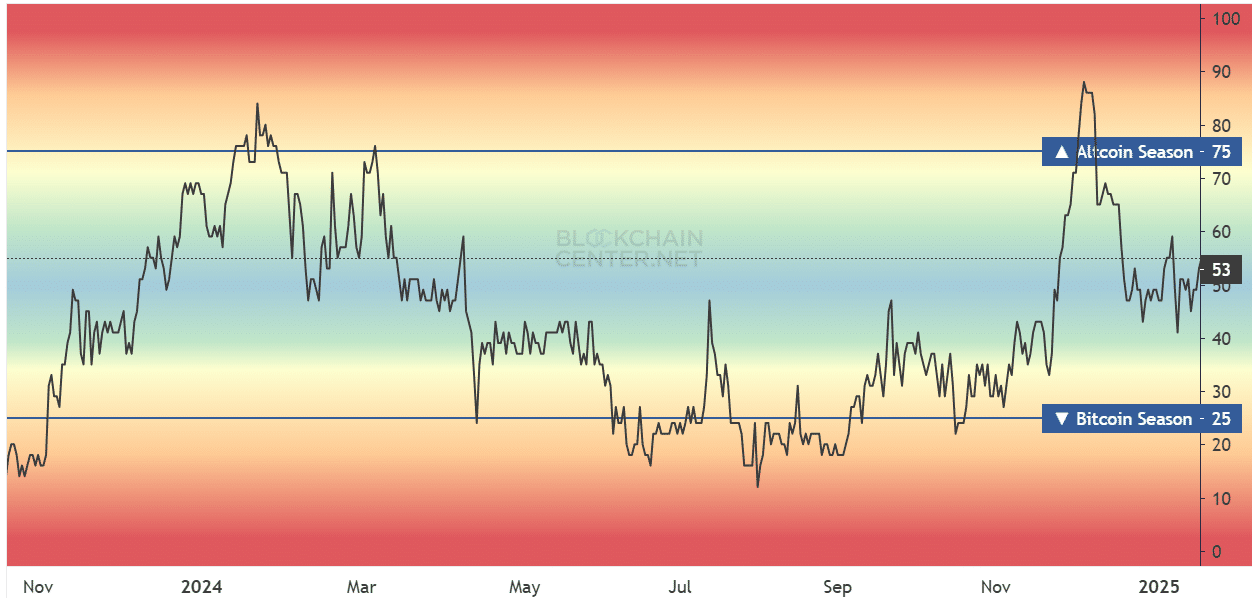

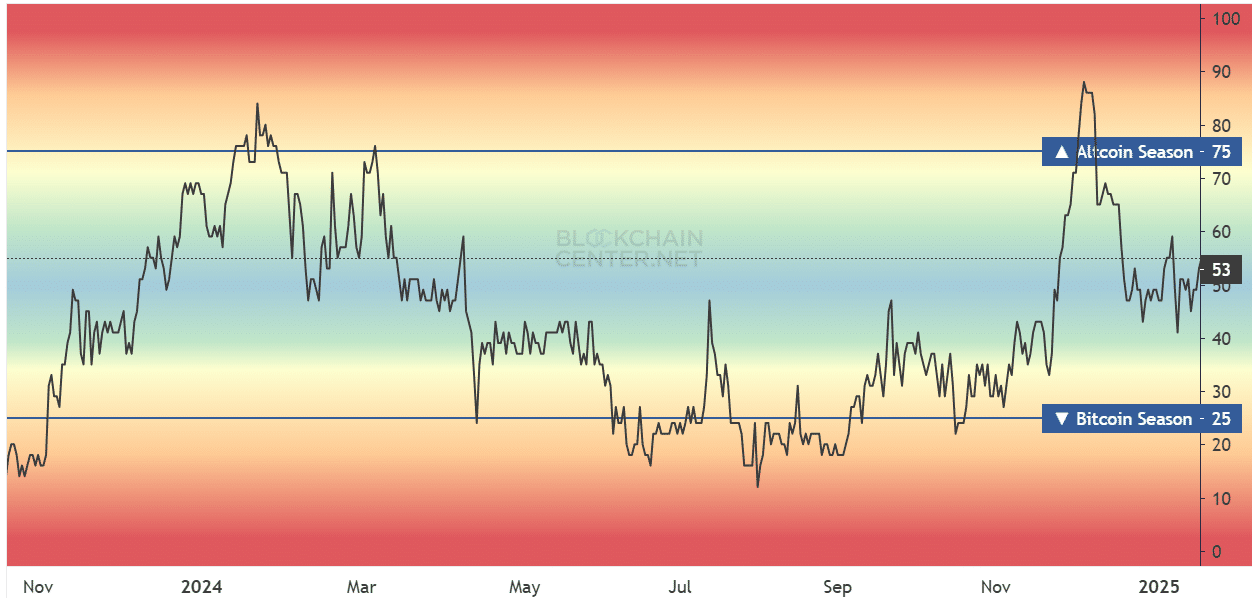

Examining the chances of an altseason

Source: Blockchain Center

While PEPE/DOGE could be bottomed out, the altcoin market might not have. The fabled altcoin season is not yet in, with the reading at 53. Yet, this was a similar situation compared to February and March 2024.

