- Base achieved a significant ATH, surpassing 4.2 million daily transactions.

- This milestone reflected a strategic approach to capitalize on Ethereum’s limitations.

Base, Coinbase’s Layer 2 blockchain, recently achieved a significant ATH, surpassing 4.2 million daily transactions.

This milestone places Base ahead of Ethereum in transaction volume, a notable achievement in the blockchain space. In this article, AMBCrypto explores how Base managed to reach this historic peak just a year after its launch, even amid broader market volatility.

Base leads over its competitors

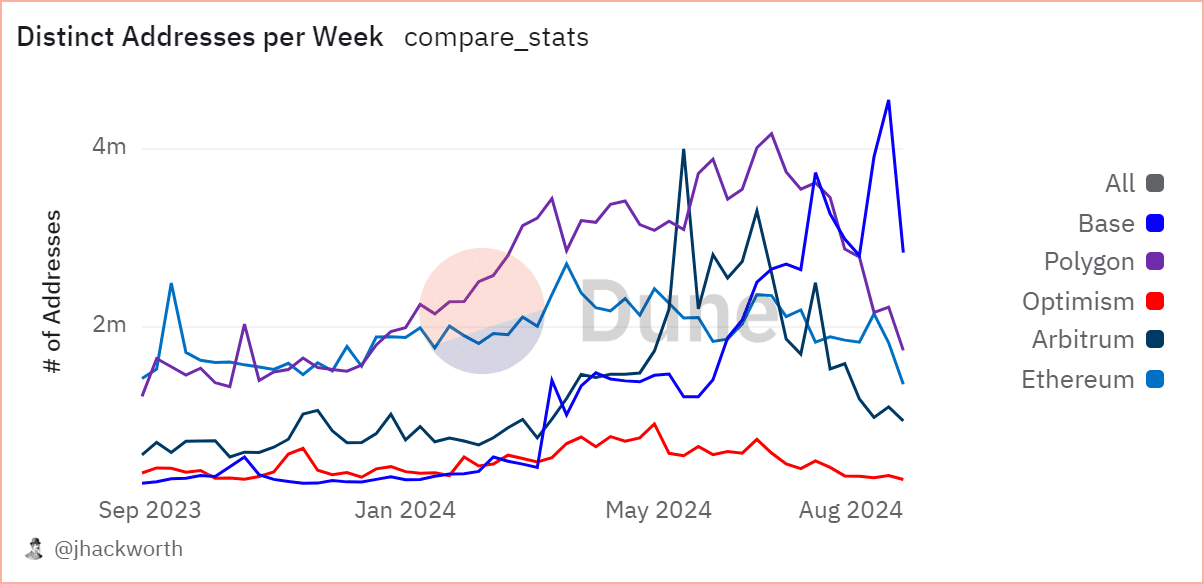

According to the data, since the beginning of 2023, there has been a resurgence in crypto activity, especially on Ethereum and its L2s.

Notably, user activity on Layer 2 networks began to surpass Ethereum itself as early as March this year, when active L2 users reached 3 million, marking a significant increase from Ethereum’s 2.38 million.

Source : Dune

The chart above revealed an interesting development.

While Polygon has long held its dominance among the top five L2 solutions, followed by Arbitrum – both outpacing others substantially – Base recently claimed a prominent position.

Currently, Base leads with over 4 million weekly addresses, followed by Polygon at 2.2 million and Ethereum at 1.82 million, signaling a notable shift in L2 adoption.

According to AMBCrypto’s analysis, the rapid increase in Base’s user activity highlights its growing appeal to a large pool of users.

What is driving this shift?

A strategy embellished in gold

By making it more affordable for users to interact with decentralized applications, Base is paving the way for mass adoption of Web3.

Ethereum, while remaining the leading blockchain for dApps and DeFi, faces challenges with scalability and high gas fees.