Back then, BTC also noted impressive gains on the back of spot ETF approvals, climbing from $42k to $72k in six weeks.

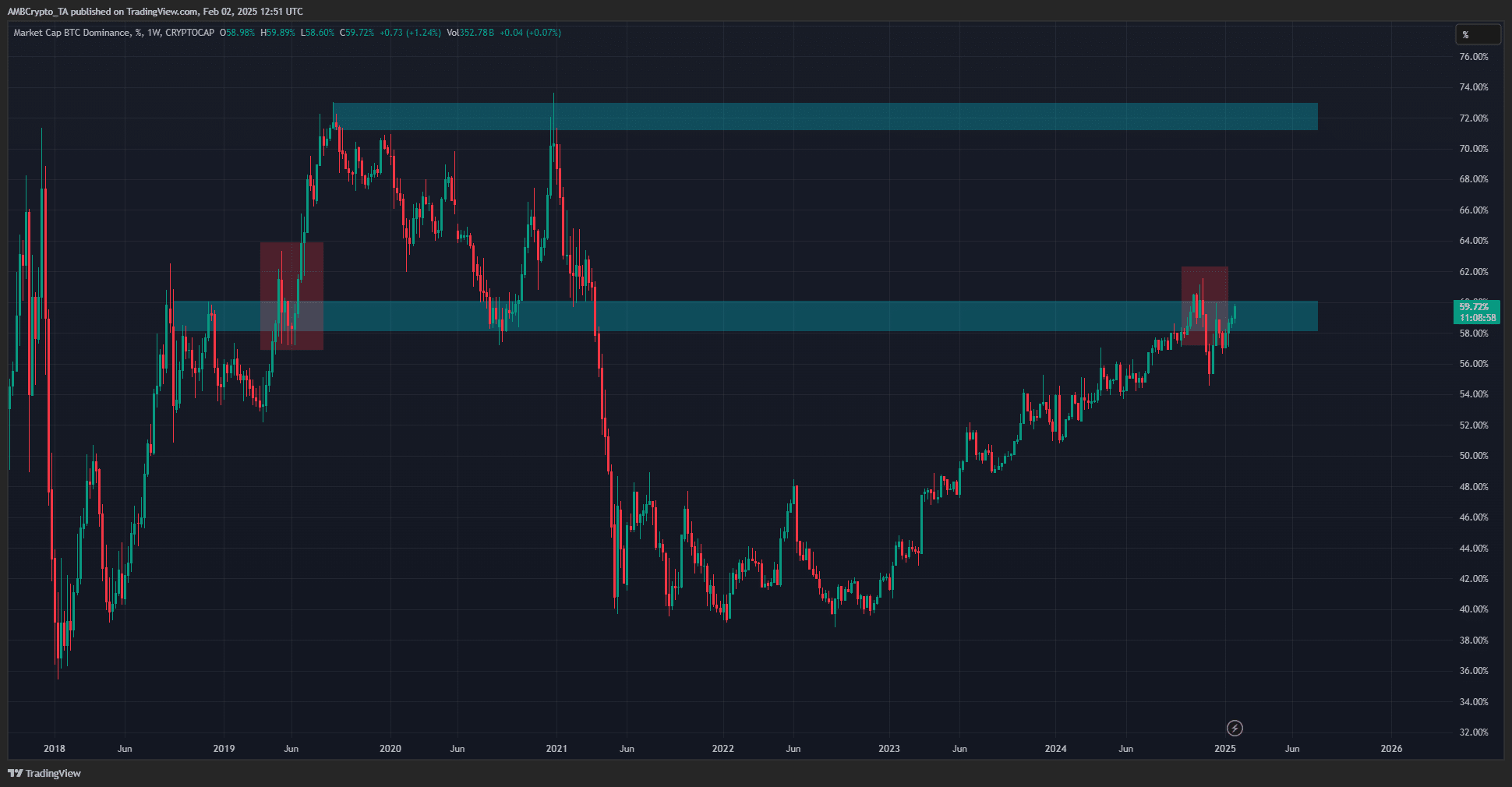

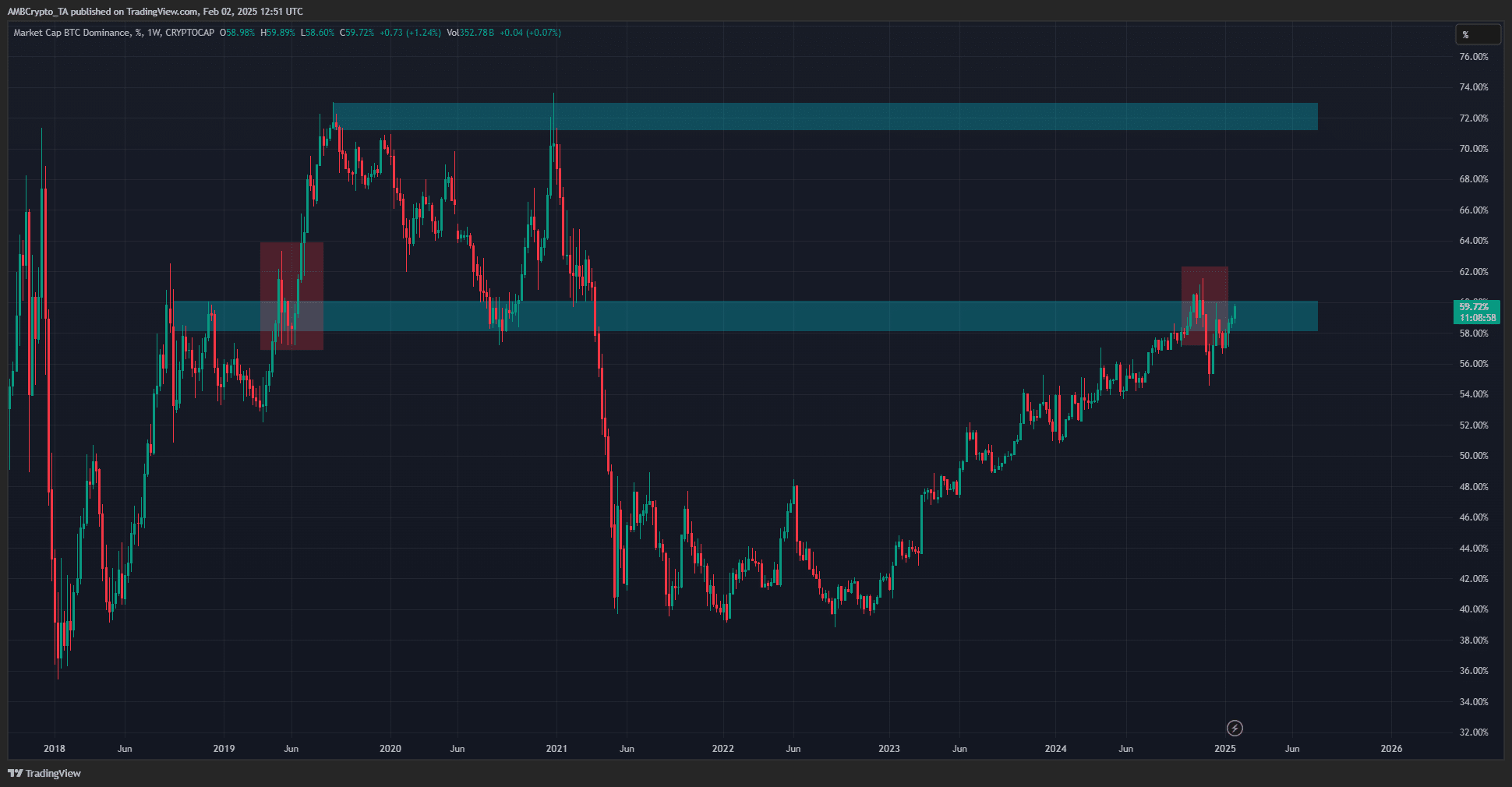

Source: BTC.D on TradingView

Comparing the Bitcoin Dominance across Bitcoin cycles, we can see that BTC.D was at a vital long-term resistance.

The rejection in November that led to a mini alt-season could ensue. In turn, this could aid the Pepe bulls’ efforts.

Read Pepe’s [PEPE] Price Prediction 2025-26

As the previous year showed, BTC and altcoins can pump higher. Whether that will happen once again was unclear. There was a lot more fear in the market and some unwillingness to “buy the dip” on social media, as many participants believe the cycle is over.

It is precisely in fearful conditions that buying could give mouth-watering returns, but investors must be aware of the risks- it might play out differently this time.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Credit: Source link