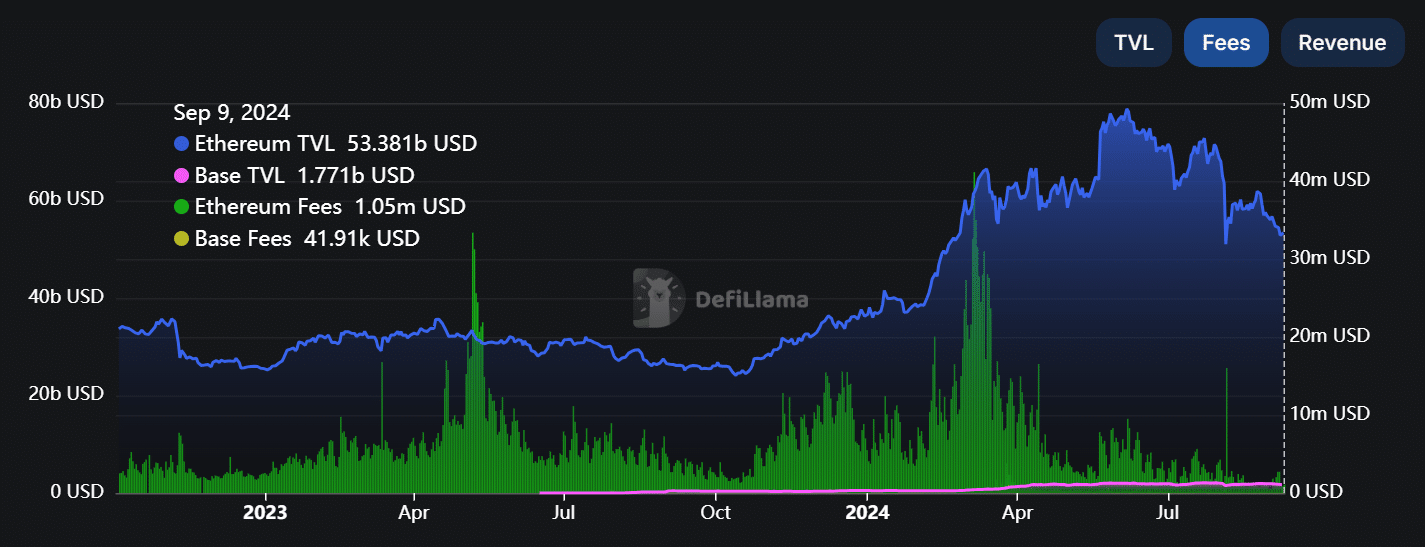

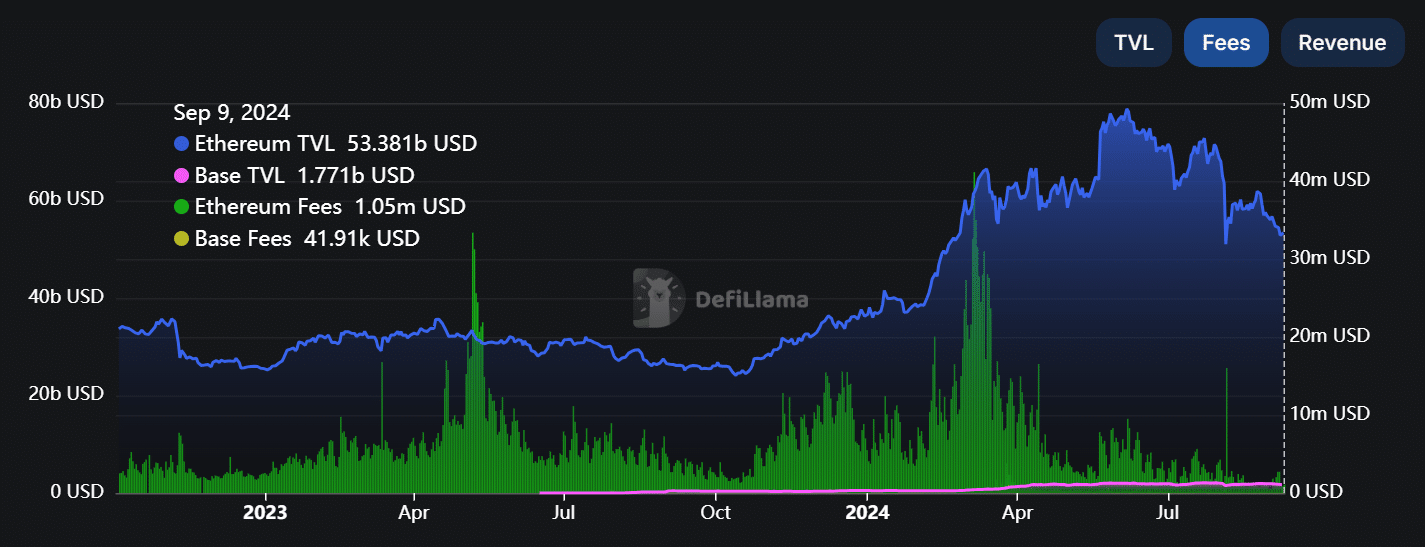

In contrast, Base has leveraged these limitations by providing lower transaction costs, superior scalability, and faster speeds, as illustrated in the chart below.

Source : DeFiLlama

Base’s average transaction fees remained substantially lower than Ethereum’s, with Ethereum averaging $1.05 per transaction compared to Base’s $0.0419, highlighting Base’s superior cost efficiency for users.

Additionally, Base’s TVL hit $1 billion by mid-March, less than a year after its launch – an impressive achievement. While it is still significantly behind Ethereum’s $54 billion TVL, it has proven its strength by capturing high transactional volume.

AMBCrypto notes that Ethereum’s performance dependency on Bitcoin has also contributed to Base being seen as a superior alternative.

Overall, Base’s Coinbase-supported ecosystem attracted users, with its robust infrastructure paving the way mass adoption.

Credit: Source link